Distributed Generation - National Energy Marketers Association

advertisement

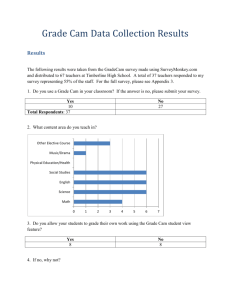

Distributed

Generation

The Next Wave of the

Technology-Enabled

Revolution

Presentation to the

Edison Electric Institute

DG Task Force

June 2001

Marc w. Goldsmith

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

1

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

2

Distributed Generation

Industry Context

The energy industry is changing. Among the more successful players are

those companies we have identified as “innovation energy.”

60

BG

“Innovation Energy”

Enron

E&P companies

Utility companies

50

AEP

40

Dynergy

P/E

Ratio

(%) 30

TFE

Centrica

Duke Energy

20

ExxonMobil

Repsol

Texaco

10

“Conventional Oil”

ENI

TXU

Shell

BP

Source: Winthrop Corporation

0

0

50

100

150

200

250

300

350

Market Capitalisation ($bn)

CAM

MG10956

3

Distributed Generation

Innovation

Enron’s reputation for innovation has enabled it to consistently outperform its peers in total shareholder return.

1000

900

ENRON

800

700

Premium

600

500

400

300

200

Peergroup Average

100

0

1/1/92

1/1/93

1/1/94

1/1/95

1/1/96

1/1/97

1/1/98

1/1/99

1/1/00

CAM

MG10956

4

Distributed Generation

Innovation & Technology

We expect energy companies will leverage innovation and technology to

close the widening growth gap.

The Innovation

Challenge:

Closing the Growth Gap and Building

Confidence for the Longer Term

How to Target

Earnings Growth

New Markets and

Ventures (Beyond

Bulking Up)

Earnings Growth

New Rules and

Standards (Beyond ISO

9000)

New Methods and

Processes (Beyond

Continuous Improvement

New Products and

Services (Beyond

Line Extensions)

Projected Business Growth: What worked

Total Anymore

Quali

Before Doesn’t Work

Through

Conventional

M&A, TQM,

BPR, and NPD

Base Business

Today

Tomorrow

CAM

MG10956

5

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

6

Distributed Generation

Threat or Opportunity Company-Specific

Generally it is corporate strategic perspectives and/or operational focus

that determine whether companies see DG as a threat or an opportunity.

Potential Opportunity

Generator

Transmission

Company

Potential Threat

•

•

Distributed virtual power plants

O&M service

•

•

•

Direct kW/kWh competition

Impact on standard cost recovery

Air quality impacts

•

Some potential increase transfer

capability

•

•

Little direct impact

Long-term stranded costs

•

•

•

•

System by-pass

Negative operational impact on

distribution system (system protection

outage recovery)

Impact on metering systems

Distribution

Company

•

•

•

New service offerings (DG ISO/PX)

Tool to help manage system growth in

de-regulated environment

Potential impact on distribution

systems design

Reliability and maintenance

Substitute for new construction

Electricity

Company

•

•

New product opportunity

New service opportunity

•

New market entrants with a

differentiated product

•

•

•

Innovative image

Reliable image

Hedge on disruptive technologies

•

•

Uncertainty of reward

Loss of traditional revenue sources

Corporate

•

CAM

MG10956

7

Distributed Generation

Threat or Opportunity

Overview

Distributed Generation (DG) has provoked significant interest and

investment from energy companies…

Definition of Distributed Generation

Integrated or stand-alone use of small

modular resources by utilities, electricity

customers, and third parties in applications

that benefit the electric system, specific

electricity users, or both.

Often synonymous with other commonly

used phrases like: self-generation, on-site

generation, combined heat and power

(CHP) or cogeneration, and "inside the

fence" generation, our definition includes

storage, superconducting and demandside management technologies.

Central Plant

Step-Up

Transformer

Distribution

Substation

Gas

Turbine

Transmission

Substation

Distribution

Substation

Fuel Cell

Distribution

Substation

Microturbine

Commercial

Recip

Engine

Photovoltaics

Gas

Turbine

Flywheel

Residential

Industrial

Fuel

Cell

Commercial

Cogeneration

Adapted from EPRI Distributed Resources Target

… If deployed on a widespread basis distributed generation represents

a fundamental shift in the electricity industry.

CAM

MG10956

8

Distributed Generation

Threat or Opportunity

Emerging Opportunities

Several forces are aligning to create opportunities for DG.

Increased risk in large

power plant

construction

Unbundling of

traditional, vertical,

integrated utilities

Difficulty siting T&D

and large plants

Emerging

Distributed

Generation

Opportunities

Advances in

communications &

control technologies

Slower demand

growth

Reliability and power

quality concerns

Improved

distributed power

technologies

CAM

MG10956

9

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

10

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

11

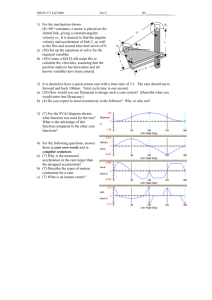

Distributed Generation Technology

Availability

There are several commercially available and emerging DG technologies.

Commercialization Status of DG Technologies

Research &

Development

Demonstration

Initial System

Prototypes

Refined

Prototypes

Commercial

Prototypes

Market

Entry

Market

Maturity

Market

Penetration

Fuel Cell

Microturbine

PV Solar

Recip Engine

Gas Turbine

• Fuel cells provide electricity and thermal services to buildings

• Proton Exchange Membrane (PEM) fuel cells are being developed for transportation applications

• If fuel cell transportation market develops, it would greatly accelerate the fuel cell market for stationary applications

• Microturbine technology was initially developed for transportation, defense and aerospace applications but now shifted to powergen

• Projected to have low capital cost, low maintenance cost, low emissions, low noise, and moderate efficiency

• Photovoltaic semiconductor-based panels convert sunlight into power

• Ideally suited and cost-effective for many off-grid applications

• Still relies on government subsidies for grid-connected use, but price is steadily dropping

• Diesel or gas recip engines packaged for power generation

• Used widely for standby, baseload, cogeneration, and peaking

• Drawbacks: emissions, noise, and high maintenance cost

• Most products available were initially developed for mechanical drive applications

• Majority of power generation applications are cogeneration or standby

• Limitations are relatively high first cost and low efficiency

CAM

MG10956

12

Distributed Generation Landscape

DG Technologies

Characteristics and Applications

Commercial

Availability

Efficiency (%)

Remote/Off-Grid

Distributed

Grid-Distributed

Industrial

Commercial

Residential

Each of these DG technologies has distinctive performance characteristics

that best fit the needs of different applications.

