Reporting Non-Business Use

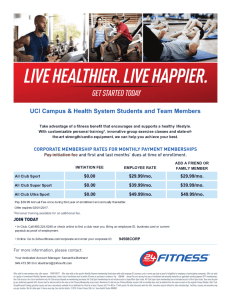

advertisement

Institutional Memberships November 2010 Institutional Memberships New Operational Guideline: Memberships Paid by University Funds can be found at http://www.utsa.edu/financialaffairs/opguidelines/ Purpose: • Authorization of membership fees • Payment process and required documentation Types of Memberships 1. Business and Professional Organizations • Those established to promote universities and colleges, such as accrediting agencies; • Organizations of institutional service agencies and administrative officers; • Scholarly societies; and/or • Community organizations. Types of Memberships Business and Professional Organizations (cont’d) • Institutional rather than individual memberships shall be obtained whenever possible • Individual memberships shall be purchased only if particular circumstances warrant an exception; • the decision to grant an exception shall be based on an evaluation of the benefits to the University and the relationship to the job responsibilities of the employee who will be designated as the member. Types of Memberships Business and Professional Organizations (cont’d) • Department heads are delegated authority to approve o Should promote the advancement of education and research, enhance the professional standing of faculty and staff, and / or facilitate favorable community relations. • Memberships for students may be allowed if there is a quantifiable benefit to the university (e.g. discounted registration for a conference that the university is paying for the student to attend.) Types of Memberships 2. Memberships to secure periodicals; online access; or to obtain materials at discount / warehouse prices • Such periodicals will become the property of the University rather than of an individual, and must be made available to all department faculty, staff, and students. • Memberships to warehouse clubs that provide access to discounted goods may be reimbursed, however the membership card should be used solely for institutional and not personal purchases Types of Memberships 3. Social, private club or entertainment / recreational memberships (includes airline clubs) • Generally not allowed • In rare circumstances these memberships may be approved if the business purpose can be established and the President’s approval is obtained in advance. • The Provost is authorized to approve these memberships for college and academic personnel. Social, Private Club or Entertainment / Recreational Memberships • The Vice President for Business Affairs must approve any membership involving the President. • The authority to approve social memberships cannot be delegated. • This approval is obtained through completion of a Business Expense Form. Social, Private Club or Entertainment / Recreational Memberships Funding Source: • Typically paid from an official occasions account • Such memberships shall not be paid with state (E&G), designated tuition, student fees or federal funds. • Membership dues for any civic or community organization, country club, social or dining club are unallowable as a direct cost of a federal grant or contract per OMB Circular A-21. Social, Private Club or Entertainment / Recreational Memberships Reporting Non-Business Use: • Payment of membership dues for any club organized for a social purpose must be included in an employee’s income to the extent that the payment is not related to a business purpose. • In order for a portion of the club dues to be excluded from an employee’s income as a working condition fringe benefit, the employee must substantiate and document the specific business purpose for that portion of the club dues. Social, Private Club or Entertainment / Recreational Memberships Reporting Non-Business Use: • Dues related to the personal use of the club will be included in the employee's income on a pro rata basis. If this is not done monthly, the Payroll office will request annually prior to the last month of the calendar year. • Non-business use shall be treated as additional compensation to the employee and included in the employee's income, subject to withholding for income and applicable employment taxes. Miscellaneous Information • Each year during the budget development cycle, the Vice President for Business Affairs authorizes certain institutional memberships to be paid from centralized university funds on behalf of the entire organization. Processing Payment • Should be made by the university directly to the association through established procedures; • Reimbursement to the employee may be allowed upon proof of payment - invoice and/or detailed receipt. Processing Payment Complete VP2 • In the field: Goods and Services Begin/End Date enter the first day of the membership in both fields (the begin and end dates should be the same). This is important. • In the field: Voucher Description include the name of the Membership – especially if the voucher is seeking reimbursement for prior payment made by the employee; • The Invoice Number can be N/A if one is not provided. Processing Payment • Comments: This section prints on the check stub and in lieu of an invoice number, should include the member ID, member name as applicable, and or other information that will allow the vendor to correctly tie the payment as intended. Processing Payment • It is also recommended that the document creator use Check Distribution T: this means that the document creator has attached a copy of paperwork that should accompany the check to be sent to the vendor. • It is also recommended that you type an X at "Separate Check” Processing Payment The ProCard may also be used for: • Business and Professional Organizations (use Object Code 1301) • Memberships that allow access to periodicals or online access (use Object Code 1407); When the amount charged does not exceed $5,000 and or other prescribed limits: http://www.utsa.edu/pds/procard/info.cfm Cannot use ProCard for social club membership payment

![[Share-My-Toys Membership] Marketing Plan](http://s2.studylib.net/store/data/005475303_1-5c5fcecf250fc9c92c1a18cc8f242409-300x300.png)