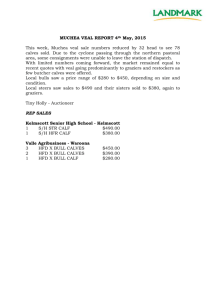

May-Apr

advertisement

Agenda Item 1

Current situation: Market trends

Beef and veal consumption robust at

around 300,000 tonnes each year

000 tonnes

310

305

300

295

290

285

280

2006

2007

2008

2009

2010

2011

2012

Source: TNS/Kantar Worldpanel

Veal production has increased

000 tonnes

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2006

2007

2008

2009

2010

2011

2012

Source: DEFRA

Exports of beef and veal have

increased since 2006

Source: GTIS

Imports somewhat level

Source: GTIS

Self-sufficiency in beef and veal

%

88

90

77

80

72

70

79

80

81

2007

2008

2009

84

85

72

67

66

2001

2002

68

68

2003

2004

60

50

40

30

20

10

0

2000

2005

2006

2010

2011

2012

Source: DEFRA

Agenda Item 2

Male dairy calves

Live exports at a low level

Head

90,000

80,000

Dutch farmers boycotted

UK calf trade mid 2008

following detection of bTB

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

2006

2007

2008

2009

2010

2011

2012

Source : BCMS

2012 - almost half to Spain

Spain

Ireland

France

Germany

Others

Source : BCMS

Dairy calf registrations since

2006 – male & female

500

411

407

388

400

350

450

435

450

480

471

465

370

335

330

326

371

370

300

250

200

150

100

50

0

2006

2007

2008

2009

2010

2011

Source2012

: BCMS

Use of sexed semen Apr 2011 – Mar

2012 (DairyCo survey of breeding companies )

2000

1836

1800

1600

1400

No. of

semen

straws

('000)

1200

Conventional

Sexed

1000

800

600

400

265

200

281

31

0

Holstein

Non-Holstein

Destination of male calves (000’s)

2006 2007 2008 2009 2010 2011 2012

Female Registrations

411.1 407.3 434.6 449.7 465.2 471.0 480.0

Male Registrations

326.3 330.1 335.1 370.3 370.3 371.4 398.1

Estimated no. males born *

411.1 407.3 430.3 440.9 451.6 452.9 457.1

Estimated no. disposed on-farm

84.8

77.2

95.2

Live exports

80.7

63.8

51.4

Estimated no. retained in GB

70.6 81.4

1.0

0.7

81.5

59.0

13.3

8.0

245.6 266.3 283.7 369.3 369.6 358.1 390.1

• From 2008 onwards, applying a 1% year on year increase in the number of

heifers born due to the use of sexed semen

Destination of dairy male calves

100%

90%

80%

70%

60%

% live exports

50%

% retained in GB

40%

% disposed on farm

30%

20%

10%

0%

2006

2007

2008

2009

2010

2011

2012

2012 Q4

£ per tonne

2012 Q3

2012 Q2

2012 Q1

2011 Q4

2011 Q3

2011 Q2

2011 Q1

2010 Q4

2010 Q3

2010 Q2

2010 Q1

2009 Q4

2009 Q3

2009 Q2

2009 Q1

2008 Q4

2008 Q3

2008 Q2

2008 Q1

2007 Q4

2007 Q3

2007 Q2

2007 Q1

2006 Q4

2006 Q3

2006 Q2

2006 Q1

Link between feed costs and

registrations evident

000 head

260

130

240

120

220

110

100

200

90

180

80

160

70

60

140

50

120

40

Rearing calf prices volatile

since 2006 – but have moved up

£ per head

160

140

Ho/Fr heifers

120

100

80

60

40

20

Ho/Fr bulls

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

Apr

Jun

Aug

Oct

Dec

Feb

0

2006

2007

2008

2009

2010

2011

2012

2013

Source : AHDB/EBLEX

Upwards evolution in finished

cattle prices continues

p per kg dw

410

400

390

380

370

360

350

340

330

320

310

300

290

280

J

F

GB R4L deadweight steer price

2013

M

A

M

J

J

A

2012

S

O

2011

N

D

Source: AHDB/EBLEX

100

2012 Q4

2012 Q3

2012 Q2

2012 Q1

2011 Q4

2011 Q3

2011 Q2

2011 Q1

2010 Q4

2010 Q3

2010 Q2

2010 Q1

2009 Q4

2009 Q3

2009 Q2

2009 Q1

2008 Q4

2008 Q3

2008 Q2

2008 Q1

2007 Q4

2007 Q3

2007 Q2

2007 Q1

2006 Q4

2006 Q3

2006 Q2

2006 Q1

Evolution of compound cereal

prices since 2006

£ per tonne

260

240

220

200

180

160

140

120

Source : DEFRA

Dairy male calf registrations/beef and

veal imports - a stable relationship

000 head/000 tonnes

400

390

380

370

360

350

340

330

320

310

300

290

280

270

260

250

240

230

220

210

200

Calf reg

2007

2008

2009

Imports

2010

2011

2012

Source : BCMS/GTIS

Economic prospects

• Tighter global & domestic

supply will tend to support

beef prices

• Margins possible for better

quality animals

• Highly dependent on input

prices

• Domestic market for veal

still underdeveloped

• What value provenence ?

