Marketing Information Managemen: E

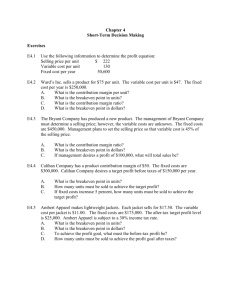

advertisement

E-Portfolio Assignment By: Sean Bindra 100170563 Descriptive Statistics Marketing and Finance Market Share Metrics Margins Breakeven Analysis Profit Dynamics Customer Lifetime Value Distribution Sales Force Management Linear Demand Promotion Profitability Advertising Metrics Web Metrics Quantitatively describing main features of a collection of data. Examples include: mean, median, and mode. Mean: arithmetic mean/average of a set of data. Ex.) data set: 2,1,2,1,4 Mean = 2+1+2+1+4/5 = 2 Median: numerical value that separates higher half of sample from lower half. Ex.) data set: 2,4,6,8,10 Median = 6 Mode: value that occurs most often. Ex.) data set: 2,2,3,1,5,2 Mode = 2 Provides insight into the overall financial condition of a firm and analyzes potential investments. Net Profit = sales – costs Ex.) If Tom made revenue of $5,000 and his costs totaled $2,000, what is his net profit? Net Profit = $5,000 - $2,000 = $3,000 Return on Investment = net profit/investment Ex.) If Tom’s net profit is $5,000 and he invests $2,500 into his business, what is his ROI? ROI = $5,000/$2,500 = 2.0 % Return on Sales = net profit/sales revenue Ex.) What is Tom’s ROS? ROS = $3,000/$5,000 = 0.60 % Earnings Before Interest and Taxes = net profit + interest payment + taxes Ex.) Tom paid interest of $400 and taxes of $100. What is Tom’s EBIT? EBIT = $3,000 + $400 + $100 = $3,500 Measures the sales of a brand or product relative to the overall size of a market. Unit market share = unit sales/ total market unit sales. Ex.) If there are 100 widgets sold in the country and company A sells 50 of them, then the unit market share is: 50/100 = 0.2% Revenue market share = sales revenue/total market sales revenue. Ex.) If company A makes $100, while companies B, C, D, & E make a combined $900 in revenue, then company A’s revenue market share is: 100/1000 = 0.10% Brand Penetration = # of people who bought specific brand/defined population. Category Penetration = # of people who bought any brand/defined population. Share of Penetration = brand penetration /category penetration. Ex.) 500 households buy Nike shoes while 2,000 households buy at least one style of product from the Nike category. Therefore, the share of penetration for Nike shoes is: 500/2,000 = 0.25% Manufacturer Distributor Wholesaler Retailer Customer. Selling Price = cost to produce + margin Ex.) If selling price is $50 and the cost is $20, then the margin is: $30 $50-$20 = $30 Other key formulas: %margin = $margin/selling price Selling Price = cost/(1- %margin) Cost = selling price(1 - %margin) Markup% = selling price – cost/margin Selling Price = cost(1 + markup%) Determines the point at which revenue received = the costs associated with receiving that revenue. Total Costs = total fixed costs + total variable costs. Total Contribution = total revenue – total variable costs. Profit = total contribution – total fixed costs. Breakeven Formulas: Unit Breakeven = fixed cost/unit contribution. Revenue Breakeven = fixed cost/contribution margin %. Revenue Breakeven = breakeven units*unit price. Breakeven Units = $breakeven/unit price. Target Profit Breakeven = (fixed costs + target profit)/contribution margin %. Financial benefit realized when the amount of revenue gained exceeds the expenses, costs and taxes. Target Volume in Units = (fixed cost + profit objective)/selling price – variable cost. Target Volume in Dollars: computed by taking the solution from above formula and dividing it by the selling price. Target Revenue = unit target volume*selling price Ex.) A product sells for $20, costs $5 to make, and company has fixed costs of $30,000. How many products must be sold to reach target profit of $30,000? Target Volume = ($30,000 + $30,000)/($20 – $5) = 4000 A product sells for $40, costs $10 to make, and company has fixed costs of $30,000. How many dollars worth of the product must be sold to reach target profit of $60,000? Target Revenue = ($30,000 + $60,000)/($40 – $10)/$40 = 3000 Discounted sum of all future customer revenue streams (-) product, servicing, and remarketing costs. Assume: $M: contribution $R: retention spending per period per active customer r: retention rate d: discount rate CLV = [$M –$R] x [(1 + d) / (1 + d -r)] Ex.) An Internet service provider charges $20.00 per month. Variable costs are $1.00 per month. The attrition rate is 0.5% per month with marketing spending of $5 per year. With a monthly discount rate of 1%, what is the