1. How much interest is paid over the entire term of a $60,000, 30

advertisement

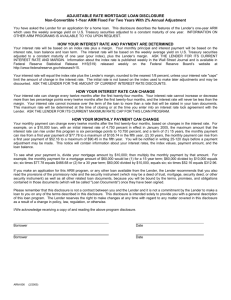

1. How much interest is paid over the entire term of a $60,000, 30 year loan at 13% if it has fixed monthly principal and interest payments of $663.72? 2. What is the principal balance after one payment on a $110,000 loan at 7.5 %, if it has fixed monthly principal and interest payments of $769.14 for 30 years? 3. A borrower signs a loan agreement for $85,000. Out of this, the lender charges a 1% loan origination fee and two discount points. How much net cash does the borrower receive? 4. A couple bought a home for $90,000 with a 20% down payment. Ten years later the house is worth $120,000 with the loan balance being reduced to $65,000. What is the percent of equity increase? 5. If a lender wants a yield or rate of return of 9 ½ %, but is only charging an interest rate of 8 ¾ %, how many discount points will be charged by the lender at closing? 6. McCabe bought a house with a mortgage loan of $61,500. The monthly principal and monthly interest payments will be $7.70 per $1,000 of the loan amount. The annual property taxes are $496.20. The homeowner’s policy is $240.00 per year. Calculate McCabe’s monthly payment including principal, interest, taxes and insurance (PITI). 7. The Kellys received $19,000 from the sale of their house to apply toward the purchase of a new home costing $90,000. They assumed an existing mortgage of $49,500 and borrowed $24,000 at 12% to be secured by a second mortgage. The lender charged them a ½% assumption fee; a 1 % origination fee on the second; and 2 points on the new loan. How much was the lender paid? 8. A prospective buyer who has contracted to buy a house for $75,000 applies to a lender for $70,000 conventional mortgage loan to finance the purchase. The buyer’s gross annual income is $30,000. The lender determines that the buyer’s housing expenses would be $720 per month and that the buyer’s expenses for recurring obligations (excluding housing expenses) are $300 per month. Does the buyer qualify under the 28/36 ratios? 9. A lender requires applicants for conventional mortgage loans to qualify under both the 28 and 36 ratios. The Bakers have a gross annual income of $36,000 and have recurring obligations (excluding housing expenses) totaling $400 per month. In order to qualify for a conventional loan under both the above standards, the Baker’s monthly housing expenses must not exceed what amount? 1. $663.72 x 360 = $238,939.20 total P + I – 60,000.00 Principal (loan amount) $178,939.20 Interest amount over life of loan 2. $110,000 x .075 = 8,250 ÷ 12 = 687.50 Int 3. $85,000 x .03 = $2,550 points and orig. fee 4. 90,000 Purchase (18,000) Down Payment 72,000 Loan 72,000 Mortgage -65,000 Balance 7,000 Reduction 5. Lender wants yield of: Interest rate charged: 7,000 + 30,000 = 37,000 2.06 206% 769.14 P+I -687.50 Int $81.64 Prin 110,000.00 Before Payment -81.64 Principal Paid $109,918.36 After Payment Net Cash = $82,450 120,000 New Value -90,000 Paid 30,000 Increase 18,000 Original equity (down payment) 9½% = 8¾% = Lender Needs: 9 & 4/8 % (8 & 6/8 %) 6/8 % more yield Need 6 points (1/8 % increase for each point from borrower) 6. $61,500 ÷ $1,000 = 61.5 units of $1,000 each 61.5 x $7.70 = $473.55 P & I + 61.35 Taxes & Insurance $534.90 PITI 7. a. $247.50 Assumption fee (.005 x $49,500) b. $720.00 ($24,000 x .03) (1% origination fee + 2% discount points) c. Fees and points = $967.50 8. NO 720 Mo.HousingExp = 29% 2,500 MoGrossInc 1,020 TotalMoRecurringDebt = 40% 2,500 MoGrossInc Does NOT pass either test 9. .36 x $3,000 mo. = $1,080 Total Mo. Recurring Debt allowed -400 Other Mo. Debt already owed $ 680 Maximum Mo.HousingExp allowable under 36% Ratio