Typical Unit Size

Range

(installation size

can be larger)

2000

Installed

Capital Cost

($/kW)

25 - 500 kW

1,000-1,300

22-30

2000

Reciprocating Engines

5 kW - 20 MW

400-6002

28-40

Now

High-Temperature Fuel

Cells

50 kW - 3 MW

NA3

45-55

2003

PAFC

50 - 500 kW

3,000+

34-40

Now

PEM

1 - 250 kW

NA4

30-40

2001+

500 kW - 20 MW

650

25-405

Now

0.5 - 200kW

NA6

20-32

2001+

0.05 - 200kW

6,000 -10,000

12-13

Now

Microturbines1

Low-Temperature Fuel Cells

Small Gas Turbines

Stirling Engines

Photovoltaic Cells

Primary Target Market

Secondary Target Market

1. Recuperated microturbine

2. Large, gas-fired reciprocating engine

3. Not available; projections of $1,000-$2,000

4. Not available; projections of $1,000 - $2,000

5. 40% efficiency achieved with advanced turbine cycle

6. Not available; projections of $700-1,500/kW

CAM

MG10956

13

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

14

Distributed Generation Landscape

Disruptive Technologies Applications

There are many DG applications emerging in both developed and

developing countries.

Commercial Building Segments

Reliability

Assembly

Education

Food Sales

Food Service

Health Care

Lodging

Retail

Office

Public Order

Worship

Warehouse

Multi-Family Residential

Farms

Power Quality

On-Site Baseload

Peaking

Industrial Segments

Food

Textile

Furniture

Paper

Pharmaceuticals

Stone/Clay/Glass

Primary Metals

Fabricated Metals

Machinery

Electronics

Transportation

Cogeneration

Remote

Portable

Landfill gas

Biomass

Residential

Power Delivery Business Needs

System Performance

•

•

•

System capacity

•

•

•

Microgrids

Avoided system improvements and capacity upgrades

Improved capacity utilization system optimization

Reduced power losses

System Maintenance

•

•

Grid Support

Service reliability

Power quality

Power transfer capability

Temporary power during maintenance of critical elements

Emergency power during system restoration

Financial Hedge

•

•

•

Energy cost reduction

Portfolio risk management

Financial resource management (capital and O&M)

CAM

MG10956

15

Distributed Generation Topics

Economics

Customer Benefits

There are benefits that DG can provide to customers that must be

considered in assessing DG economics.

ISO New England Market Clearing Price

Market Clearing Price ($/MWh)

$1,200

$1,000

$800

$600

$400

$200

$0

May 1, 1999 - April 9, 2000

• Reduced energy costs for thermal

energy loads (steam, hot water and

cooling)

• Decreased exposure to electricity

price volatility

• Increased power reliability

• Improved power quality

• New sources of revenues

CAM

MG10956

16

Distributed Generation Topics

Economics

Grid-Side Benefits

There are also benefits on the grid-side that will also impact DG economics.

•

•

•

•

•

•

•

•

•

•

Avoided increases in system capacity

Reduced transmission and distribution (T&D) electric losses

T&D upgrade deferrals

VAR support

Transmission congestion relief

Peak shaving

Reduced reserve margin

Improved power quality

Improved power reliability

Avoided T&D siting concerns

CAM

MG10956

17

Distributed Generation Topics

Economics

Added Costs for Customer

Besides benefits there are additional costs to the customer when

installing DG.

• Typical additional costs when installing DG, include:

– Standby charges

– Exit fees

– Competitive transition charges (CTC)

– Additional incremental capital costs for interconnection and

permitting

• These added costs are extremely site-specific, and vary widely

state by state.

CAM

MG10956

18

Distributed Generation Topics

Economics

Benefits and Costs

The attractiveness of DG will vary by these added benefits and costs

that will fluctuate by fuel and electricity prices.

4.2 MW Gas Turbine

12

11

5-year payback

with customer or grid

benefits

1998 Gas Prices ($/MMBtu)

10

9

5-year

payback

8

MA

7

FL

VA

AZ

6

CA

5

5-year payback

with added

NY

cost

IL

TX

4

3

2

4

5

6

7

8

9

10

11

12

1998 Electricity Prices (¢/Kwh)

CAM

MG10956

19

Distributed Generation Topics

Economics

Vertically Integrated Utility

DG could be an attractive option for the vertically integrated utility if their

system is constrained.

Range of Utility Costs to Meet New Demand

na

r

io

s

in

ts

Al

lS

on

st

C

N

o

ce

ra

...

io

n

G

en

er

at

io

n.

..

ns

m

is

s

a.

.

Tr

a

io

n

at

G

en

er

Costs to

Meet New

Demand

($/Kwh)

0.24

0.2

0.16

0.12

0.08

0.04

0

Central Plant

Distributed

Generation

CAM

MG10956

20

Distributed Generation Topics

Economics

Wires Company

DG could be an attractive option for a wires company in lieu of system

expansion.

Range of Utility Costs to Meet New Demand

0.16

0.12

Range of

Utility Costs

to Meet New

Demand

($/Kwh)

0.08

0.04

0

Transmission and

Distributed

Constrained

No Constraints

Central Plant

All Scenarios

Distributed

Generation

CAM

MG10956

21

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

22

DG Going Forward

Market Perspective

The DG opportunity will come in waves.

