the minutes - ecr-shrink

advertisement

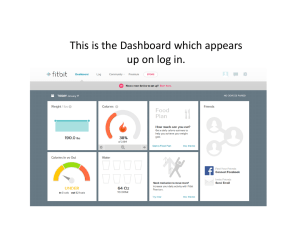

ECR Europe Shrinkage & OSA Group – Summary of 24th June 2014 meeting Date: 24/06/14 Present: Adrian BECK (UNIVERSITY OF LEICESTER), Andreas BERLIN (OLIVER WYMAN), Nathalie BLEACH (L'OREAL BENELUX), Megan BORNMAN (UNIVERSITY OF LEICESTER), Paul BOYLE (RETAIL INSIGHT), Rob BROECKMEULEN (UNIVERISTY EINDHOVEN), Mark CASSIDY (ASDA), Luc COOMAN (CARREFOUR), Ruud DE WEERD (BIJENKORF), Anujah DEWITT (SAINSBURY'S), John FONTEIJN (ROYAL AHOLD), Phil HAGON (SAINSBURY'S), Kris HAMER (ASDA), Steve HEWITT (MARKS & SPENCER), Hiddo HILBOEZEN (CHECKPOINT SYSTEMS GmbH), Michael KERN (BEIERSDORF), Bernard FRADIN (MONDELEZ), Carine LYATHAUD (L'OREAL), Peter OLIJSLAGER (METRO GROUP), Colin PEACOCK (PROCTER & GAMBLE), Dominique REUMERS (CHECKPOINT), Paul R SMITH (SAINSBURY'S), Peter WERE (AHOLD), Andrew YOUNG (WAITROSE) 24th June 2014 1. Welcome and Introduction Colin welcomed all the members to the group and the members were given the opportunity to introduce themselves briefly. The group were all reminded of the anti-trust caution*. The new members, Mike Bowie from CHEP and Andrew Young from Waitrose were given the opportunity to discuss their interest in the group and motivation to be involved. *Reminder of anti-trust caution: ECR Europe will not enter into any discussion, activity or conduct that may infringe, on its part or on the part of its members and participants, any applicable competition laws. By way of example, members and participants shall not discuss, communicate or exchange any commercially sensitive information, including non-public information relating to prices, marketing and advertisement strategy, costs and revenues, trading terms and conditions and conditions with third parties, including purchasing strategy, terms of supply, trade programmes or distribution strategy. This applies not only to discussion in formal meetings but also to informal discussions before, during or after meetings. 2. The Retail Loss Landscape: An Interactive Discussion – Professor Adrian Beck Adrian presented the background to latest project on the Retail Loss Landscape specifically looking at what the term ‘shrinkage’ means and what it represents in modern retailing. The project motivation is dependant on ever-changing nature of retail, specifically, how the retail has changed from ‘behind counter’ retailing to open shelf, self selection and more recently to mobile and online retailing. It is because of these changes that retail losses have changed and transformed and as such there is a need to review the current landscape. Adrian reviewed the first draft of the proposed landscape typology and the floor was opened to the members for discussion, review and input. The group was then subdivided into smaller groups to discuss the first draft in more detail and feedback from each group was then reviewed and discussed. 3. Bringing the Outside In – Paul Boyle CEO Retail Insight The total loss Manager’s Dashboard – Beta Paul gave background and contextual information about Retail insight. He then discussed what the 2018 dashboard should look like. This included 5 essential elements, (see attached slides), as well as screenshot examples of the dashboard. The dashboard aims to be simple, easy and intuitive but with capabilities that allow for more detailed mapping and analysis. The data in the dashboard is then used to prompt retailers to create action plans for root issues that have been identified. Action/Decision/Remark Who When The dashboard is also used to create a Road Map to illustrate organisational aims and objectives. Alongside this, Maturity curves are also created to track the progress along the Road Map. The dashboard also includes a competency comparison that assesses where the gaps have formed in the organisation’s strategy. The Performance Engine is used to understand and map the drivers of Total Lost Sales and what the magnitude of each driver is. Overall, the dashboard has been found to be a useful tool for retailers to maximise the use of their data in order manage total losses in a proactive manner. 4. On Shelf Availability – Bernard Fradin – Mondelez Bernard presented on OSA from the Mondelez’ perspective and strategy, the key points were: OSA is a well-known key growth opportunity. The challenge is to connect to the future and make OSA a discipline Three steps that need to be explored are: - Assessing organisations Identifying barriers Determine ongoing business process The three main barriers that have been identified are: - Mindset alignment Data sharing Organisational design and structure Rise (Retail Intelligence & Sales Efficiency) is an initiative to implement collaborative business process supported by a web-based portal and aiming to bring quantifiable benefits to prioritised use cases. Thus it is a cross-functional project within the company as well as between retailers and suppliers. A final important point, is that there needs to be store level collaboration in order to impact on OSA efficiently. 