(SBA) 504 Loan - Federal Reserve Bank of Kansas City

advertisement

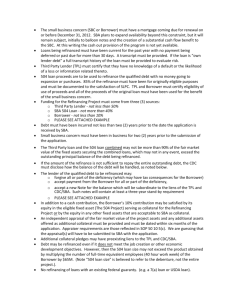

Lender Summit August 19, 2011 The Small Business Administration (SBA) 504 Loan Major differentiations between 7a and 504 loans: Delivered by certified development companies (CDC). All shapes and sizes of CDC’s. “Licensed” by SBA to deliver the 504 product. Partnership loan – always involves a CDC, a lender, and a business. Niche product – capital equipment and owner-occupied real estate only. No working capital. SBA relationship with the CDC, not the lender - no paperwork/on-going SBA monitoring for the lender. Primarily used by existing businesses. 1. 2. 3. Traditional 504 Loan - provides monies for expansion/purchases Partial 504 refinancing product – couples an expansion with a refinancing of existing debt Total 504 refinancing product – temporary product – expires 9/30/12. Provides only refinancing of existing debt. No expansion money or cash out available. Expansions 10% down payment most attractive feature Permanent financing Must demonstrate community impact (jobs or 1 of 12 other impacts) Long term fixed rate for 10 or 20 years Junior lien position behind participating lender (~50% LTV for lender) Uses Land New Building Soft Costs/ Interim interest $200,000 $750,000 $ 50,000 Total $1,000,000 Sources Bank/Lender CDC 504 Loan Equity $500,000 (50%) $400,000 (40%) $100,000 (10%) Total $1,000,000 SBA project costs can include a refinancing component not to exceed 50% of the cost of an expansion Works very well for borrowers expanding an existing building with debt Equity for borrower can be inferred – 100% financing might be available Must demonstrate 10% savings to business Subordinating to existing debt in excess 50% threshold can be considered outside the SBA project costs Uses New Construction Costs Debt refinance (50% of new costs) $ 900,000 $ 450,000 Total SBA project costs: Debt in excess of 50% $1,350,00 $ 50,000 Sources Bank/Lender CDC 504 Loan Equity Total: $ 725,000 (50% of new + debt in excess of 50%) $ 540,000 (40% of new) $ 135,000 (10% of new) $1,400,000 (SBA project + debt in excess of 50%) Not the traditional 50%/40%/10% structure Project structure governed by recent appraisal Lender always does 50% of appraised value Step One: Determine Value by New Appraisal Step Two: Structure: Lender funds 50% of appraisal Borrower injects all equity (appraisal less debt) CDC does remainder Appraisal of building Debt on Building $1,000,000 $ 800,000 Bank (always 50%) Borrower (appraisal less debt) CDC 504 $ 500,000 $ 200,000 $ 300,000 Too much equity – not eligible or feasible for 504 refinance product Too little equity or upside down – borrower has to inject cash or pledge other collateral Documentation challenging - must submit entire genealogy of the loan (since origination) – not bad if originated at same bank that is refinancing Temporary Product – expires 9/30/12 Rate on refinancing product ~ 30 basis points higher than traditional product – SBA expects higher default of this tranche of SBA loans Borrower historically must been current on debt service payments Partial Refinancing (permanent) and Total Refinancing (expires 9/30/12) All electronic processing - doesn’t directly affect the lenders or borrowers, but it does reduce costs of product (shipping & handling) and expedites processes Expanded the definition of small businesses $15MM NW & $5MM PAT Maximum loan increased from $2MM to $5MM Waived most SBA fees for parts of 2009 & 2010 David C. Long 1-877-504-SPOT david@hbcloans.com