Watt

Wave

Kilowatt Wave

Megawatt Wave

Why?

•

•

•

•

Technology availability

Transaction and project costs ($/kW)

Project economics

Receptive customers

– Large commercial and industrial

– Wires companies

CAM

MG10956

23

DG Going Forward

Market Perspective

What does the Megawatt wave look like?

• Gas turbines, reciprocating engines, photovoltaics

• Customer needs - price volatility and reliability

– Rentals

– Back-up generation plus DG

– Capacity

– T&D support

– Hedge

• Still traditional players

– Equipment suppliers

– Gas and electric utilities

– Wires companies

– Large customers

CAM

MG10956

24

DG Going Forward

Market Perspective

What does the Kilowatt wave look like? The Megawatt wave with more

uncertainty.

• Microturbines and fuel cells

• Drivers?

–Power quality

–Image

–Green power

–Cost savings

• Seamless direct access to

markets

• Traditional players

–Moving down and up value chain

–Creating new value networks

• Nontraditional players?

–Market channels

- Appliance manufacturers

- Consumer products

- HVAC suppliers

- Retail (Home Depot, Walmart)

- e-business

–Equipment suppliers

–Automotive

–Appliance

–HVAC

–Consumer

–Energy suppliers

- Large and small C&I (telecom,

supermarkets)

- Residential

–Customers

- Residential

- Small commercial

–Large energy companies

CAM

MG10956

25

Back-up Generation Market Review North American Market

The North American back-up generation market continues to grow steadily,

driven by the < 2 MW recip engine segment.

Annual Sales (US$M)

North American Market for Backup Generators

5500

5000

4500

4000

3500

3000

2500

2000

1500

1000

500

0

1992

Market Trends for Backup Generators

• The gas turbine and > 2 MW reciprocating engine

markets both maintain a 2% CAGR, while < 2 MW

reciprocating engines maintain a 7% CAGR.

GT Backup

Recip Backup >2MW

• Post Y2K markets for standby generators are

primarily: data centers, internet applications and

telecom. These segments make up roughly 50% of

standby generator market.

Recip Backup <2MW

• Recip engines now dominate this market, but they

may see competition from fuel cells and

microturbines as the technologies develop.

• Sales of backup generators to utilities and endusers will continue to be driven by reliability

concerns.

1994

1996

1998

2000

2002

2004

• There is increasing interest in using backup

gensets for peak shaving/DG, but there are barriers

(interconnection and emission standards).

Annual sales based on Power Systems Research and “Diesel and Gas

Turbine Worldwide” historical data (1992-1999) and ADL analysis.

CAM

MG10956

26

Distributed Generation Markets DG Market and Reliability Pockets of System Weakness

Generation and transmission constraints and reliability concerns are

creating near-term opportunities for DG.

New York City/Long Island

Wisconsin/Upper Michigan

Lack of transmission

capability between upper

Michigan and Wisconsin has

resulted in congestion.

California

Generation shortages

and transmission

constraints result in

repeated voluntary load

shedding and rolling

blackouts during 20002001

WSCC

Peak demand growth

has exceeded new

generation capacity.

The southwest

portion of WSCC may

not have adequate

resources for

widespread heat

waves.

Dallas-Fort Worth

NYC and Long Island have a

peak load of 14,840 MW with a

combined capacity and import

capability of 19,021 MW.

With demand growing, ISO

published that ‘”after summer

2000, the New York Control

Area will not be able to meet

NPCC adequacy criteria.”

S. Illinois

PJM

PJM has issued 19

Emergency

Generation actions

and/or Manual Load

Dump Warnings,

including 2 days of

voluntary load

shedding in 2000.

Texas

ERCOT issued 10

incidents of voluntary

load curtailment

resulting in 9,407 MW

shed as of September

2000.

ISO NE has issued

6 voluntary load

curtailments in 2000

and 11 during the

summer of 1999.

Boston/Connecticut

Congestion in

Southern IL due to

the shipment of

power to the south.

Dallas-Fort Worth has

800-1,000 MW annual

load growth and

insufficient generation

and transmission

capacity into the area.

New England

Houston

Houston has excess

generation but lacks

export transmission

capability.

Transmission into

Boston is often

heavily congested.

Connecticut also

has congestion

problems.

Delmarva

S. Delmarva had 13

Emergency generation and/or

manual load dump warnings in

Summer 2000, and continues

to pose problems to grid. No

grid upgrades are planned as

S. Delmarva is rural.

CAM

MG10956

27

Distributed Generation Markets

Case Study

Commonwealth Edison

Commonwealth Edison has been using DG for capacity and system

support during peak periods over the last three summers.

Recip Engines installed by ComEd

for system support

Over the past 3 summers, ComEd bolstered its

system with rental recip engine packages

350

• Modular diesel generators installed in

groups of 20 to 30

• 160 Caterpillar Power Modules producing

240 MW at 8 locations

– trailer-mounted units driven to location

– units have on-board fuel capabilities

• 60 Aggreko container generators

producing 60 MW at 2 locations

– unloaded using cranes

– standard design, e.g., switchgear is

same from unit to unit

• Setup takes about 1 month for the

Caterpillar units and within 1 week for the

Aggreko units

Summer Installed Capacity (MW)

300

250

200

150

100

50

0

1998

1999

2000

Source: PMA Online

In the summer of 2000, ComEd began to use

small gas turbines as well.

• In each of the three years ComEd has used

DG, they have looked at alternatives to recips,

including GTs

• Low emissions, a feature of GTs, are an

increasing large concern for users of DG,

particularly in urban areas where air quality

may be poor

• In summer of 2000, ComEd rented

5xTM2500’s (22.8MW each) from GE Rentals.

CAM

MG10956

28

Distributed Generation Markets

Back-up Generation

Texas

Based on prior ADL analysis, there are potentially 3,300 MW of operable

gensets available in Texas.

