Keys to Success* Home Buyers Guide

advertisement

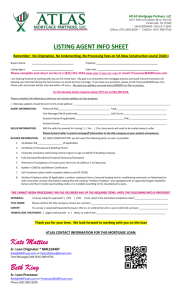

Keys to Success… Home Buyers Guide Jared Kelley Real Estate Agent BRE Lic#01793501 619.993.6065 Jared@MissionRealtyGroup.com Table of Contents Getting Started Real Estate Brokerage Relationships Key Question You Should Ask My Promise To You My Ideal Client The Team Reasons To Buy A Home Action Plan Lenders, Loans and Money Selecting A Lender Loan Application Required Information Top 8 Things NOT To Do During The Loan Process Funds And Reserves Needed Who Pays For What The Search Nice To Have…Need To Have Questionnaire Pricing Of Property…Understanding Value Range The Search Don’t Go It Alone Reality Check Closing and Moving Timeline At Closing What Happens In Escrow Tips & Checklist / General Information / Questions & Answers Supplemental Tax Bill Explained Tax Bill Guide Moving Timetable / Checklist Change Of Address Forms – USPS & DMV Local Utility & Services Contact Sheet Glossary TO BE FILLED OUT AND RETURNED TO ME Client Appreciation Form / Preferred Client Club “Nice To Have…Need To Have” list Questions for Jared Keys to Success… Home Buyers Guide Table of Contents In This Section: Getting Started – 5 Star Service Real Estate Brokerage Relationships Key Question You Should Ask My Promise To You My Ideal Client The Team Reasons For Selling Your Home Action Plan – Customized VIP Marketing Plan Real Estate Brokerage Relationships In California: Real Estate brokers and their salespersons are required to disclose the type of working relationship they have with the buyers in a real estate transaction. There are several types of relationships that are available to you. You should understand these at the time a broker provides specific assistance to you in buying real estate. Buyer’s Agent and Seller’s Agent relationships are commonly referred to as ‘agency’ relationships and carry with them legal duties and responsibilities for the broker as well as for the buyers and sellers. Buyer’s Agent: A Buyer’s Agent acts solely on behalf of the buyer and owes duties to the buyer which includes the utmost good faith, loyalty, and fidelity. The agent will negotiate on behalf of, and act as an advocate for, the buyer. The buyer is legally responsible for the actions of the agent when that agent is acting within the scope of the agency. The agent must disclose to sellers all adverse material facts concerning the buyer’s financial ability to perform the terms of the transaction and whether the buyer intends to occupy the property. A separate written buyer’s agreement is required that sets forth the duties and obligations of the parties. Seller’s Agent: A Seller’s Agent acts solely on behalf of the seller and owes duties to the seller that includes the utmost good faith, loyalty, and fidelity. The agent will negotiate on behalf of, and act as an advocate for, the seller. The seller is legally responsible for the actions of the agent when that agent is acting within the scope of the agency. The agent must disclose to the buyers or tenants all adverse material facts about the property known by the broker. A separate written listing agreement is required which sets forth the duties and obligations of each party. Key Questions You Should Ask You’ll Want To Choose A Real Estate Professional Who Is… Working in real estate as their full time career Fully aware of current market conditions Associated with a reputable Real Estate firm Willing to cooperate with ALL brokers Who is a REALTOR, a member of the National Association of Realtors, not just a licensed sales person Has a strong team of lenders, inspectors, title, escrow and other professional services available Key Questions You Should Be Asking… What type of market are we in now…buyers or sellers and what does that mean to me? What do we do first? Why is it so important that I select a lender now? What is the difference between pre-approved and pre-qualified? What do you mean by ‘value range’? What are the benefits and disadvantages? What do I need for deposits? Who pays for inspections? Why do I need them? Are all properties sold “as is”? What about repairs? How do we look for a home? My Professional Promise To You… My promise to you is that I will serve as Your Advocate, Your Consultant and Your Realtor providing guidance as a Real Estate professional with the highest level of integrity and honesty. I will keep you up to date of our progress and will present/prepare all offers in a timely and fair manner. You have my word that my guidance during our transaction will be based on information and statistics from the market place. I understand that we are partners