Lender Paid transactions

advertisement

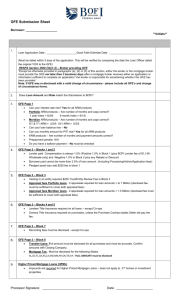

BOFI Federal Bank Good Faith Estimate Guidance and Samples 1 Table of Contents Page 1 of GFE: Slide 3-5 GFE - Lender Paid Comp with Rebate : Slide 6-7 GFE - Lender Paid Comp with Discount: Slide 8-9 GFE- Lender Paid Comp at PAR : Slide 10-11 GFE - Borrower Paid Comp with Rebate: Slide 12 GFE - Borrower Paid Comp with Discount: Slide 13-14 GFE Fees Block B: Slide 15-16 2 Correct Way to Complete Page 1 of GFE Loan amount on GFE must match the loan submission. Loan term must be correct - 20 or 30 years Can your interest rate rise? Check Yes for any ARM Products. Can your loan balance rise? Check No. Can your monthly amount for PITI rise? Check Yes for any ARM Products. 3 Correct Way to Complete Page 1 of GFE continued Do you have a balloon payment – No must be checked See example of GFE - Page 1 for a 5/1 ARM below: 4 Example of GFE for a Lender Paid Transaction with Rebate BOFI Federal Bank pays a fixed 1.0 % origination for all Lender Paid transactions. Example: GFE for a loan amount of $1,000,000 Block 1 of GFE would read $10,000 plus BOFI’s lender fee of $1,145 = $11,145 Block 2 of GFE should have a corresponding credit of $10,000, plus or minus the rebate or discount amount. So if the rebate is $500, this would be added to the $10,000 credit for a total of ($ 10,500) 5 Continued See example below: 6 Example of GFE – Lender Paid Transaction with Discount BOFI Federal Bank pays a fixed 1.0 % origination for all Lender Paid transactions. Example: GFE for a loan amount of $1,000,000 Block 1 of GFE would read $10,000 plus BOFI’s lender fee of $1,145 = $11,145 Block 2 of GFE to have a corresponding credit of $10,000, plus the discount amount. For this example the Discount is 1.0% or $10,000 – so Block 2 would be $0.00. See example below 7 Lender Paid with Discount continued: 8 Example of GFE – Lender Paid Transaction at Par BOFI Federal Bank pays a fixed 1.0 % origination for all Lender Paid transactions. Example: GFE for a loan amount of $1,000,000 Block 1 of GFE would read $10,000 plus BOFI’s lender fee of $1,145 = $11,145 Block 2 of GFE to have a corresponding credit of $10,000, As loan is at par there is no rebate or discount See example below 9 Example of GFE – Lender Paid Transaction at Par 10 Example of a GFE for Borrower Paid Transaction with rebate Maximum total origination charge allowed on a Borrower paid transaction is 2.0% of loan amount. (This includes processing, admin fees, etc.) So if Broker is charging a 1.0% origination fee on a million dollar loan, plus $500 processing and $500 admin fee, these fees will be reflected in Block 1 of the GFE as 10,000 + 1000 + 1,145(Bofi Lender Fee)=12,145 Any rebate or discount will be reflected in Block 2 of GFE – see example below of $500 rebate. 11 Example of GFE for Borrower Paid Transaction with Discount So if Broker is charging a 1.0% origination fee on a million dollar loan, plus $500 processing and $500 admin fee, these fees will be reflected in Block 1 of the GFE as 10,000 + 1,000 + 1,145(BOFI lender fee) =12,145 The discount will be reflected in Block 2 of GFE – see example below of $500 discount. 12 Continued 13 Example of GFE with Trust Review Fee 14 Example of GFE with Pledged Asset Fee 15 GFE Fees Block B Lender Paid transactions: Do not allow for Broker fees such as processing or admin fees – only tangible fees such as credit report and flood fees are allowed. Borrower Paid transactions: Maximum total origination charge allowed on a Borrower paid transaction is 2.0% of loan amount. (This includes processing, admin fees etc.) Minimum loan amount is $300,000. BOFI Lender fee of $1,145 must be disclosed in Block 1 If borrower will pledge assets, there is a Pledged Asset fee of $250 to be reflected in Block 1 of the GFE. Loans vesting in entities such as a Trust or LLC, must reflect a fee of $250 is Block 3 of the GFE. We require 2 appraisals for a loan amount over 1 million, so be sure to have reflected a reasonable appraisal fee in Block B or loan will be rejected. 16 Purchases must reflect Owners Title Insurance (even if Seller will pay for them)or loan will be rejected. All loans require Lenders Title Insurance to be disclosed Purchases must reflect sufficient mortgage transfer tax or loan will be rejected. Confirm transfer tax amount with Closing Company. Note: Purchases must always reflect transfer tax, even if Seller will be paying the transfer tax. Mortgage tax must be disclosed for the following states: AL,DC,FL,GA,KS,LA,MD,MN,NY,OK,TN,VA. Recording fees must be disclosed. 17