Population of Gensets Available in Texas

600

< 1 MW

Continuous

15%

> 1 MW

400

Peaking

4%

300

200

100

Standby

81%

0

19

77

19

78

19

79

19

80

19

81

19

82

19

83

19

84

19

85

19

86

19

87

19

88

19

89

19

90

19

91

19

92

19

93

19

94

19

95

19

96

19

97

19

98

Gensets Available (MW)

500

Applications of Available Gensets

Cumulative Capacity of Gensets Installed

in Texas: 3,300 MW

The vast majority of the gensets are less than 1 MW in size and were

originally designed for standby application. About 1/3 might be convertible.

CAM

MG10956

29

Distributed Generation Markets

Uncertainties

While the market potential is very large, the development of DG still carries

some fundamental uncertainty…

Which technologies (and

suppliers) will be the

winners?

No single technology is likely to dominate, some will fail; there will

be different speeds to market.

How soon will technical

uncertainties be resolved?

Most technical uncertainty is likely to be resolved (eventually), but

not as quickly as predicted and with unexpected barriers.

Fit With

Needs?

Will product attributes find a

match with customer needs,

enabling a winning product?

A key issue that involves technology, product and business/

service model components - a 50/50 proposition at this point.

Disruptive

Potential?

Will customers find “value”

in other than commodity

electricity?

The great unknown - a lot of speculation, but none identified yet.

The key to Distributed Generation’s real potential to revolutionize.

Economics?

Will the economics work at

application and business

levels?

Economics vary widely from application to application, with

several areas of uncertainty. Although there will be attractive

applications, mass market economics will be more difficult than

assumed.

Regulatory

Environment?

Will a supportive regulatory

environment emerge?

A regulatory environment which is technology neutral is likely to

emerge. Disruptive triggering events could tip the scale.

Winning

Technology?

Technology

Development?

CAM

MG10956

30

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

31

DG Policy Overview

Impact Analysis

We measured the impact of eight DG policy issues against five broad

public policy objectives and on DG-specific policy.

DG Policy Issues

• Grid-side benefits

• DISCO participation

• Interface with grid

• Interconnection

• Stranded costs

• Stand by charges and customer

retention tariffs

• Siting and permitting

Public Policy Objectives

• Encourage competition and economic

efficiency

• Protect consumers from cost-shifting

• Maintain a viable utility franchise

• Protect the environment

• Ensure safety and grid reliability

• Create a competitive environment for

DG

• Public support

CAM

MG10956

32

DG Policy Overview

Impact Analysis

The analysis linked eight DG policy questions most directly with two major

regulatory policy objectives, and five questions had a high impact on the

policy goal of a competitive environment for DG.

DG Policy Questions

Major regulatory policy objectives

Encourage competition and economic efficiency

Ensure safety and grid reliability

Priority DG issues for creating a

competitive environment for DG

System interfaces

Interconnection

Siting and permitting

Stranded costs

Standby charges

CAM

MG10956

33

DG Policy Overview

Impact Analysis

Among the eight DG policy questions, five had a high impact on the

policy goal of a competitive environment for DG.

• Engineering connections and market access.

System Interfaces

Interconnection

• High technical complexity vs. additional capacity for

T&D system, customer market access and operational

flexibility.

• Technical requirements, processes and contracts

modified for DG?

• Safety and reliability vs efficiency and fairness.

CAM

MG10956

34

DG Policy Overview

Priority Issues

Among the eight DG policy questions, five had a high impact on the

policy goal of a competitive environment for DG. (continued)

Siting and

permitting

Stranded Costs

(CTCs and exit

fees)

• Streamlined process vs. adequate consideration.

• Environmental goals vs. reliability and other public

policy objectives.

• Potential high assessed costs (disproportionate to cost

of DG project) that discourage innovative solutions that

are more efficient and cost effective vs. recognition of

past investment and loss of load.

• Scale of DG threat to load vs. customer choice and

opportunity for system improvement.

Standby Charges

• Excessive (e.g., no recognition of combined reliability

of DG units) vs. too low (no recognition of cost of

backup power on spot markets.

• Cost to utility vs. benefit to system and customer.

CAM

MG10956

35

DG Policy Overview

Additional Key Issues

Three other key policy questions were identified in the analysis.

Grid-side Benefits

Stranded Costs

(CTCs and exit

fees)

Public Support

• Correct price signals by sharing DG benefits and costs

among appropriate parties vs. difficulty of calculating

these benefits for local conditions.

• Best position to recognize best DG opportunities in

distribution network vs. unique access to customers

could threaten open markets and customer choice.

• Alternatives to ownership that share benefits.

• Active encouragement of commercialization of advanced

technologies to provide public benefits (e.g., improved

system reliability, climate change, energy efficiency) vs.

distorted price signals and pursuit of poor technical risks.

CAM

MG10956

36

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

37

DG Business Models

Developing a DG Business

In order to assess the total value of a distributed generation business,

revenue from all segments of the value chain should be considered.

Marketing & Sales

Marketing

Sales

- Advertising

marketing

collateral

- Sales force

- Customer

analysis

- Account

management

- Training

Product Development & Supply

Manufacture

- Technology

core

- Equipment

selection

- System design

- Pricing

decisions

- Financing

packages

- Fuel cells

- Battery storage

- Small GTs and

microturbines

- Small IC

engines

- Automation/

diagnostics

- Photovoltaics

- Flywheels

- Power

electronics

- Switchgear

- Controls

Packaging

Financing

- Generation

- Marketing

- Distribution

- Service

requirements

- Storage

- Portable

systems (e.g.,

barge, truckmounted)

- Sales/lease

Operations

Distribution

&

Installation

Fuel

Supply

- Distribution

networks

- Structuring

contracts

- Dedicated

sales staff

- Gas marketing

Operate

Service

Service

Delivery

Maintain

- Savings levels

- Billing

- Performance guarantees

- Payment terms

- Outage arrangements

- Customer

satisfaction

- Electric

marketing

- Noise and environmental

- Fuel switching

- Customer interfaces

- Operating

strategies

- Maintenance services

- Remote multi-node

system control

- Operate/maintain facilities

network

- Managing end-user

systems

- Service/overhaul centers

- Ownership of

distributed systems

- Contingency

planning

- Service

- Hedging

strategies

- TQM strategy

- Fuel management

acquisition/ storage service

- Replacement packages

- Providing energy

services

- Performance/monitoring

maintenance management

system

Arthur D. Little’s approach is designed to assist in assessing the fit

where there is substantial business in the DG area.