in this transaction and I do not take the trust that you have placed in me lightly. I will continue to do everything to perform above expectations on your behalf. -Jared Kelley Let me tell you what I am looking for in a client… Someone who will let me be honest and open with them Someone who will allow me to tell you what you NEED to hear…Not just what you WANT to hear Someone who will be realistic – based on current market conditions Someone who will agree to work with me and me only Someone who will let me show them homes consistently until they buy Someone who understands what I get paid to do Someone who will let me do what I get paid to do Someone who will let me give them good news and bad news equally Someone who will make adjustments when necessary (remembering that we don’t control the market, we just respond and react to it.) Someone who will be happy to introduce me to their friends and family members who are in need of help with their real estate needs The Team Buying or Selling a home is like taking an airline flight cross country. When you start on your trip, you have no idea how the trip will go. Neither does the pilot! You could run into 88 different types of turbulence, or you could have a smooth flight and land on time. As your Personal Real Estate Consultant, I see myself as the pilot of your plane, taking you 1st class on this journey. My job is to assist you in getting the purchase or sale of your home done in the least time with the least aggravation. My job is also to manage the ‘flight crew’ consisting of: Lenders Inspectors Escrow Title Transaction Coordinator who is the “Air Traffic Controller” During this trip, we will be overseeing 70-100 pieces of papers which includes contracts, disclosures, reports and communications, most of which require signatures or initials. We’ll also be receiving and sending upwards of 100-150 phone calls and emails, each loaded with critical details and information that require attention. This is why your team and crew need the guidance of an experienced “Pilot”. Our mission is to have you enjoy your trip and to have a safe landing at the end! Reasons to Buy A home Advantages of Home Ownership… Whether you are looking for more space to raise a family or the perfect place to make your own, there are many advantages to owning your own home, ranging from the purely personal to the very practical. For many people, the motivation for home ownership is primarily financial. Owning a home is a first rate investment for a number of reasons. Here are just a few…. Scheduled Savings: When you buy a house, your monthly mortgage payments serve as a type of scheduled savings plan. Over time you gradually accumulate equity. Stable Housing Cost: Another advantage of home ownership is that while rents typically increase year after year, the principal and interest portion of most mortgage payments remains unchanged throughout the entire repayment period (typically 30 years). Increased Value: Houses typically increase in value or ‘appreciate’ over time. It’s not unusual to find a house that sold for $150,000 fifteen years ago to be valued at much more than that. Even if the market slows or adjusts, in the long run over a 5 year period you will have increased value. Tax Benefits: Homeowners also get significant tax breaks that are not available to renters. Most importantly, interest paid on a home mortgage is usually deductible. Additional Value and Benefits of Home Ownership: Quality of life Deferred gain and capital gain tax treatment Pride of home ownership No landlord Leverage (where else can you buy this size of an investment with only 3.5-10% of your own money down?) The real cost of renting (at $700 per month with a 6% rental increase per year, you will have paid $110,719 over a 10 year period) Action Plan Plan of Action for the purchase of your new home: We will explore your needs, wants and dreams. You will meet with the lender to obtain financing and pre-approval. We’ll go out to see if I got it right. We go buying! We write the offer. We negotiate the best offer on your behalf and we open escrow. Our team processes the sale. You participate in inspections. You sign your loan documents and bring in your money. We close escrow. You receive the keys to your new home!!! Keys to Success… Home Buyers Guide Table of Contents In This Section: Lender, Loans And Money Selecting A Lender Loan Application Required Information Top 8 Things NOT To Do During The Loan Process Funds And Reserves Needed Who Pays For What Who Pays For What In The Market Loan Application Required Information When preparing to call or go see a Lender, these are typically items that