opportunity cost

advertisement

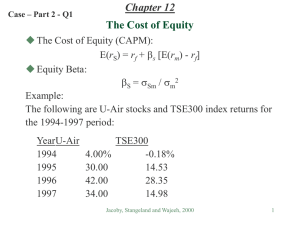

What is Mortensen’s assignment? • Calculate a corporate WACC • Calculate the WACC of each division 1 What is the WACC used for? • When a measure for the long-term opportunity cost of funds (i.e., a discount rate) is needed, such as – – – – Capital budgeting Asset appraisals for financial accounting exercises Determining stock repurchases Evaluating M&A proposals • Will also likely be used for performance assessments at the corporate and division level 2 Calculating the corporate WACC • Ideally we want to use long-term target capital structure ratios, using market values. • We want target ratios because we want the capital structure that will correspond to the future cash flows. 3 E D WACC ke k d 1 t V V rf 4.98% k d 4.98% 1.62% 6.60% t 35% D V 42.2% 57.8% V D 73.01% E ke ? E 4 • The current corporate beta of 1.25 reflects the current capital structure. We can’t use it in the WACC formula using target capital structure. • Need to unlever current beta to take out the financial risk attributed to the current capital structure 5 unlevered levered 1 1 t D E 1.25 1 1 0.350.593 0.90223 We then relever to reflect the target capital structure levered unlevered 1 1 t D E 0.902231 1 0.350.7301 1.3304 6 Solving for the cost of equity k e r f MRP 4.98 1.3304 5 11.632 Solving for WACC E D WACC ke kd 1 t V V 11.6320.578 6.60.4220.65 8.5337% 7 Should the company use single hurdle rate to evaluate investment opportunities for its divisions? • The discount rate must reflect the riskiness of the cash flows being discounted. This is because if we want to maximize value, the discount rate must reflect the opportunity cost of the funds. This is appropriate regardless of how corporations actually raise funds (internally, externally, debt, equity), etc. • Divisions (or projects) with different risks must have different discount rates. 8 Divisional WACCs • Calculate unlevered betas for Exploration & Production and Refining & Marketing Exploration & Production: Equity Net Market Value Debt Equity D/E Beta Unlevered beta Jackson Energy, Inc. 57,931 6,480 11.2% 0.89 0.83 Wide Palin Petroleum 46,089 39,375 85.4% 1.21 0.78 Corsicana Energy Corp. 42,263 6,442 15.2% 1.11 1.01 Worthington Petroleum 27,591 13,098 47.5% 1.39 1.06 39.8% 1.15 0.92 Average Refining & Marketing: Bexar Energy, Inc. 60,356 6,200 10.3% 1.70 1.59 Kirk Corp. 15,567 3,017 19.4% 0.94 0.83 White Point Energy 9,204 1,925 Petrarch Fuel Services 2,460 (296) 20.9% 1.78 1.57 -12.0% 0.24 0.26 Arkana Petroleum Corp. 18,363 5,931 32.3% 1.25 1.03 Beaumont Energy, Inc. 32,662 6,743 20.6% 1.04 0.92 Dameron Fuel Services 48,796 24,525 50.3% 1.42 1.07 20.3% 1.20 1.17 <<<< ----- average excluding Petrarch Fuel Services Average 9 Solve for Petrochemical unlevered beta using the E&P, R&M, and corporate unlevered beta. Here I use Net Income as the weights. unleveredCORP wE & P unleveredE& P wR & M unleveredR& M wP unleveredP 12,556 4,047 2,097 0.90223 0.92 1.17 unleveredP 18,701 18,701 18,701 unleveredP 0.2795 10 Finally, we solve for the divisional WACCs Assumptions: 30-Year T -Bond Equity Market Risk Premium T ax Rate 4.98% 5.00% 35.0% Target Consolidated Target D/E 73.0% Target D/V 42.2% Target E/V 57.8% Asset Beta 0.90 Equity Beta 1.33 Cost of Equity 11.63% Treasury Spread 1.62% Cost of Debt 6.60% WACC 8.53% Exploration & Production Refining & Marketing Petrochemicals 85.2% 44.9% 66.7% 46.0% 31.0% 40.0% 54.0% 69.0% 60.0% 0.92 1.17 0.28 1.43 1.51 0.40 12.13% 12.53% 6.98% 1.60% 1.80% 1.35% 6.58% 6.78% 6.33% 8.52% 10.01% 5.84% 11