CAM

MG10956

38

DG Business Models

Utility Business Strategy

Competing Players and Strategies

Although a number of approaches are being tried, the winning strategies

are yet to emerge, giving the new entrant significant strategic freedom.

Strategy

Core Component Technology

Supplier

Key Players

Howmet

Ballard

Visteon

Delphi

Key Discriminators

•

•

Strong proprietary technology position

Unique production capabilities

Equipment Package Supplier

AlliedSignal

Plug Power

Capstone

•

•

Efficient production processes

Strong product design capabilities

Exclusive Regional Distributor

Unicom

DTE Energy

GE Power Systems

•

•

Regional market and distribution channels

Ability to manage inventory risk

Turnkey Customer Solution

Provider

Sempra

PSEG

Williams

•

•

Creative solution design capabilities

Access to product and technology

solutions

Field Service Provider (Install,

Operate, Maintain)

Honeywell

•

•

Extensive contractor network

Efficient dispatch and field support

processes

Energy Service Provider

Enron

Duke

•

•

Energy marketing and trading capabilities

Ability to manage technical and economic

risks

CAM

MG10956

39

DG Business Models

Market Potential

Formation

Because DG technologies, business models, and regulatory frameworks

are still embryonic, there is significant uncertainty in key market drivers.

Technologies

Business Models

Regulatory Frameworks

• Microturbines nearing

commercial status - beta

units in the market today

• Fuel cells

– PEM nearly commercial;

residential beta units

available by mid-2000

– SO commercial by 2005

• IC engines established incremental improvements

• Supporting technologies

(power conditioning, fuel

processing) developing

rapidly (costs still high)

• No clear winning business

model (yet)

• Equipment supply and

distribution channels

forming

• Commercial & Industrial

business models tend to

focus on energy service

(similar to traditional

ESCO)

• Residential business

models aim toward

eventual mass market

• Emerging in several states

(CA, TX, PA, NY, OH) as

part of deregulation - some

allowing DG net metering

• Interconnection standards

now being developed

(IEEE)

• Duration and level of

competitive transition

charges and impact on DG

varies

• In a number of states,

there is no penalty for

disconnecting from the grid

CAM

MG10956

40

DG Business Models

Business Opportunities and Risks

The emergence of distributed generation creates both important

opportunities and risks for utility businesses.

Unregulated Utility Business

• Increased portfolio of products, services

and technologies to support turnkey

customer solutions offerings

• Potentially large, new markets for

innovative DG products and services (e.g.,

residential)

• New value chain and industry structure

create opportunities for alliances and equity

investments

• Risk that national and global scale

companies (GE, auto manufacturers, megaESCOs) will capture bulk of market

• Risk that technologies or disruptive market

potential do not develop

Re

gulated Utility Business

• Risk of stranded investments (especially

T&D) as end-users adopt DG solutions

• Opportunity for DG to economically

displace required T&D investments

• Both opportunities and risks created by

introducing end-user DG adoption into the

regulatory equation

– Potential ongoing role for T&D utilities as

small-scale generators

– Will equitable costs of providing standby

power be recovered?

– Added uncertainty in forecasting for

regulated rate development

CAM

MG10956

41

DG Business Models

Strategic Option Identification Value Chain

Analyzing the value chain, under alternative future scenarios is another

tool to identify potentially attractive strategic options.

Equipment Supplier

Core

Component

DR value creation C&I

by VC Segment

1includes

Equipment

Core

Integration /

Component Packaging

26%

Res

Operator

and

Maintainer

Product Distributor and Supplier

Equipment

Sales and

Distribution

8%

33%

7%

System

Design and

Sales

Installation

and Interconnection

Financing

Operation

and

Maintenance

5%

7%

1%

4%1

5%

6%

1%

Energy

Provider

Energy

Service

Fuel

Delivery

48%

10%

1%

37%

1%

replacement parts

System Designer

and

andSeller

Seller

Strategic Technology/

Product Investor

Equipment Seller

and Distributor

• Able to achieve

synergies with other

business areas of the

investor

• Complete distribution

network

• Innovative product and

services

• E-commerce capability

(or alliance)

• Financial staying power

• Secure exclusive

distribution rights for

key products or

technologies in the

region of interest

• Brand recognition

• Strong system and

application

engineering

capabilities

• Well-established

relationship with DR

equipment suppliers

Financing

Financing

Supplier

Provider

• Experience in

consumer

product finance

Equipment/System

Equipment/System

Installer

Installer

• Make DR equipment/systems

transparent to the end-users

• Expertise in system/process

optimization

• Provide integrated valueadded gas/electric solutions

FuelFuel

Supplier

Supplier

• Ability to provide

customers with

multiple gas supply

options

• Comprehensive fuel

sales and distribution

network

Operation and

Maintenance

Maintenance

Provider

Provider

• Rapid accessibility

of O&M personnel

to customer sites

Energy

Energy Services

Services

Provider

Provider

• Broad portfolio of

energy services

package offerings

• System/product

monitoring

capability

CAM

MG10956

42

DG Business Models Utility

Business Strategy

The Challenge

The challenge: to capture the opportunities from DG, companies must

act quickly, but without enough information to fully resolve uncertainty.

Potentially

Large

Opportunity

DG presents potentially

attractive opportunities . . .

Unresolved

Uncertainty

Near-Term

Delay

Diminishes

Strategic

Position

• Commercial/small industrial DG products/services

• Residential DG products/services

• Equity investment opportunities (DG technologies

and innovative DG product/service elements)

. . . about which there is

substantial uncertainty

which won’t be resolved

in the near term . . .