you will need…Be sure to ask the Lender what items they require… Date of Birth and Social Security Numbers of those who will be applying for the loan Two months most recent bank statements (all pages, even if blank) Most recent consecutive paystubs to cover the last 30 days, or current Profit and Loss statement Two years employment history and two years residency history Recent mortgage statement or name, address, phone number of landlord Two years W-2’s and 1040’s (all pages) If FHA loan, copy of driver’s license and Social Security Card If VA loan, copy of DD-214 / Certificate of Eligibility Check for credit report and appraisal fee Top 8 Things NOT To Do During The Loan Process 1) Quit your job. Lenders will verify your employment a couple of days prior to funding your loan 2) Buy a new car or make any other large purchases. The new payment may make it difficult for you to qualify for your mortgage. 3) Stop making payments on your mortgage, credit cards, etc. Falling behind on your current debt can cause your application to be denied. 4) Put your home on the market. Lenders will not lend on a home that is listed for sale. 5) Begin improvements on your home. A home that is currently under construction may be difficult to appraise at its true value. 6) Draw off your home equity line. Your loan approval is based on balances at the time of application. Drawing money on your credit line can affect your approval. 7) File for Bankruptcy. Most programs require that you be outside of a bankruptcy for at least two years before you can qualify for a loan. 8) Take advice from your mechanic on mortgage programs and rates. Would you take advice from your loan officer on what is wrong with your car? When you need expert advice on mortgage rates and programs, ask your mortgage specialist. Funds and Reserves Needed 1) Deposit / Good Faith needs to be in account (usually is 1-5% of property list price). This is applied towards your total down payment. 2) Down Payment (usually 3.5%-10% depending on loan program) 3) Closing costs (may be negotiated with seller) 4) Transaction Coordinator Fee ($395) 5) Inspection Fees a) Home inspection ($300-$800, based on sq. ft.) b) Pool ($100-$400 if applicable) c) Fireplace ($40-$75 if applicable) d) Septic / Well (Buyer will ask seller to have pumped and certified if applicable) e) Other – if needed: Structural Engineer, Roofer, Etc. f) Recommended: Heating and A/C unit inspection g) Plumbing inspection 6) Locksmith (re-key property upon close of escrow) 7) Property taxes re-assessment 8) Loan reserves as required by Lender Who Pays For What SELLER: Estimate 8% of Sales Price: Commission for both buying and selling agent Escrow expenses (usually half of total escrow fee’s for transaction) Title Termite inspection and section 1 repairs Disclosure of Natural Hazards Report Transaction Coordinator ($395 paid at close of escrow) Septic inspection and certification (if applicable) Repairs as required / requested BUYER: Good faith deposit to be presented with offer Escrow expenses (usually half of total escrow fee’s for transaction) Transaction coordinator ($395 paid at close of escrow) Physical inspection ($300-$800 depending on property size) Inspections as necessary (pool, fireplace, foundation, etc.) Cushion for closing as required by lender HOA – Documentation request fee ($200-$250 paid upfront) What We Negotiate Prior To Listing: Listing Price Commission Terms of Contract o Service Providers o Possession o Contingencies o Inclusions / Exclusions Transaction Coordinator Fee Traditional Sale Seller Buyer Commissions X X Escrow Title Termite Inspection Termite Repairs $50 X X Short Sale Seller Buyer X X X X X X X X X X X X X X X Varies Disclosures $100 Natural Haz Report HOA $200+ Documentation $300 Home $500 Warranty X Foreclosure Seller Buyer X* X* X X Fireplace Inspection Septic (if applicable) $50 X* X* X X Varies X* X* X X Pool / Spa Varies X* Repairs Varies X* X* X X X X Good Faith Deposit Transaction Coordinator Physical Inspection 1 – 3% X X X X X X X $400 $250 $550 X X X X Change of Door $50+ X X X Locks Replacement of Garage Door $50+ X* X* X X Openers $10 X* X* X X Mail Box Keys $50 X* = Items that are negotiated in a traditional transaction Transaction Coordinators are typically used on each side; Buyer / Seller to pay their own TC fee Buyer and Seller list is based off a ‘traditional’ sale where the actual owner is selling the property. Not a short sale, not a foreclosure. All prices are strictly an estimate of sample cost List of items above may be included, but are not limited to, actual cost of items. Who REALLY Gets What – Compensation Two Ways