Strategic Marketing

1. Imperatives for Market-Driven Strategy

2. Markets and Competitive Space

3. Strategic Market Segmentation

4. Strategic Customer Relationship Management

5. Capabilities for Learning about Customers and Markets

6. Market Targeting and Strategic Positioning

7. Strategic Relationships

8. Innovation and New Product Strategy

9. Strategic Brand Management

10. Value Chain Strategy

11. Pricing Strategy

12. Promotion, Advertising and Sales Promotion

Strategies

13. Sales Force, Internet, and Direct Marketing Strategies

14. Designing Market-Driven Organizations

15. Marketing Strategy Implementation And Control

Chapter 10

Value Chain

Strategy

McGraw-Hill/Irwin

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

Value Chain Strategy

*

*

*

*

Strategic role of value chain

Channel strategy

Managing the channel

International channels

10-3

Dell’s dilemma

* Business built around powerful direct

business model

* Direct model poor fit with customer

preferences in new target markets and weak

on service

* Dell is braodening business model

* Targeting computer re-sellers

* Global retail strategy (including Wal-Mart, Dellbranded stores, kiosks in malls)

* Redesigning value chain is critical strategic

move

10-4

Strategic role of value chain (1)

Distribution functions

*

*

*

*

*

*

*

*

*

*

*

Buying and selling

Assembly

Transportation

Financing

Processing and storage

Advertising and sales promotion

Pricing

Reduction of risk

Personal selling

Communications

Servicing and repairs

10-5

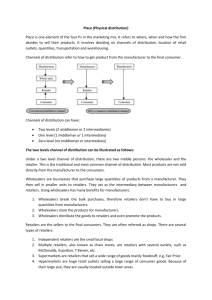

Value chain structures - consumer products

Consumer Products

Producers

Supply Chains

Sales

Agents

Direct

Channel

Retailers

Wholesalers

Wholesalers

Retailers

Retailers

Consumers

10-6

Value chain structures - organizational products

Organizational Products

Producers

Supply Chains

Sales

Agents

Direct

Channel

Distributors

Distributors

Sales

Agents

Distributors

Re-sellers

Organizational Customers

10-7

Strategic role of value chain (2)

* Channels for services

* Direct distribution by manufacturers

*

*

*

*

Buyer considerations

Competitive considerations

Product characteristics

Financial and control considerations

10-8

Factors Favoring Distribution by Manufacturer

Profit margins

adequate to support

distribution

organization

Complete line

of products

Opportunity for

competitive

advantage

Distribution

by the

manufacturer

Purchases are

large and

infrequent

Small number of

geographically

concentrated

buyers

Rapidly changing

market environment

Early stages of

product life cycle

Complex product

application

Supporting

services are

required

Extensive

purchasing

process

10-9

Branded manufacturers enter retail

* Nespresso (Nestle) “coffee boutiques” to

establish lifestyle brand

* Heineken branded beer bars in airports and

retail

* Strategic logic is to avoid control of thirdparty retailers over brand

* Move from selling “A product in a box” to

offering a superior service experience for

the brand

10-10

Channel strategy (1)

* Types of channel

* Conventional channel

* Vertical marketing systems

* Ownership VMS

* Contractual VMS

* Administered VMS

* Relationship VMS

* Horizontal marketing systems

* Digital channels

* Product digitization

* Channel digitization

10-11

Channel strategy selection

1. Type of distribution channel

Conventional

Horizontal

marketing system

Vertical marketing system

Ownership

Contractual

Administered/

Relationship

2. Intensity of distribution

Intensive

Selective

Exclusive

3. Channel configuration

10-12

Channel strategy (2)

* Distribution intensity

* Intensive

* Exclusive

* Selective

* Channel configuration

* End-user considerations

* Product characteristics

* Manufacturer's capabilities and resources

* Required functions

* Availability and skills of intermediaries

10-13

Channel strategy (3)

* Channel maps

* Selecting the channel strategy

*

*

*

*

*

Market access

Value-added competencies

Financial considerations

Flexibility and control considerations

Channel strategy evaluation

10-14

Illustrative channel map for heating units

Production =

100,000 units

Consumption =

100,000 units

Direct sales = 10,000 units

84,000 units

Independent

Distributors

Construction

SubContractors

42,000 units

42,000 units

Production

Of Central

Heating

Boilers

Small

Hardware

Retailers

5,000 units

Direct sales = 1,000 units

Large

Hardware

Retailers

40,000

units

75,000 units

Commercial

Construction

Companies

(85,000 units)

7,000

units

2,000

units

5,000 units

Domestic

Customers

(15,000 units)

10-15

Channel strategy (4)

* Changing channel strategy

* Channel strategy modification

* Channel migration

* Channel audit

10-16

Illustrative Channel Strategy Evaluation

Evaluation

Criteria

Manufacturer’s

Representatives

Company

Salesforce

Market access

Rapid

1 to 3 year

development

Value-added competencies

Medium

Sales forecast (2 years)

$20 million

$30 million

Forecast accuracy

High

Medium to low

Estimated costs

$2 million*

$3.6 million**

Selling Expense (cost/sales)

10%

12%

Flexibility

Good

Limited

Control

Limited

Good

*

High

Includes 8% commission plus management time for recruiting and training

representatives.