•

•

•

•

Technology commercialization

Technology economics

Disruptive product attributes

Competitive intensity

. . . and upon which a

• Competitors moving now

company must act soon, or • Diminishing alliance options

significantly diminish its

• Losing first mover advantages

future DG strategic

• Disadvantaged learning curve position

position.

CAM

MG10956

43

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Industry

Wires Perspectives

Interconnection

Iso’s and Grid

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

44

Distributed Generation Industry

Wires Perspective

DG Concerns

Wires companies are concerned about the DG technologies and how

they would interact with the grid.

90

80

70

60

50

40

30

20

DG Equipment related concerns

Other

Islanding

Slower Service

Restoration for

Those Without

DG

Safety to

Workers

Reduced System

Protection

Quality Control

0

Inconsistent

Maintenance

10

Negatively

Impact Reliability

% of Respondents Who Agree

100

Grid-related concerns

Source: Arthur D. Little Interviews with 14 U.S. electric distribution companies.

CAM

MG10956

45

Distributed Generation Industry

Wires Perspective

DG Potential Benefits

Most wires companies consider DG’s potential to augment the T&D

system as its most important benefit.

100

% of respondents who agree

90

80

70

60

50

40

30

20

10

Other

Provide Fuel

Diversity

Defer T&D

Expansion

Relieve

Transmission

Congestion

Reduce T&D

Losses

Provide/Reduce

Reserve margin

Provide Reactive

Power

Deliver Ancillary

Services

Provide Black

Start Capability

Provide Additional

Capacity

0

Source: Arthur D. Little Interviews with 14 U.S. electric distribution companies.

CAM

MG10956

46

Distributed Generation Industry

Interconnection

The interconnection black box provides protection for the customer’s

and the utility’s equipment, safety of line workers as well as the parallel

operation of the DG with the utility grid.

TYPICAL GENERATOR PROTECTION

TYPICAL UTILITY PROTECTION

52 TRIP SIGNAL

52 TRIP SIGNAL

CTs

(3)

CTs

(3)

52

27

59

81

O/U

PTs

86

87G

32

RV

46

CTs

(3)

52

32

27/

59

47

81

O/U

PTs

86

87T

50/

51

32

CTs

(3)

FROM 87G

51N

50/

51

FROM 87T

GEN

TO 86

40

CTs

(3)

C

T

TO 86

ALTERNATE

C

CTs T

(3)

51G

51G

INCOMING UTILITY

21 - Distance relay

25 - Sync check relay

27 - Undervoltage relay

32 - Reverse power relay

32RV - Reverse vars (loss of excitation)

40 - Loss of excitation

46 - Negative phase sequence time overcurrent relay

47 - Voltage sequence/undervoltage relay

50 - Instantaneous overcurrent relay

51 - Time overcurrent relay

51G - Ground overcurrent relay

51N - Residual ground overcurrent relay

52 - Circuit breaker

59 - Overvoltage relay

59G - Ground overvoltage

81O/U - Over/under frequency relay

86 - High speed lock-out relay

87G - Generator differential overcurrent relay

87T - Transformer percentage differential overcurrent

relay

Source: Enercon Engineering

CAM

MG10956

47

Distributed Generation Industry

Interconnection

Levels of Complexity

Grid interconnection and process has emerged as an important issue

for multiple reasons.

• The number of small generators seeking interconnection to the grid could

increase in the future which will present stakeholders with:

– Increased burden for processing

– Potentially negative impact on the system

– Potentially positive impact on the system if done properly

– Opportunity for standardization and thus reduce costs

• DG advocates contend that the current interconnection requirements and

approval processes are effectively increasing costs unfairly and pricing DG out

of this market (negative history of cogen).

• Distribution companies are concerned that DG will negatively impact the safety

and reliability of the grid, and unfairly increase the distribution companies’

costs.

• ISO/RTOs may add another level of complexity relative to metering, scheduling

and settling DG accounts and vice versa.

CAM

MG10956

48

Distributed Generation Industry

Interconnection

Issue Summary

There are three overlapping elements of interconnection that must be

addressed together.

Process

Technical

Contract

CAM

MG10956

49

Distributed Generation Industry

Interconnection

Technical

The technical issue revolves around having a safe, reliable, meterable

and standardized interconnection.

• Existing requirements perceived by some as

unreasonable

• To ensure safety and reliability, utilities must

test each alternative solution before it can be

integrated with the distribution system

• Technical requirements vary by utility

• Utilities give the minimum requirements that

may change with each interconnection

Process

Technical

Contract

• Alternative solutions/ technologies (new and

existing) particularly for integrated devices are

not readily accepted by utilities

• Existing requirements do not account for

emerging applications and needs for dispatch,

metering and power quality

CAM

MG10956

50

Distributed Generation Industry

Interconnection

Issue Summary

Interconnection processes vary widely across the country in that some

are reasonable and others are lacking or onerous.

• Lack of defined process at some utilities,

ISOs, RTOs ; or process and technical

requirements limited to Qualifying Facilities

• Perceived lengthy, onerous process

• Process controlled by entities that view DG as

competition

• Utilities’ process can be an early warning

system of loss of customers and respond with

reduced rates

• Lack of timely and efficient settlement of

disputes

• Results of interconnection analysis not always

made available to customers

• Customers must pay for studies the utility

performs on interconnection based on fees

set by the utility

• Interconnection studies are required in some

states no matter the size of the facility

Process

Technical

Contract

CAM

MG10956

51

Distributed Generation Industry Interconnection

Issue Summary

Contract terms are overwhelmingly in favor of incumbent wires companies.

• Lack of standardized utility contracts for

interconnection.

• Those that exist are more complicated

than necessary for DG.

• Contract length and complexity not in line

with DG facility’s impact on the grid

• Contracts not reciprocal in terms of liability

and indemnification (e.g. universal

indemnification required by some utilities)

Process

Technical

Contract

• Interconnect agreements require

customers to carry general liability

insurance to cover utility’s interests

CAM

MG10956

52

Distributed Generation Industry

Current DG Programs

Utility and ISO Examples

There are several examples of ISO and utility programs that now

incorporate DG.

