Appraisal Checklist

advertisement

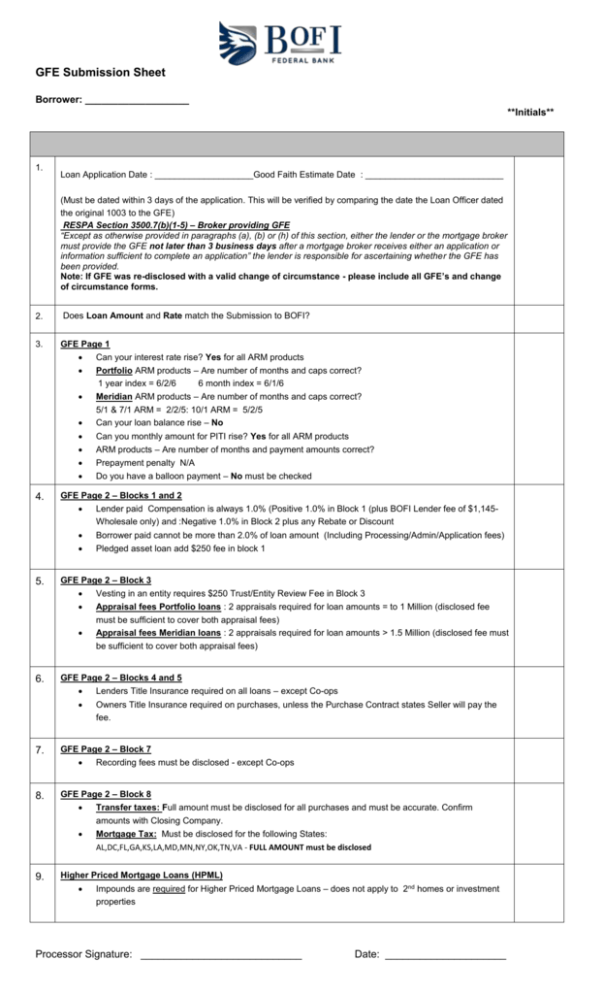

GFE Submission Sheet Borrower: ___________________ **Initials** 1. Loan Application Date : ____________________Good Faith Estimate Date : ____________________________ (Must be dated within 3 days of the application. This will be verified by comparing the date the Loan Officer dated the original 1003 to the GFE) RESPA Section 3500.7(b)(1-5) – Broker providing GFE “Except as otherwise provided in paragraphs (a), (b) or (h) of this section, either the lender or the mortgage broker must provide the GFE not later than 3 business days after a mortgage broker receives either an application or information sufficient to complete an application” the lender is responsible for ascertaining whether the GFE has been provided. Note: If GFE was re-disclosed with a valid change of circumstance - please include all GFE’s and change of circumstance forms. 2. Does Loan Amount and Rate match the Submission to BOFI? 3. GFE Page 1 Can your interest rate rise? Yes for all ARM products Portfolio ARM products – Are number of months and caps correct? 1 year index = 6/2/6 6 month index = 6/1/6 Meridian ARM products – Are number of months and caps correct? 5/1 & 7/1 ARM = 2/2/5: 10/1 ARM = 5/2/5 Can your loan balance rise – No Can you monthly amount for PITI rise? Yes for all ARM products ARM products – Are number of months and payment amounts correct? Prepayment penalty N/A Do you have a balloon payment – No must be checked 4. 5. GFE Page 2 – Blocks 1 and 2 Lender paid Compensation is always 1.0% (Positive 1.0% in Block 1 (plus BOFI Lender fee of $1,145Wholesale only) and :Negative 1.0% in Block 2 plus any Rebate or Discount Borrower paid cannot be more than 2.0% of loan amount (Including Processing/Admin/Application fees) Pledged asset loan add $250 fee in block 1 GFE Page 2 – Block 3 6. 7. GFE Page 2 – Blocks 4 and 5 Lenders Title Insurance required on all loans – except Co-ops Owners Title Insurance required on purchases, unless the Purchase Contract states Seller will pay the fee. GFE Page 2 – Block 7 8. Recording fees must be disclosed - except Co-ops GFE Page 2 – Block 8 9. Vesting in an entity requires $250 Trust/Entity Review Fee in Block 3 Appraisal fees Portfolio loans : 2 appraisals required for loan amounts = to 1 Million (disclosed fee must be sufficient to cover both appraisal fees) Appraisal fees Meridian loans : 2 appraisals required for loan amounts > 1.5 Million (disclosed fee must be sufficient to cover both appraisal fees) Transfer taxes: Full amount must be disclosed for all purchases and must be accurate. Confirm amounts with Closing Company. Mortgage Tax: Must be disclosed for the following States: AL,DC,FL,GA,KS,LA,MD,MN,NY,OK,TN,VA - FULL AMOUNT must be disclosed Higher Priced Mortgage Loans (HPML) Impounds are required for Higher Priced Mortgage Loans – does not apply to 2nd homes or investment properties Processor Signature: ____________________________ Date: _____________________ Helpful Hints for a Successful GFE Submission Typical Errors Resulting in Loan Suspension or Denial: The GFE is not dated within 3 days of the date on the loan application. Per Reg Z 226.19 (a)(1)(i) Timing of early Reg Z Disclosures for mortgage transactions subject to RESPA. In a mortgage transaction subject to the RESPA that is secured by the consumers dwelling, the creditor shall make good faith estimates of the disclosures required by226.18 and shall deliver or place them in the mail not later than the third business day after the creditor receives the consumer’s written application. BofI requires compliance with RESPA 3500.7(b)(1-5) and Regulation Z 226.19(a)(1)(i) for mortgage transactions subject to RESPA. RESPA references the GFE & Reg Z references the TIL (aka early Reg Z disclosures). Transfer Tax is under disclosed Mortgage Tax is under disclosed Lenders Title Insurance was not disclosed. Owners Title Insurance was not disclosed on a purchase transaction. If seller will be paying the Owners Title Insurance, it would have to be disclosed on the Purchase contract. Page 1 of the GFE was not completed correctly, per the examples shown on the above checklist BOFI Lender fee of $1,145 was not properly disclosed. Common Valid Changes of Circumstances based on new information particular to our loan programs: If your borrower is vesting in an entity, we have a $250 dollar fee for review and approval of the entity. This $250 fee must be disclosed in block #3 of the GFE. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. The loan has a Pledged Asset feature; we charge a $250 dollar fee for Pledged Asset loans. This $250 fee must be disclosed in Block #1 of the GFE. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Loan Amount has changed since your loan submission. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. 2 appraisals are required on loan amounts over 1 Million for Portfolio products and 1.5 Million for Meridian If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Higher Priced Mortgage Loans require the borrower to have an impound account. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Cross Collateralization loans require: 2 appraisals, 2 Preliminary Title reports and 2 recording fees to be disclosed. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Maximum Lender Paid Compensation is 1.0%. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. If loan has Lender Paid Compensation, Block 1 needs to be equal to1.0% of the loan amount plus the Lender Fee of $1,145. Block 2 must be equal to (-1.0%) of the loan amount to represent the lender credit to the borrower for the originator compensation. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Borrower Paid Compensation is limited to 2.0% of loan amount (Including Processing/Admin/Application fees) If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower. Mortgage Transfer Tax must be properly disclosed on all New York loans. The full amount of the Mortgage Transfer Tax should be disclosed on the GFE. The lender credit to the borrower for the required .25% (one quarter of one percent) will be reflected as a credit on Page 1 of the HUD-1 at closing. If you re-disclose to borrower, provide us with 1) Revised GFE and 2) a Change of Circumstance form signed by the borrower.