** Includes $150,000 for 10 salespeople, plus management time.

10-17

Managing the Channel (1)

* Channel leadership

* Management structure and systems

* Physical distribution management

* Supply chain strategy

* The impact of supply chain management

on marketing

* E-procurement

10-18

Efficient Consumer Response

Traditional channel problems

* Forward buying and diverting

* Excessive inventories

* Damages and unsaleable goods

* Complex deals and deductions

* Too many promotions and coupons

* Too many new products

Efficient Consumer Response

* Category management

* “Value” pricing replaces promotions

* Continuous replenishment and cross-docking

* Electronic data interchange

* New performance measures

* New organizational processes and structures

* Internet-based network for supplier-buyer trading

10-19

Lean Supply Chain Elements

1. Definition of Value

2. Identification of Value Streams and

Removal of Muda (Waste)

3. Organizing Around Flow, Instead

of “Batch and Queue”

4. Responding to Pull Through

the Supply Chain

5. The Pursuit of Perfection

10-20

Marketing/supply chain relationship

* Focus on real drivers of customer

value not just technical

* Do not create inflexibility and inability

to respond to change

* Protect brands and competitive

strength over short-term cost savings

* Do not confuse supply chain strategy

with competitive advantage

10-21

Managing the channel (2)

* Channel relationships

* Degree of collaboration

* Commitment and trust among channel members

* Power and dependence

* Channel globalization

* Multichanneling

* Conflict resolution

* Channel performance

* Legal and ethical considerations

10-22

Channel metrics

Performance

Objective

Possible Measures

Applicable Product and

Channel Level

PRODUCT AVAILABILITY

Coverage of relevant

retailers

Percent of effective

distribution

Consumer products at

retail level

In-store positioning

Percent of shelf

facings or display

space gained

by product,

weighted by store

importance

Consumer products at

retail level

Coverage of

geographic markets

Frequency of sales

calls by customer

type; average

delivery time

Industrial products;

consumer goods at

wholesale level

10-23

Channel metrics

Performance

Objective

Possible Measures

Applicable Product and

Channel Level

PROMOTIONAL EFFORT

Effective point-ofpurchase (POP)

promotion

Percent of stores

Consumer products

using special

at retail level

displays and POP

materials, weighted

by importance of store

Effective personal

selling support

Percent of

Industrial products;

salespeople’s time

consumer durables at all

devoted to product;

channel levels; consumer

number of salespeople convenience goods at

receiving training on wholesale level

product’s characteristics

and applications

10-24

Channel metrics

Performance

Objective

Possible Measures

Applicable Product and

Channel Level

CUSTOMER SERVICE

Installation,

training and

repair

Number of service

technicians receiving

technical training;

monitoring of

customer complaints

Industrial products,

particularly those involving

high technology; consumer

durables at retail level

MARKET INFORM,ATION

Monitoring sales

trends, inventory

levels, competitors’

actions

Quality and

timeliness of

information

obtained

All levels of

distribution

COST-EFFECTIVENESS

Cost of channel

Functions relative

To sales volume

Middleman margins

and marketing costs

as percent of sales

All levels of

distrbution

10-25

Value chain ethics

* Retailers’ Global Social Compliance

Program

* Growing “green consumer” pressure

* B2B suppliers increasingly mandated

to meet customer’s values in

employment practices, environmental

standards, ethical behavior

10-26

International channels

* Examining international distribution

patterns

* Factors affecting global channel

selection

* Global issues regarding multichannel

strategies

10-27

International Channel of Distribution Alternatives

Home country

Foreign country

The foreign marketer or

producer sells to or through

Domestic

producer or

marketer sells

to or through

Open

distribution

via domestic

wholesale

middlemen

Exporter

Importer

Foreign

agent or

merchant

wholesalers

Foreign

retailer

Foreign

consumer

Export management company

or company

sales force

Source: Philip R. Cateora, International Marketing, 7th ed., Homewood, Ill.: Richard D. Irwin, Inc., 1990, 572.

10-28

![[DATE] Mary Ziegler Director Division of Regulations, Legislation](http://s3.studylib.net/store/data/007212021_1-b96b03cd98cadfc74a22865c0247494d-300x300.png)