5. Employee Engagement Round Table – Professor Adrian Beck Adrian provided a brief summary and overview of the Employee Engagement research project: - There is a link between Employee Engagement and Loss The report is a modest interpretation of Benefits There is a key Role of Store Manufacturers. The aim of this section of the meeting was to gather input from members as to what members will do with the findings of the research. Key Responses: The findings can/should be used to: - 6. bring attention to high-level management. Impact the selection of store managers. on a store-to-store level specifically looking at the training, development and coaching of store managers. create specific targets and goal for stores and store managers – Impact on the HR department of the organisation: HR should be more proactive. The study provides a basis for HR to communicate with other departments in the organisation on HR related issues in a manner that these departments can relate to. Fresh, Waste & Availability Project Update - Professor Brockmeulen Rob explained that thus far the biggest hurdle to overcome in the project is convincing retailers to participate. Rob hopes that by September meeting, he should have data from at least one or two retailers. Rob also stated that three main categories that were decided on are, ‘fruit and vegetables’, ‘meat’ and ‘convenience’. These are categories were chosen because they are considered specifically challenging for retailers. 7. Open Platform What are the top three hot topics keeping you awake at night? A concern about cyber crime was raised - specifically the fast rate at which online and technological crime has increased. A point was made about retailers not waiting for the crime to occur and being reactive but rather being proactive about learning about the latest types of crime and how to prevent it. In addition to cyber crime, extortion was also raised as a concern, specifically with the invention of online currency such as Bitcoins. One proposed solution is to ensure board level support and awareness of cyber criminality since this is an essential factor in combating cyber crime. CPNI is a helpful resource with regards to preventative measures and advice: http://www.cpni.gov.uk https://www.gov.uk/government/publications/cyber-risk-management-a-board-level-responsibility There was also some discussion of mobile scanning technology, specifically, Scan and Go. Albert Heijn is currently piloting Scan and Go at 6 stores in the Netherlands. After piloting the project in the United States, it has been established that the Scan and Go system and technology is fully functional. A question was raised about how many people use mobile scanning tech mischievously? The response was that there is an element of error in scanning however the strength of the training on the technology has a major impact on the level of error. Another retailer, who is also currently using mobile scanning technology, noted that thus far, they have had very few incidences of mis-scans and have only had a positive experience with mobile scanning technology. A final issue was raised regarding the risk of online shopping. There have been incidences of computer hacking and as such, there are concerns about whether police are aware of ecommerce risks and issues. Anonymity causes problems for recovery of stolen items, which are sold on illegally online and thus, assistance from the police and additionally, support and assistance from Ebay is needed in order to combat this issue. 8. Miscellaneous Colin thanked Annabel (in absentia) for her active input with the communication strategy and press releases. Colin also made the following announcements: - He and John received the long-standing Achievement award from the ECR on behalf of the group. Adrian will be speaking at an ECR Australia Conference on August 5th and 7th in Australia. All members are invited to attend. All group members are also invited to attend the RILA conference in Savannah, Georgia on 23rd September 2014. Colin also made the group aware of his retirement from P&G in August 2014. He described the current governance structure for the group and proposed a new model for governance of the group. A vote was held and it was agreed that Colin would fill the role of Group Strategic Coordinator. Sept 17th and 18th 2014: Next meeting date: Tesco UK