Financial performance (May-Apr)

Extensive Beef Finishing

Source: AHDB/EBLEX estimates

1400.00

1200.00

1000.00

Noncash costs

800.00

Overheads (£)

Variable costs (£)

600.00

Stock purchases (£)

Output (£)

400.00

200.00

0.00

2006

2007

2008

2009

2010

2011

2012

Higher prices through 2011 and 2012 filtering through

to improve returns, but still negative margin for many

Intensive Beef Finishing

Source: AHDB/EBLEX estimates

1200

1000

800

Noncash costs

Overheads (£)

600

Variable costs (£)

Stock purchases (£)

Output (£)

400

200

0

2006

2007

2008

2009

2010

2011

2012

Agenda Item 3

Health and welfare of dairy calves

Dairy calf health and welfare

• Calf survival a continuing focus

of attention

– Perinatal mortality

– Early stage nutrition

– Control of disease

• Dearth of robust industry data

• Specialist rearing units more

switched on to best practice ?

• Outcome based welfare

measures for dairy cows

Colostrum (volume and quality)

• Too much milk does not cause scour

• Well fed calves develop higher immunity

• 60% calves have inadequate colostral

immunity

• Recommendation for 10% of body weight

in critical first 6hrs

• £14/calf added cost feeding saleable milk

• Reinforcement of strategies/best practice

• Needs agreement on protocol from all

parties

Emerging results from DairyCo

funded CASE studentship

• Perinatal mortality

– Mean 5.4 % (Range 1% to 13.9%)

• Differences in feeding regime for male calves

– Yes:34%, No:66%

• Recorded examples, males given

– increased volume of milk to prepare for sale

– waste milk, often in significant volume

– milk powder, while heifers given fermented whole milk

• Proportion of bull calves disposed of on farm

– 6.3%

Nutrition up to weaning

• A system based on feeding:

– 10% of bodyweight

Little more than

maintenance

• (45 kg calf gets 4.5 litres)

– 10% concentration of powder

• (4.5l @10% - 450 g powder)

• Whereas feeding:

– 2.5 % of bodyweight

• (45 kg calf @15% = 5.5l)

– 5% concentration of powder

• (5.5 l @ 15% = 825 g powder)

Maximum

growth, when

calf is

biologically

most efficient

Disease Risk/Effect on Yield

Calf health & welfare workshop

• Royal Vet College, 23 July 2013

– DairyCo Research Partnership (Health, welfare & nutrition)

• Aim to identify

– best practice guidelines for calf rearing

– gaps to be addressed in current knowledge

• Four themes

– health, welfare, housing and production economics

• Cross sector representation

– Farmers, vets, researchers, legislators

Agenda Item 4

Developments in breeding

Reducing heifer losses

• Average heifers calving down at 28 months

• Attrition rate of heifers during rearing period still

too high

• Higher losses of dairy progeny from heifer calvings

• Management during first lactation

• Targetting better performance

– DairyCo PD+ blueprint

– Benchmarking (e.g. Milkbench+)

– PhD study: Economic analysis of heifer rearing and

breeding selection in UK

Current purebred genetic evaluations

•

•

•

•

•

•

DairyCo provides evaluations for major dairy breeds

Pursuit of fitness traits tends to select for animals

with better conformation

UK genetic ranking encourages use of fitness traits

– Longevity, Fertility, Mastitis, Lameness

Genetic trends in all 4 areas are in a positive

direction

Since 2012, information available on farm’s herd

genetic reports

HUK introduced Body Condition Score indexes

Sire usage for combined fitness

(Note; 2007 saw major change in £PLI)

Current PLI review likely further emphasise fitness traits,

and include a Live weight component

Use of sexed semen

•

DairyCo survey of breeding companies indicate that

sexed semen accounted for 13% of sales in 2011/12

Resulting in approx. 5% skew towards female

progeny

Constraints to greater adoption of sexed semen

•

•

–

–

–

–

Reduced conception rates

Less attractive to block calving systems

Lack of semen availability from elite bulls

Price ?

Cross breeding

•

•

•

Since 2010, DairyCo also evaluates cross-bred

animals

Andy – some words on cross breeding and

impact on calf price?

Dairy systems modeling (Moorepark economic

model)

Make it easier to choose semen

• Industry KT events on-going to educate farmers on

use of the indexes on a pure and cross-breed basis

• DairyCo and Holstein UK both have websites that

allow farmers to select the bulls that suits them

• Genomic selection

Extended lactations

•

•

Industry trend towards increasing lactation length

Modern genotypes can still be yielding significantly

beyond 305 days

Theoretical advantages of 18 (or 24 month) lactations

•

–

–

–

–

Fewer progeny

reduced metabolic stress and increased longevity

insemination costs

reduced number of dry days within the cow's lifetime

Extended lactations

Evidence to date indicates

• Feasible, but yield level and persistency of lactation are key

• Different cows and sire groups react differently to delayed

breeding

• Potential for cows to get too fat, compromising subsequent

lactations

• Economics not sufficiently proven

• Block calving systems more challenging, need 24 month

system

• Further information needed to on interactive effects of

lactation pattern, diet and management before any wider

recommendations

Development of Carcass EBV’s

•

DairyCo/EBLEX funded study to evaluate potential

of combining abattoir data with BCMS data

Alternative approach in absence of beef progeny test

Feasibility study indicated

•

•

–

–

•

Heritability estimates for net carcass weight, conformation & fat

class: 0.31, 0.24, & 0.14

Data challenges, registration

EBLEX in discussion with breed societies regarding

funding of potential implementation phase