Introduction to Bond Markets, Analysis, and Strategies

advertisement

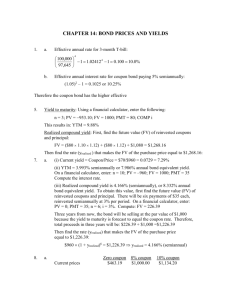

Measuring Yield

Chapter 3

Computing Yield

yield = interest rate that solves the following

CF

CF

P = CF + CF

+

+ . . .+

1

1

2

y

1

1

y

3

1

2

y

3

1

internal rate of return

Promised Annual Payments

(Cash Flow to Investor)

Years from Now

1

$100

2

100

3

100

4

1,000

N

y

N

IRR

Years from Now

1

2

3

4

Years from Now

Promised Annual Payments (Cash Flow to Investor)

$100

100

100

1,000

Promised Annual Payments Present Value of Cash

(Cash Flow to Investor)

Flow at 10%

1

$100

$90.91

2

100

82.64

3

100

75.13

4

1,000

683.01

Present value = $931.69

IRR

Years from Now Promised Annual PaymentsPresent Value of Cash

(Cash Flow to Investor)

Flow at 12%

1

$100

$89.29

2

100

79.72

3

100

71.18

4

1,000

635.52

Present value = $875.71

Years from Now Promised Annual Payments )Present Value of Cash

(Cash Flow to Investor)

Flow at 11%

1

$100

$90.09

2

100

81.16

3

100

73.12

4

1,000

658.73

Present value = $903.10

Yields

simple annual interest rate

effective annual yield

EAY = (1 + periodic interest rate)m – 1

examples

current yield = (annual $ coupon int.) / price

only considers coupon interest not capital gain/loss

if selling at discount/premium

Yields

YTM

bond-equivalent yield

convention in bond market to move from semiannual yield to an annual yield

by doubling the semiannual yield

Why is practice of doubling a semiannual yield followed?

Wouldn’t it be more appropriate to compute EAY by compounding?

YTM considers current coupon and capital gain/loss

factors affecting reinvestment risk

for a given YTM and a given non-zero coupon rate, the longer the

maturity, the more the bond’s total dollar return depends on reinvestment

income to realize the YTM at time of purchase (ie, the larger the

reinvestment risk)

for a coupon paying bond, for a given maturity and a given YTM, the

higher the coupon rate, the more dependent the bond’s total dollar return

will be on the reinvestment of the coupon payments in order to produce

the YTM at time of purchase

Yields

Yield to Call

in practice, YTM and YTC calculated for callable

bonds

to calculate, find PV of all coupons until bond is

called and then use call price as final value

convention is to calculate yield to first call (or yield

to next call), yield to first par call, and yield to

refunding

Yield to Call

Annual Interest Semiannual Rate Present Value of 6 PV of $103

PV of CFs

Rate (%)

y (%)

Payments of $3.5

6 Periods from Now

5

2.5

$19.28

$88.82

108.10

5.2

2.6

19.21

88.30

107.51

5.4

2.7

19.15

87.78

106.93

5.6

2.8

19.09

87.27

106.36

8 year 7% coupon bond with maturity value of $100

first call date is end of year 3

call price of $103

note that YTC assumes that all CFs can be reinvested at YTC until

assumed call date – may not be true

Yields

Yield to Put

rate that makes PV of CFs to first put date equal to

price plus accrued interest

example

Yield to Worst

calculate yield to call/put for all possible dates and

YTM and then pick minimum of all of these

does not mean much since problem with all yield

measures are they do not identify potential return

over investment period

Yields

Yield (IRR) for a Portfolio

not simply weighted average of YTMs for all bonds in portfolio

Bond

A

B

C

Coupon Rate (%)

Maturity (years) Par Value

Price

YTM (%)

