TEMPORARY 504 DEBT REFINANCE LOAN PROGRAM

SMALL BUSINESS JOBS ACT of 2010

TEMPORARAY 504

DEBT REFINANCING LOAN

PROGRAM

NAR, May 16, 2012

1

Today’s Program

Agenda

• Temporary 504 Debt Refinance Loan

Program

• Permanent 504 Loan Program

– Basic Program

– Permanent 504 Refi Program

504 Portfolio : 56,677 loans, $23.8 B in 504 loans;

$53.5 B in total project financing outstanding!

2

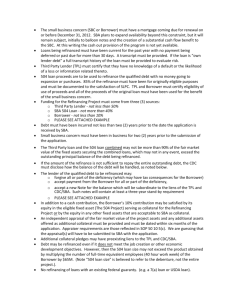

TEMPORARY 504 DEBT

REFINANCE LOAN PROGRAM

What is it for?

• To refinance owner-occupied commercial property and equipment (not already government guaranteed)

– Debt must be at least two years old

– Can finance up to 90% of current appraised value

– With sufficient equity, other businesses expenses and debt can be financed

3

TEMPORARY 504 DEBT REFINANCE

LOAN PROGRAM (CONT’D)

• Works like regular 504

• Equity in other fixed assets can be pledged to increase the financing

• Lock in long-term, low fixed-rate financing for working capital as well as real estate (about

5% or less)

• Must be current (on agreed upon terms the past 12 months

Expires September 27, 2012

4

EXAMPLE CASE STUDY #1

Refinancing Using Equity in the Property

Appraised Value of Property $1,400,000

Outstanding Balance of Debt $1,260,000

90% LTV $1,260,000

• First Mortgage Loan

• SBA 504 Loan

$700,000

$560,000

• Borrower Equity Contribution $140,000

Borrower uses equity in property to lock in 44% of debt at long-term, low fixed-rates

5

EXAMPLE CASE STUDY #2

Maximum Working Capital

Appraised Value of Property $1,400,000

Outstanding Balance of Debt $1,000,000

90% LTV $1,260,000

• First Mortgage Loan $700,000

• SBA 504 Loan $560,000

• Borrower Equity Contribution $140,000

• Proceeds for Working Capital $260,000

Borrower benefits from lower cost working capital and

44% of debt at long-term, low fixed-rates

6

EXAMPLE CASE STUDY #3

Other Collateral Added to the Deal to Maximize SBA Debt

Appraised Value of Property $ 800,000

Outstanding Balance of Debt $1,000,000

Appraised Value of Other

Pledged Collateral

80% of Total LTV

$ 600,000

$1,120,000

First Mortgage Loan

SBA 504 Loan

$560,000

$560,000

Borrower Equity Contribution $280,000

Available for Working Capital $120,000

Borrower gets:

- 50% of their debt fixed

- to refinance an underwater loan

7

- working capital

7

Resources

For more information about the Jobs Act 504

Debt Refinance Program contact: jobsact_debtrefinancing@sba.gov

To find a SBA Certified Development Companies that service you area :

• Contact the nearest SBA SBA District Office

• www.sba.gov

Or:

Linda Reilly, Financial Analyst

202-205-9949 linda.reilly@sba.gov

8