FIRST, I work on a contingent basis versus a retainer basis, which means as your consultant / negotiator and overseer of all details, I invest all of the up-front money and time to help you make your dreams of buying or selling come true. ONLY when we have successfully completed that goad, do I actually receive compensations. Then of course the SECOND way you compensate me is in the form of your recommendations and introductions to your friends, family and neighbors that you care about and that I can help. 3% to Seller’s Side 3% to Buyer’s Side Seller’s Broker Buyer’s Broker Agent Taxes / Cost of Business Agent Taxes / Cost of Business Agent Check Agent Check Keys to Success… Home Buyers Guide Table of Contents In This Section: The Search Nice To Have…Need To Have Questionnaire Pricing of Property…Understanding Value Range The Search Don’t Go It Alone Reality Check Nice To Have…Need To Have Top 5 MUST / NEED To Have… 1. _____________________________________ 2. _____________________________________ 3. _____________________________________ 4. _____________________________________ 5. _____________________________________ 3 Nice to Have Items… 1. _____________________________________ 2. _____________________________________ 3. _____________________________________ Top Areas: 1. ______________________________________ 2. ______________________________________ 3. ______________________________________ When would you like to be in your new home by? __________________ If currently renting, are you month to month or on a lease? ___________ How would you rate your “handyman” skills? _____________________ Best way to communicate with you? Email / Phone / Text / Mail ________ What do you expect from me? ________________________________ Other: _________________________________________________ Pricing Your Property – Value Range / List Price When listing a property, a seller has the option to set a LIST PRICE, for example $425,000, or establish a VALUE RANGE such as $399,000-$450,000. LIST PRICE can be compared to a fisherman with a single pole whereas you can only catch one fish at a time. However, a VALUE RANGE is comparable to a fishing net in that you are able to catch many different fish at the same time. In that way you increase your chances of securing your buyer. Sometimes it is necessary to adjust the range to enlarge the pool of potential buyers for your home. Regardless as to what type of market we are in, there are always buyers needing, wanting and able to buy. We are consistently reviewing status reports and evaluations are made regularly in order to determine if a price adjustment or reduction is necessary. One general rule of thumb works well…. IF you are getting NO SHOWINGS…your home is overpriced. IF you are getting SHOWINGS BUT NO OFFERS…your home is close, but still priced too high. IF you are getting SHOWINGS AND OFFERS…you are priced right! The Search How I Find Homes For You To View… Using the information you provided in our consultation, I can create a custom search based off your “needs assessment” MLS SEARCH (Multiple Listing Service) I check the MLS daily using your parameters to find out What’s new on the market What’s been taken off the market and what been put back on the market On which homes prices have been reduced NETWORKING I network with other agents, as well as others in related fields. DRIVE BY AND / OR PREVIEW If I find something that may be just the perfect fit, I will call or leave a message for you. Soooo…don’t be surprised if you’ll have to change your “after work plans” so we can look at a home. Likewise, if you drive by a home or homes that interest you, give me a call and I’ll arrange for us to see it. CUSTOM SEARCH I will set up a custom search for you so that you will receive email on properties of interest, as soon as they become available. Don’t Go It Alone Have a few of my business cards handy… You might be out and about and tempted to stop into an open house, a new home sales office, or even see a sign that is a FSBO (For Sale By Owner)…I would prefer to have you get the address and bring it to me, but if temptation over comes you and you do stop in, it is critical that the first thing you do is present them with MY CARD! They need to know that you have already arranged for a Realtor to represent you and protect your best interest. Reality Check At some point we may need to have a reality check….is what you WANT really in your price point? Often your first purchase is not your dream home….It is your started home and you make it into your dream home! What we dream about… …What we think we want What we can afford now… Keys to Success… Home Buyers Guide Table