7

5 $10,000,000 $9,209,000

9

10.5

7

20,000,000 20,000,000

10.5

6

3

30,000,000 28,050,000

8.5

Period CF Received Bond A

Bond B

Bond C

Portfolio

1

$350,000 $1,050,000

$900,000

$2,300,000

2

350,000

1,050,000

900,000

2,300,000

3

350,000

1,050,000

900,000

2,300,000

4

350,000

1,050,000

900,000

2,300,000

5

350,000

1,050,000

900,000

2,300,000

6

350,000

1,050,000

30,900,000

32,300,000

7

350,000

1,050,000

—

1,400,000

8

350,000

1,050,000

—

1,400,000

9

350,000

1,050,000

—

1,400,000

10

10,350,000

1,050,000

—

11,400,000

11

—

1,050,000

—

1,050,000

12

—

1,050,000

—

1,050,000

13

—

1,050,000

—

1,050,000

14

—

21,050,000

—

21,050,000

Yields

Cash Flow Yield

MBS and ABS have CFs that include interest and principal –

amortizing securities

prepayment speed must be assumed to project CFs needed to

calculate yield

yield calculated using assumed prepayment rate is cash flow yield **

example

limitations

projected CFs assumed to be reinvested at CF yield

MBS or ABS is assumed to be held until final payoff of all loans

based on a prepayment assumption

Spread/Margin Measures for

Floating Rate Securities

coupon rate for floater changes periodically

“margin” measures

spread for life (simple margin)

SpreadForLife [

100 (100 Pr ice)

100

QuotedM arg in] * (

)

Maturity

Pr ice

discount margin

determine CFs assuming reference rate does not change over life

select a margin

discount CFs in step 1 by current value of reference rate plus margin

compare PV of CFs in step 3 to price plus accrued interest

if PV = security’s price + acc. int., discount margin is margin assumed in step 2

if PV does not equal, go back to step 2 and try another margin

for bond selling at par, discount margin is quoted margin in coupon reset

formula

Discount Margin

Exhibit 3-1. Calculation of the Discount Margin for a Floating-Rate Security

Floating-rate security:

Maturity: six years

Coupon rate: reference rate + 80 basis points

Reset every six months

PV of CF at Assumed Annual Margin (bp)

Reference

Cash

Period

Rate

Flow

80

84

88

96

100

1

10%

5.4

5.1233

5.1224

5.1214

5.1195

5.1185

2

10

5.4

4.8609

4.859

4.8572

4.8535

4.8516

3

10

5.4

4.6118

4.6092

4.6066

4.6013

4.5987

4

10

5.4

4.3755

4.3722

4.3689

4.3623

4.359

5

10

5.4

4.1514

4.1474

4.1435

4.1356

4.1317

6

10

5.4

3.9387

3.9342

3.9297

3.9208

3.9163

7

10

5.4

3.7369

3.7319

3.727

3.7171

3.7122

8

10

5.4

3.5454

3.5401

3.5347

3.524

3.5186

9

10

5.4

3.3638

3.358

3.3523

3.3409

3.3352

10

10

5.4

3.1914

3.1854

3.1794

3.1673

3.1613

11

10

5.4

3.0279

3.0216

3.0153

3.0028

2.9965

12

10

105.4 56.0729 55.9454 55.8182 55.5647 55.4385

Present Value =

100 99.8269 99.6541 99.3098 99.1381

Sources of Bond Return

coupon payments

capital gain/loss on sale of bond (or when

called)

reinvestment of coupon payments – interest on

interest

yields

current

YTM

CF Yield

1 r n 1

C

nC

r

Dollar Return

coupon interest + interest on interest =

1 r n 1

C

r

interest on interest =

1 r n 1

C

nC

r

example

Total Dollar Return

Total Return

measure of yield that makes an assumption

about the reinvestment rate

bond

A

B

C

D

coupon

5

6

11

8

maturity

3

20

15

5

YTM

9

8.6

9.2

8

If all 4 have the same credit quality, which is the

most attractive?

Total Return

1.

2.

3.

4.

5.

Compute the total coupon payments plus the interest

on interest based on the assumed reinvestment rate.

Determine the projected sale price at the end of the

planned investment horizon.

Sum the values computed in steps 1 and 2.

To obtain the semiannual total return, use {total

future $ / purchase price}1/h -1

Double the interest rate in step 4 (as interest is

assumed to be paid semiannually.)

Yield Changes

absolute yield change

measured in basis points

absolute value of difference between two yields

percentage yield change

ln of the ratio of the change in yield

% yield change = 100 x ln(new yield / initial yield)