Utility/ISO

Strategy

Program Size

New York Power

Authority

Program created in Summer of 2000 and scheduled to go online

Summer of 2001. Created to meet New York Power needs.

500 MW

Commonwealth

Edison (ComEd)

Program created to begin in Summer of 2000 to meet market demand

and relieve constraints on distribution system.

>400 MW

Kansas City Power

and Light

Program designed to reduce utility’s generation costs during times of

peak load via DG located on the grid.

30 MW

Portland General

Electric

Program locates utility-owned assets on the grid created to increase

generation capacity and reduce customer costs during times of peak

load.

Currently has 30 MW generating capacity

with goal of 100 MW for 2005.

Mississippi Power

Program created to provide extra capacity during peak loads and also to

provide customers with improved reliability.

Currently has 20-25 MW generating

capacity.

Illinois Municipal

Electric Agency

Program locates Agency-owned assets at customer sites and pays

customers a capacity fee, Goal is highly reliable energy supply for key

IMEA accounts and lower Illinois Municipal Electric Agencies energy

costs.

183 MW of DG, with JITKA representing

20MW of this total. IMEA plans to

increase to 270 MW of DG capacity in 17

member communities.

Georgia Power

Program created in 1992 to offset peak capacity costs.

CAL ISO

Program designed to increase California’s generating capacity and

improve grid reliability in 2001.

PJM ISO

Pilot Program created to evaluate interconnection issues and DG role in

improving grid reliability through DG at customer sites.

66 MW

2000 MW

80 MW

CAM

MG10956

53

Distributed Generation Industry

ISO Perspective DG Interests and Concerns

In an interview program, ISOs expressed both support and concern over

potential DG use in bulk electricity markets.

ISO Support

• Relatively small amounts of DG capacity

can positively affect reliability and market

pricing under the right circumstances and

conditions

• DG solutions may be more economic than

traditional bulk power engineering solutions,

provide faster solution, and avoid/postpone

more extensive or expensive alternatives

• DG may be next logical broad policy

initiative to complement programs for

bidding load reductions into the market

• DG may be most effective during peak

periods when systems need relief the most

• DG can be a source of ancillary services

• Market opportunities could be structured to

encourage aggregation of DG capacity for

economies of scale

ISO Concerns

• Potential for gaming the system so that

profits are made without improving system

operations

• Rules must avoid both inadequate and

excessive control of DG (e.g., 1 MW

scheduling threshold)

• Transco is prevented from owning

generation; Transco and ISO need to

coordinate with and rely on other parties for

important elements of a reliability solution

• Practical considerations of interconnection

and operation that could affect system

integrity and safety

• Existing technical and economic barriers to

DG (e.g., interconnection, metering and

tariffs)

CAM

MG10956

54

Distributed Generation Industry

Integrating DG with Power Markets

Example

US Postal Service - Anchorage, Alaska

• The US Postal Service facility in Anchorage is just one example of remote

dispatch of DG.

• Opened August 9th, 2000

• “Nation’s Largest Assured Power Commercial Fuel Cell System”

– Five fuel cells connected in parallel to produce 1MW of electricity

– Primary source of power for the US Postal Service Anchorage

facility

– Owned/Dispatched by Chugach Electric

• Fuel Cells provided by International Fuel Cells

• Interconnection, Site Management System and Dispatch Software

provided by GE Zenith Controls

Fuel Cell LSM

Control Signals

Fuel Cell No 1

Fuel Cell

Bus

Fuel Cell No 2

Chugach Electric

Control Center

Telephone Line

Controller

Utility

Grid

SSW

Isolation

Switch

STATIC TRANSFER

SWITCH (SSW)

Fuel Cell No 3

Fuel Cell No 4

Global

Bypass

Fuel Cell No 5

Post Office Load

Source: GE Zenith Controls

CAM

MG10956

55

DG Going Forward

Conclusions

The ever popular conclusions slide

• The Megawatt Wave is happening now.

• Emerging technologies will be better from both an economic and

market perspective.

• DG has the potential to “disrupt” the utility industry.

• There are benefits to customers, wires companies, vertically integrated

companies and the electric system.

• DG implementation will need to be understood and managed to obtain

the optimal benefits.

• Policy and regulatory issues exist and will need to be collaboratively

solved.

CAM

MG10956

56

Contents

1

Distributed Generation and Innovation

2

Distributed Generation: Threat or Opportunity?

3

ADL Research in Distributed Generation

Technology

Economics

Markets

Policy

Business Models

Industry

4

The ADL Difference: Our Expertise and Experience

CAM

MG10956

57

The ADL Difference

ADL is a world leader in its capacity to combine the application of

technology-based solutions to business issues for the energy industry .

Power Generation

Equipment

• Gas turbine

technology

• Fuel cells

• IC engines

• Coal technology

• Energy storage

Renewable Energy

Systems

•

•

•

•

•

•

Photovoltaics

Wind

Biomass

Solar thermal

Hydro

Geothermal

Advanced Energy

Systems

•

•

•

•

Hydrogen generation

Fuel reforming

Battery technology

Electric/hybrid

vehicle

• Hydrogen storage

•

•

•

•

•

•

•

•

•

•

Operational

Efficiencies

Optimal resource

portfolio

Sourcing

economies for the

fuel mix portfolio

Enhancement of

information and

control technologies

Process changes

due to delivering

synergies in power

plant dispatch and

operations

•

•

•

•

•

•

•

•

•

Industrial heating

Burners

Alternative fuels

Air toxics control

Exhaust/flue gas

treatment

Energy

Technology

Strategic

Issues

Strategy

Formulation

Integration of

strategies

Visioning

Planning and

management of

strategic

investments

Technology

management

R&D portfolio

management

Technology

assessment

Combustion

Emissions Control

Organizational

Effectiveness

Optimization of

staffing levels and

skill sets

Best set of

corporate values

Consolidation of

collective

bargaining

agreements

Best set of

compensation and

benefits programs

Financial

Management

• Optimization of

resource portfolio

through asset

management

• Appropriate

financial management practices with

regard to dividend

policy, capital structure and treasury

manage-ment

• Best means to deal

with non-performing

assets

Regulatory Tactics

• Achieving

regulatory flexibility

in a multijurisdictional

environment

• Minimization of

environmental

compliance

program costs

CAM

MG10956

58

Distributed Generation Experience

Utility Business Strategy

Developed the business strategy selected by a major U.S. utility to pursue

growth opportunities related to distributed generation.

