Financial Management

advertisement

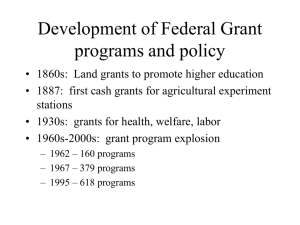

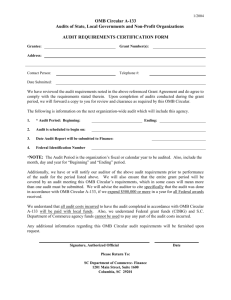

CDBG Financial Management For Local Officials 1 Financial Management - Objective • The objective of this module is to provide local government officials with a basic understanding of the financial management requirements related to the CDBG program • Local officials must be aware that, as a recipient of CDBG funds, their jurisdiction must be in compliance with these requirements in addition to any local or other state requirements 2 Objective - continued • Local officials are ultimately responsible for the accuracy and adequacy of records and reports related to management of the CDBG funds their jurisdiction has received 3 Financial Management - Overview • State CDBG Programs are required to have financial management standards or fiscal and administrative requirements as described in the program regulations at 24 CFR 570.489(d) • Local CDBG recipients must comply with the standards established by the state 4 State Standards The fiscal and administrative requirements established by each state CDBG program must: • Show that uses of funds comply with all applicable statutory and regulatory requirements • Document that all funds received have been spent only for reasonable and necessary costs of program operation • Demonstrate that program funds have not been used for general expenses of State or 5 local government Financial Management Using Part 85 • Fiscal control and accounting procedures of local recipients must be sufficient to: – Permit preparation of reports required by statute and regulation – Permit tracing of funds to establish that they have not been used in violation of any statutory or regulatory restrictions 6 Financial Management Using Part 85 continued • Financial management systems of state and local CDBG recipients must meet the following standards: – Accurate, current and complete financial reporting – Accounting records that identify the source and application of funds – Effective internal controls and accountability for all assets 7 Financial Management Using Part 85 continued – Budget controls with actual expenditures compared with budgeted amounts – Use of OMB cost principles (Circular A-87) in determining the reasonableness, allowability and allocability of costs – Complete source documentation for all accounting records – Effective cash management to maximize timeliness of spending 8 Financial Management Using Part 85 - continued Internal control and accountability must be maintained for all cash, real/personal property, and other assets 9 Internal Control • Basic elements of internal control – – – – – organizational chart written definition of duties formal system of authorization and supervision separation of duties control over access to assets, blank forms, and confidential documents – comparison of actual assets and liabilities to financial records Determining Allowable Costs • Allowable cost – determine if costs are reasonable, allowable, and allocated appropriately (to the grant) – Follow OMB Circular A-87 • Cost is allowable under CDBG if it is: – – – – necessary, reasonable, directly related to the grant authorized by the grantee not prohibited under Federal, state or local laws consistently treated • An expense may be claimed only once 11 OMB Circular A-87 OMB A-87 Attachment B: (Unallowable) Listing of selected Items of Cost 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Advertising and public relations costs Advisory councils Alcoholic beverages Audit costs and related services Bad debts Bonding costs Communication costs Compensation for personal services Contingency provisions Defense and prosecution of criminal and civil proceedings, and claims Depreciation and use allowances Donations and contributions Employee morale, health, and welfare costs Entertainment costs Equipment and other capital expenditures Fines and penalties Fund raising and investment management costs Gains and losses on disposition of depreciable property and other capital assets and substantial relocation of Federal programs General government expenses Goods or services for personal use Idle facilities and idle capacity 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. Insurance and indemnification Interest Lobbying Maintenance, operations, and repairs Materials and supplies costs Meetings and conferences Memberships, subscriptions, and professional activity costs Patent costs Plant and homeland security costs Pre-award costs Professional service costs Proposal costs Publication and printing costs Rearrangement and alteration costs Reconversion costs Rental costs of building and equipment Royalties and other costs for the use of patents Selling and marketing Taxes Termination costs applicable to sponsored agreements Training costs Travel costs. 12 Allowable Costs • • • • • • • • • Advertising Audits Bonding Insurance Meetings Professional Services Publications and Printing Training Travel Unallowable Costs • • • • • • • • Alcoholic Beverages Bad debts Contingency provisions Defense and prosecution of criminal and civil proceedings Fund raising General government expenses Lobbying Fines and penalties Pre-agreement Costs • State CDBG program regulations allow for reimbursement of costs incurred before the establishment of a formal grant relationship between the state and the unit of general local government • State must have established procedures (which may include environmental requirements) • Costs must be incurred for eligible activities 15 Annual Audit Requirements • Single Audit – OMB Circular A-133 requires entities that expend $500,000 or more during a fiscal year* in federal awards (from all sources) have a Single Audit conducted for that fiscal year. • Audits must be in accordance with Generally Accepted Government Auditing Standards (GAGAS) and OMB A-133 16 Annual Audit Requirements continued • The State may determine when audit must be submitted • Instructions – Include date of entity’s fiscal year end – List sources of all federal expenditures Annual Audits Knowing the Rules • Local Governments and Non-Profit Organizations receiving Federal Funds: – Single Audit Act and OMB Circular A-133 www.whitehouse.gov/omb/grants/grants circulars.html 18 Annual Audit Requirements • Upon completion, the Grantee must: Submit a copy of the Audit to the State If no Audit Findings or questioned costs, grantee may provide written notification to the state that audit was conducted in accordance with A-133 Submit copies of Collection Form (SF-SAC) and/or Reporting Package to Federal Clearinghouse, and each federal awarding agency as appropriate 19 Annual Audit Requirements • • The Grantee is responsible for followup and corrective action on all audit findings. The Grantee must prepare a corrective action plan to address each audit finding. Plan must include: – – – Name of person responsible Corrective action planned Anticipated completion date 20 Auditor Selection • • • • • • • Must be selected through procurement Request for Proposal most appropriate Should be CPA or licensed public accountant Must be experienced with Single Audits, CDBG programs, and local government Verify completion and timeliness of previous audits CDBG funds can pay for grant’s share of Audit Charge to General Administration 21 Financial Management Conclusion • Local governments that receive CDBG funds must: – Comply with applicable Federal, state and local laws, regulations, standards, and procedures – Conduct financial management procedures in accordance with Generally Accepted Government Auditing Standards (GAGAS) 22 Conclusion - continued • Local officials must be aware that all financial management practices will be: – Monitored by the state CDBG program – Examined closely by independent auditors Make sure that your financial management practices are sound! 23