CLV for a customer we plan on acquiring? $M = $20.00 -$1.00 = $19, $R = $5/12 = $0.42, r = 0.995, d = 0.01 CLV = [$19 –$0.42] x [(1+.01)/(1+.01-0.995)] CLV = $1,251 Purpose: - To understand sales dynamics in retail channel. Helps in making right decisions where expansion and growth strategies are concerned. Numeric Distribution = (# stores that stock a brand)/(total stores in relevant market) All Commodity Volume = (total sales of stores carrying brand) / (total sales all stores) Product Category Volume = (tortilla sales of stores carrying Madre’s) / (tortilla sales all stores) Outlet All Sales All Shoe Sales Baley SKUs stocked Finley SKUs stocked Store 1 $100,000 $1,000 5ct, 23ct 10ct, 21ct Store 2 $70,000 $400 12ct 24ct Store 3 $40,000 $500 5ct, 23ct n/a Store 4 $20,000 $200 n/a 10ct, 21ct Numeric Distribution of Baley is: All Commodity Volume of Baley is: (3) / (4) = 75% ($100k + $70k + $40k) / ($100k + $70k + $40k + $20k) = 91.3% Product Category Volume of Baley is: ($1000 + $400 + $500) / ($1000 + $400 + $500 + $200) = 90.5% Workload = Current Accounts (#) * Average time to service account + Prospects (#) * Time trying to convert prospect to sale. Ex.) The sales territory of Magma has 20 current accounts requiring 10 days of support per year and 40 prospects. It is estimated to take 15 hours in the sales process for phone and on-site follow-up. The yearly workload is: (20 * 10 ) + (40 * 15 / 8) = 150 + 75 = 275 days Sales Potential = Number of Possible Accounts * Buying Power ($) Ex.) A company has determined that there are 200 doctors in 6 cities that could be a source of business. Of those, 100 are cardiologists, with an avg. potential account value of $45K, and 100 rheumatologists with an avg. potential account value of $30K. The sales potential is: = (100 * $45,000) + (100 * $30,000) = $7,500,000 Sales Goal formulas: Historical = Share of prior year sales (%) * Overall objective ($) Sales Potential = Share of sales potential (%) * Overall objective ($) Historical + Inc = Prior year + Share of sales potential (%) * Overall increase objective ($) Weighted = Historical * Weight + Sales Potential * (1 – Weight) Relationship between quantity and price is linear. Quantity = (Slope * Price) + MWB Maximum Willing to Buy = (Quantity – Slope) * Price Maximum Reservation Price = MWB / (Slope Profit Maximizing Price = ½ (Unit Cost + MRP) Ex.) We observe that at a price of $6, a quantity of 8 is sold and that at $5, 10 units of a product are sold. Compute the slope, quantity, MWB, MRP, and PMP. Slope = (8 - 10) / (6 - 5) = - 2 (Quantity) 10 = (slope) -2 *(price) 5 + MWB, so MWB = 10 + 10 = 20 MRP: 0 = 20 – 5*price = $4 (solving for price at which we sell 0 units) PMP = ½ (8 + 4) = $12 (assuming unit cost = $8) Lift (%): measures incremental sales generated as percentage of baseline sales. Cost of Incremental Sales = Marketing spend ($)/ incremental sales ($,#) Return on Marketing Investment = (incremental sales*contribution marginmarketing spending)/marketing spending Coupon Redemption Rate = coupons redeemed/coupons distributed Cost per Redemption = coupon face amount + redemption charges Percentage Sales on Deal = Sales with temporary discount/total sales Impressions = Exposures = Opportunities to See Rating Points: impressions as a % of population. Ex.) If a TV ad is shown 2 times and that show is watched by 7,000 people out of a population of 100,000, that advertisement would generate 35 rating points (5 x 7,000 / 100,000). Gross Rating Points = impressions/total population Cost per Impression: monitored to measure the cost efficiency of campaigns. Calculated as follow: cost of advertising/impressions generated Ex.) If there are 10,000 impressions which are generated from $500 of costs, then cost per impression is: $500/10,000 = $50. Share of Voice = company impressions/total impressions in market Hits: number of file requests received by the server is counted. Page-views: amount of times a page is requested by the server. Visitors: amount of different users to a site. Click-through Rate = click through(#) /impressions determines how effective internet advertising is. Cost per Click = total cost/# of clicks generated Cost per Order = total cost/# of orders placed refers to amount paid for each click that is generated. refers to the cost that is paid for each order Cost per Customer Acquired = total cost/# of customers acquired Bounce Rate = visits that access only a single page/total Visits to the Website specifies how effective a company is at producing relevant traffic