CAPITAL BUDGETING

advertisement

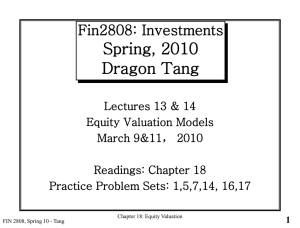

EQUITY VALUATION Claims on Cash Flows of Firm Investors forego consumption and invest expecting future returns Risk is associated with the investment Investors are differ in their Risk/return tolerance Priority on claims to cash flows in the case of bankruptcy Claims in Bankruptcy 1. Administrative expenses related to bankruptcy 2. Expenses after filing and before assignment of Trusted 3. Wages, Salaries, Commissions 4. Contribution to employee benefit plan 5. Consumer claim 6. Government Tax claims 7. Payment to unsecured creditors 8. Payment to preferred stock holders 9. Payment to common stock holders Scope of Equity Valuation Valuation is the estimation of an asset’s value. Equity valuation can be used in a number of ways Stock Selection Inferring market expectation Evaluation of corporate events Evaluating business strategies and models Appraising private business Valuation Process Understanding the business Forecasting Performance Selecting Valuation model Understanding Business Industry size and growth potential Recent development in industry Overall supply demand balance Qualitative factors including legal and regulatory Valuation Methods Valuation by Comparison Dividend Discount Model Constant Growth Dividend Discount Model Life Cycles and Multistage Growth Models Price-Earnings Ratio Free Cash Flow Valuation Valuation by Comparison Value of the firm is estimated by comparing some elements of the financial statements of the company with other firms in the same industry Price to Earnings (P/E ratio) Price to Book Value Price to Sales (Price to Earning)/Growth Rate (PEG) Book Value uses historical numbers and includes depreciation Liquidation Value Replacement cost Tobin q = Market Value/Replacement cost (mainly of interest to economists) Dividend Discount Model Assume one year holding period Let P1 be value at end of investment horizon Let D1 be Dividend P0 = (D1 + P1)/(1+k) k = Market Capitalization Rate CAPM P1 = (D2 + P2)/(1+k) P0 = D1/(1+k) + (D1 + P1)/(1+k)2 ……. Scope of Equity Valuation