The

Challenge

The

Approach

The

Result

Develop a business strategy that positions the

utility to capitalize on growth opportunities, while

managing resources effectively and achieving

synergies with other business areas and initiatives

Identified strategic options along the value

chain, including equipment supply, sales and

distribution, and turnkey end-user solutions,

and using a blend of technologies, internal

capabilities, alliances and equity investments

Screened and evaluated the options based on

business potential, competitive differentiation

and fit with the utility’s overall strategy

Designed a phased, learnings-based approach

and organization to capture the upside, while

maintaining high investment flexibility.

The utility adopted our recommended approach and decided to form a small,

entrepreneurial organization to develop innovative product and service solutions

and pursue the specific distributed generation business areas we identified.

CAM

MG10956

59

Distributed Generation Experience

Electric Utility

Assisted a large U.S. electric utility with developing a strategy to increase

the penetration of distributed generation in its service territory.

The

Challenge

The

Approach

The

Result

A large regulated utility wanted to use

Distributed Generation as a resource to

meet customer needs in the near future.

Assessed the current market

penetration of Distributed Generation

in the utility’s service territory

Determined the market potential for

Distributed Generation within the

service territory

Evaluated the economic drivers and

the economic potential for Distributed

Generation over the next five years

Developed incentives that would be

required to facilitate more widespread

adoption of Distributed Generation

The client has a strategy that will promote the use of Distributed

Generation in its service territory in a manner that fits with the utility’s long

term strategic objectives.

CAM

MG10956

60

Distributed Generation Experience

Energy Company

Developed a global distributed generation strategy with a large energy

company that maximises the opportunity across its business units.

The

Challenge

The

Approach

A large global energy company wanted to

maximize the distributed generation (DG)

opportunity across all its regulated and

unregulated businesses.

Developed a common understanding

of the future external and internal

environment for DG

Assessed the strengths and

weaknesses of each business unit.

Identified threats and opportunities

presented to each business unit.

Explored innovative ways to create value with DG in the future business

environment.

Created a shared vision which will guide the development of strategies at

both the Corporate and Business Unit level

Defined priorities for investment, support, and collaboration among

businesses and with the corporate parent

The

Result

The client implementing business unit strategies that are consistent with a

shared corporate vision for Distributed Generation.

CAM

MG10956

61

Distributed Generation Experience

Electric Utility

Evaluated the effect of different distributed generation incentive programs

for a large U.S. electric utility.

The

Challenge

The

Approach

The

Result

A large regulated utility needed to

increase the penetration of Distributed

Generation in its service territory to meet

the projected capacity shortfall.

Evaluated the economic

attractiveness of DG under several

Distributed Generation incentive

programs

Estimated the economic market

potential of Distributed Generation

under the incentive programs

Ranked the effectiveness of the

Distributed Generation incentive

programs

DG Equipment

First Cost and

Operating Cost

Grid Cost

of

Delivered

Energy

Economic

Incentives

from Local

Utility

DG

Economic

Model

Achievable DG

Market Potential

Under Different

Incentive Programs

The client was able to make strategic decisions based on the ranked

effectiveness of the programs to promote Distributed Generation.

CAM

MG10956

62

Distributed Generation Experience

Electric Utility

Developed a resource allocation framework for distributed generation,

demand side management and load management for an electric utility

The

Challenge

The

Approach

The

Result

A large regulated utility desired assistance

in its resource allocation planning, based

upon growth in peak demand and energy.

Quantified the future impact of

customer on-site generation, potential

demand-side management, and load

management programs on forecasted

load requirements

Analyzed existing studies of market

potential for each of these resource

types to establish feasibility

Contrasted results with the forecast

growth in peak demand and energy

Determined power needs that must be

met by other sources

The client successfully revised its Integrated Resources Plan and was able

to develop strategies for resource allocation.

CAM

MG10956

63

Distributed Generation Experience

Regulatory

Assisted 12 Distributed Generation equipment suppliers in developing

information to educate policymakers in Distributed Generation.

The

Challenge

The

Approach

The

Result

A group of equipment suppliers needed to

educate regulators, legislators, and policy

makers with sound, fact-based information

on Distributed Generation.

Identified gaps in the current

understanding in Distributed

Generation on part of regulators,

legislators, and policy makers

Created a Distributed Generation

primer to provide the sound

intellectual foundation for decision

making

Wrote a series of white papers

addressing regional, stake-holder,

and technical issues in Distributed

Generation

{1}

Legislators

Regulators

Exec.

Summary

White Papers

{3}

Staff

DG Primer

{1}

Intellectual Foundation

Clients will have a uniform, unbiased, information base to educate

regulators, legislators, and policy makers on Distributed Generation.

CAM

MG10956

64

Distributed Generation Experience

DG Impact Study

Completed a DG impact study for a northeastern U.S. electric utility to help

it understand the market potential for DG in its service territory.

The

Challenge

The

Approach

The

Result

Perform a detailed assessment of the market

potential for DG within the client’s customer base

and determine the impact on the client’s business

Developed a detailed economic performance

model that simulated DG operation under

several scenarios, and applied the model

using actual customer data to determine

market adoption of DG

Completed an assessment of the local,

regional and national regulatory environment

with respect to DG

Assessed the likely impact of DG on the

client’s power delivery business and made

recommendations for strategic response

The utility used the results of the study to begin a strategic DG business planning

effort.

CAM

MG10956

65