of Contents In This Section: Closing And Moving Timeline At Closing What Happens In Escrow Timeline at Closing Although date and time lines are mapped out in the contract, one thing that I have learned in this business is that not everyone works the same schedule…no one punches the ole time clock the same…thus sometimes it might take a day or two to get an answer back from the supporting vendors and parties involved… PATIENCE IS SOMETIMES THE KEY! Final timely steps: Once it has been verified that all disclosures are submitted and signed off…. Escrow will prepare its final HUD statement and money will go into escrow if needed… The lender will hit the magic button for funding the loan…. Title will notify us that the funds have been received… Title then prepares for recording the deed and that officially makes the transfer of ownership complete! “We have recorded” are the magic words we wait for and then… IT IS OFFICIAL! Time for celebration and keys get turned over to you!! Keys to Success… Home Buyers Guide Table of Contents In This Section: Tips & Checklist / General Information / Q&A’s Supplemental Tax Bills Explained Tax Bill Guide Moving Timetable / Checklist Change Of Address Forms – USPS & DMV Local Utility & Services Contact Sheet Glossary Questions For Jared Supplemental Tax Bills Explained The fiscal year runs from July 1st to June 30th On January 1st, tax liens are placed on properties in advance for the upcoming fiscal year. There are 2 billing cycles, one from July 1st to December 31st (bills go out in October and due no later than December 10th), and the other from January 1st to July 1st (bills go out in February and due no later than April 10th). OLD rate will reflect what the seller had been paying – based on what they had purchased the property for. NEW rate will reflect what you the buyer will pay based on your purchase price. Reassessments are done at the time of sale, transfer of title or when building permits are pulled for construction / remodeling purposes. At the time of closing, if the taxes have already been paid by the seller, the seller will be due a credit for overpayment of taxes for the days he was not in the home, and the buyer will be charged for these days at closing, at the new tax rate. The county takes from 2 to 10 months to update their records. The first tax bill you receive will be at the seller’s old rate. Once records are updated, you will be sent a supplemental tax bill to pay for the difference between the old rate and the new rate. Supplemental tax bills are only sent out once. Lender’s calculate your taxes at your new rate, thus usually funds for the supplemental tax bill have already been collected and are in your impound escrow account. GLOSSARY ACCEPTANCE: The date when both parties, seller and buyer, have agreed to and completed signing and / or initialing the contract ADJUSTABLE RATE MORTGAGE (ARM): A mortgage that permits the lender to adjust the mortgages interest rate periodically on the basis of changes in a specified index. Interest rates may move up or down, as market conditions change. AMORTIZED LOAN: A loan which is paid in equal installments during its term. ANNUAL PERCENTAGE RATE (APR): A term used in the Truth in Lending Act. It represents the relationship of the total finance charge (interest, discount points, origination fees, loan broker, commission, etc.) to the amount of the loan. APPRAISAL: An estimate of real estate value, usually issued to standards of FHA, VA, and FNMA. Recent comparable sales in the neighborhood are the most important factor in determining value. This should be contrasted against the home inspection. APPRECIATION: An increase in the value of a property due to changes in the conditions or other causes. The opposite of depreciation. ASSUMABLE MORTGAGE: Purchaser takes ownership to real estate encumbered by an existing mortgage and assumes responsibility as the guarantor for the unpaid balance of the mortgage. BILL OF SALE: Document used to transfer title (ownership) of PERSONAL property. CLOSING STATEMENT (HUD1): A financial statement rendered to the buyer and seller at the time of transfer of ownership, giving an account of all funds received or expended. CLOUD ON TITLE: Any condition that affects the clear title to real property. COMPARABLE SALES: Sales that have similar characteristics as the subject property and are used for analysis in the appraisal process. CONTRACT: An agreement to do or not to do a certain thing. CONSIDERATION: Anything of value to induce another to enter into a contract, i.e., money, services, a promise. DEED: Written instrument, which when properly executed and delivered, conveys