Break Even

advertisement

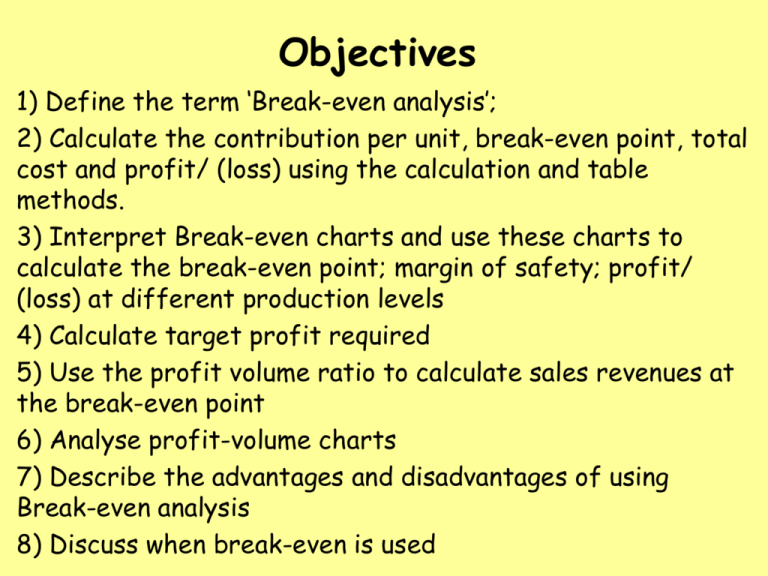

Objectives 1) Define the term ‘Break-even analysis’; 2) Calculate the contribution per unit, break-even point, total cost and profit/ (loss) using the calculation and table methods. 3) Interpret Break-even charts and use these charts to calculate the break-even point; margin of safety; profit/ (loss) at different production levels 4) Calculate target profit required 5) Use the profit volume ratio to calculate sales revenues at the break-even point 6) Analyse profit-volume charts 7) Describe the advantages and disadvantages of using Break-even analysis 8) Discuss when break-even is used AAT Level 3 Break Even Analysis Absorption Costing Direct Materials + Direct Labour +Direct Expenses + Production OH * Absorption Cost Marginal Costing £ X X X X X * Remember that Overheads are absorbed throughout the period using the OAR Direct Materials + Direct Labour +Direct Expenses + Production OH Marginal Cost Marginal Cost IS Variable Cost £ X X X X X Chocolate!!! Example – Manufacturing chocolates 500 units had total variable costs of £1500 Selling price is £6 each = £3000 Fixed costs are £700 Direct Materials + Direct Labour +Direct Expenses Marginal Cost Remember that MC is VC! £ 1000 350 150 1500 £ Selling price 3000 Les Variable Costs 1500 Contribution 1500 Fixed Costs 700 Profit 800 Break Even Where total costs = Total Sales BE in Units = Fixed Costs Contribution BE in Value = Break Even Point (units) x Selling Price Per Unit Activity 1 Carl Wright, a market trader, makes and then sells his surfers neckwear for £19 each. The Variable Cost of producing each item is £14. This is also the Marginal Cost. Carl also has Fixed Costs of £200 a week for his sales pitch at an indoor market. Calculate the contribution per unit and the break even point. Calculate the contribution per unit Calculate the Break Even Point Selling Price per unit Variable Cost per unit Contribution per unit Total Fixed Costs Contribution per unit £19 £14 £5 Break even point in units = 40 £200 £5 = 40 units Break Even in £ = 40 x £19 = £760 Activity 2 Activity 2 (5) Answer Units of output Fixed Costs Variable costs Total Costs Sales Revenue Profit / (loss) 1000 90,000 9,000 99,000 24,000 (75,000) 2000 90,000 18,000 108,000 48,000 (60,000) 4000 90,000 36,000 126,000 96,000 (30,000) 6000 90,000 54,000 144,000 144,000 0 8000 90,000 72,000 162,000 192,000 30,000 Now try Activity 3 Margin of Safety Either: Actual Output – Break Even Point Or: In units Margin of Safety (output) Output produced As a % X 100 Activity 4 a) If Carl produced 70 units his margin of safety (MOS) would be: MOS = Actual Output – Break Even Point BE point (from Activity 1) = 40 units Output = 70 units 70 – 40 = 30 units Margin of Safety = 30 units b) If Carl produced 55 units his margin of safety would be: = Actual Output – Break Even Point BE point = 40 Output = 55 50 – 40 = 15 Margin of Safety = 15 units c) If Carl produced 60 units his margin of safety as a percentage would be: = Actual Output – Break Even Point BE point (from page 4) = 40 Output = 60 Margin of Safety (output) X 100% Output = 20 x 100 60 = 33% 60 – 40 = 20 Margin of Safety = 20 units d) At an output of 70 units Carls percentage MOS would be: = Actual Output – Break Even Point BE point = 40 Output = 70 70 – 40 = 30 Margin of Safety = 30 units Margin of Safety (output) X 100% Output = 30 x 100 70 = 42.9% Ian Taylor Hand-out Your turn! Complete activity 6 Activity 7 Price, Porter & Co manufacturer packs of writing equipment for schools. The annual fixed costs of producing packs are £40,000 and the variable costs are £3 per pack. The packs sell for £5 each. a. Calculate the number of packs that the company needs to sell in order to break-even. a. How much profit will be made if sales are 35,000 per year? a. Suppose that fixed costs rise by 50%. Draw the new line for total cost on your break-even chart and state the new break-even level of sales. Targeted/Expected Profit = Total Fixed Costs + Expected Profit Contribution per Unit Selling Price per unit 19 (Activity 1) (Requires Variable Costs per unit 14 £200 profit) Contribution per unit 5 = 200 (FC) + 200 (EP) = 80 units Total Contribution (80 x 5) £400 Less fixed costs 5 £200 Profit £200 Activities 8 - 12 Selling Price per unit Unit Contribution Activity 13 – Batman Robin Sales& Revenue ÷ Budgeted Units = Selling Price – Variable Costs 5000000 ÷ 500000 = £10 Variable Costs per unit 1,000,000+1,250,000+1,500,000 = 3,750,000 Per unit = 3750000 ÷ 500000 = £7.50 Unit Contribution 1,000,000 2.50 400,000 480,000 Break even (units) = Fixed Costs ÷ Contribution per unit = 1,000,000 ÷ 2.50 = 400,000 units = Selling Price – Variable Costs = £10 - £7.50 = £2.50 Margin of Safety = Output – Break even output Question 13 – Batman & Robin =480000 – 400000 = 80,000 units 1,000,000 2.50 400,000 480,000 80,000 16.67 Margin of Safety as a % = MOS ÷ Output x 100 = 80,000 ÷ 480,000 x 100 = 16.67% Complete Robin Profit Volume Ratio £ Contribution per Unit x 100 £Selling Price per Unit Shows contribution per £ of sales (%) Can be converted to a decimal Profit Volume Ratio Break even point £ = Fixed Cost Profit Volume Ratio Can also be used for target profit (just add targeted profit to the top line) Calculated on previous slide Question 13: Using the PV ratio, what is the sales revenue required to break-even? • Contribution per unit £25 • Selling price per unit £32 • Fixed costs £1100 £ contribution per unit x 100 £ selling price per unit = 25 X 100 32 = 78.13% or (0.78 as a decimal) Sales Required to Break Even = £ Fixed costs PVR (decimal) = 1100 0.78 = £1410 Practice Activities 14 - 17 Activities 16-17 KKQs Will require some applied thinking!