title to real property. DISCOUNT POINTS: A loan fee charged by a lender of FHA, VA or conventional loans to increase the yield on the investment. One point=1% of the loan amount. EASEMENT: The right to use the land of another. ENCUMBRANCE: Anything that burdens (limits) the fee title to property, such as liens, easements, or restrictions of any kind. EQUITY: The value of real estate over and above the liens against it. It is obtained by subtracting the total liens from the value. ESCROW PAYMENT: The portion of a mortgagor’s monthly payment held in trust by the lender to pay for takes, hazard insurance, mortgage insurance, lease payments and other items as they become due. FANNIE MAE (FNMA): Nickname for the Federal National Mortgage Corporation (FNMA), a taxpaying corporation created by congress to support the secondary mortgages insured by FHA or guaranteed by VA, as well as conventional home mortgages. FEDERAL HOUSING ADMINISTRATION (FHA): An agency of the U.S. Department of Housing and Urban Development (HUD). Its main activity is the insuring of residential mortgage loans made by private lenders. The FHA sets standards for construction and underwriting but does not lend money or plan or construct housing. FHA INSURED MORTGAGE: A mortgage under which the Federal Housing Administration insures loans made, according to its regulations. FIXED RATE MORTGAGE: A loan that fixes the interest rate at a prescribed rate for the duration of the loan. FORECLOSURE: Procedure whereby property pledges as security for a debt is sold to pay the debt in the event of default. FREDDIE MAC (FHLMC): Nickname for the Federal Home Loan Mortgage Corporation (FHLMC), a federally controlled and operated corporation to support the secondary mortgage market. It purchases and sells residential conventional home mortgages. GRADUATED PAYMENT MORTGAGE: Any loan where the borrower pays a portion of the interest due each month during the first few years of the loan. The payment increases gradually during the first few years to the amount necessary to fully amortize the loan during its life. INVESTOR: The holder of a mortgage or the permanent lender for whom the mortgage banker services the loan. Any person or institution that invests in mortgages. LEASE PURCHASE AGREEMENT: Buyer makes a deposit for future purchases of a property with the right to lease the property for the interim. LOAN TO VALUE RATIO (LTV): The ratio of the mortgage loan principal (amount borrowed) to the property’s appraised value (selling price). Example – on a $100,000 hoe, with a mortgage loan principle of $80,000 the loan to value ratio is 80%. MORTGAGE: A legal document that pledges a property to the lender as security for payment of a debt. MORTGAGE INSURANCE PREMIUM (MIP): The amount paid by a mortgagor for mortgage insurance. This insurance protects the investor from possible loss in the event of a borrower’s default on a loan. MORTGAGOR: The borrower of money or the giver of the mortgage document. NOTE: A written promise to pay a certain amount of money. ORIGINATION FEE: A fee of the loan paid to the lender, expressed in points. PRIVATE MORTGAGE INSURANCE (PMI): See mortgage insurance premium. PROMISSORY NOTE: A written contract containing a promise to pay a definite amount of money at a definite future time. REALTOR: A member of local and state real estate boards, which are affiliated with the National Association of Realtors (NAR). RENT WITH OPTION: A contract, which give one the right to lease property at a certain sum with the option to purchase at a future date. SECOND MORTGAGE / SECOND DEED OF TRUST / JUNIOR MORTGAGE OR JUNIOR LIEN: An additional loan imposed on a property with a first mortgage. Generally, a higher interest rate and shorter terms than a “first” mortgage. SEVERALTY OWNERSHIP: Ownership by one person only. Sole ownership. SURVEY: The process by which a parcel of land is measured and it area ascertained. TENANCY IN COMMON: Ownership by two or more persons who hold an undivided interest without right of survivorship. (In the event of the death of one owner, his/her share will pass to his/her heirs.) TITLE INSURANCE: An insurance policy, which protects the, purchaser or lender, against loss arising from defects in title. QUESTIONS I HAVE FOR JARED Jared – 619.993.6065 Jared@MissionRealtyGroup.com 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ Notes: _____________________________________ _____________________________________ _____________________________________ _____________________________________ _____________________________________ _____________________________________ _____________________________________