Strategies, Tactics & Dreams

advertisement

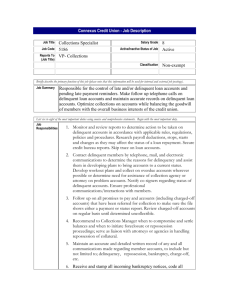

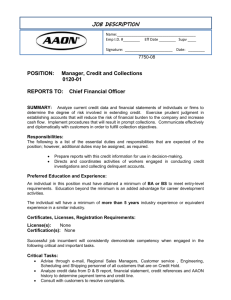

Innovative Strategy Approaches “Strategies, Tactics & Dreams” Setting the Scene Create a backdrop against which the credit industry leaders will be operating during 2015 3 Portfolio Life Cycle “THROUGH THE DOOR” [Branches & Sales Channels] PROSPECTING (ACQUISITION) [Direct Marketing] 1 NEW BUSINESS APPLICATION PROCESSING (ORIGINATION) UP-TO-DATE [High Utilisation] F P D [Medium Utilisation] DELINQUENT 2 [Low Utilisation] 3 [“Transactors”] INACTIVE 4 EXISTING BUSINESS [Mildly Delinquent] [Recently Inactive] [Highly Delinquent] [Highly Inactive] [Severely Delinquent] [Long Term Inactivity] WRITTEN-OFF CLOSED BUSINESS N T U CLOSED 4 Maturity Life Stages Return on Capital Employed • Champion Strategy • Base Operations • Base Reporting • 1st Gen Strategy • 2nd Gen Strategy • Strategy MIS • Profit Metrics • Bespoke Models • Simple Direct Marketing • Risk Proxies • Basic Portfolio Segmentation • Generic Risk • Pooled Data • Spend Stimulation • Cross-Sell • Customer Loyalty • Empirical Strategy Keys • Node Level Analysis • Profit Driven Design • Closer to Ops • Forecasting • Attrition Models • One Rule For All • Multiple Complex Models • Frequent Outcome Review • Markov Matrices • Brand Affiliation • Customer Value Management • Product Needs Year 2-5 Year 1 Basic Intermediate • Commodity Clusters Year 6-14 Year 4-10 Advanced Expert Leader Life Stage 5 Strategies, Tactics & Dreams What are the credit industry leaders considering in terms of longer term strategies, shorter term tactics & in some cases dreams? 6 1 New Business “Knowing Your Future Customer” • Direct marketing strategies are deeply entrenched – underpinned by affordability regulations through to data privacy • SA has a rich source of consumer/credit information – which is often not applied/used optimally • Response models not producing cost effective results – generating consumer direct marketing fatigue • Innovative leaders are understanding future customers – product needs i.e. which product are they likely to acquire next – brand affiliation i.e. which brand appeals to them the most – driving more focussed call centre strategies 7 New Business – contd. “Knowing Your Future Customer” 2.5 x better response rate! Do Not Market Select for Marketing • Modelling towards a brand results in a lower acquisition cost as no longer directly linked to the marketing message, the channel used nor time 8 Up-To-Date Accounts “Managing Past Credit Decisions” 2 • Leaders perform stringent champion: challenger testing – crowning the new champion at the end of the test (12 months) • Longer term effect of new strategy was not understood – often resulting in poorer credit risk performance • Leaders are rethinking this approach – ensuring that these longer term effects are measured over a longer period (36 months) applying Credit Risk Mandates • Credit Risk Mandates curb breaching “waterfall” points – Ensuring longer term profitability improvement of more than 10% 9 3 Delinquency Management “Optimising Cost of Collections” • Dire level of consumer indebtedness creating stresses – collections burden falls back onto the collections dept. (R1.5BN?) • Proven technologies & strategies no longer working – bespoke Payment Projection scores, bureau-based collections scores, multiple champion: challenger strategies, etc. having limited real, long term effect • Contact optimisation techniques are being sought – sophisticated collection of contact information from within the call centre, dialler, collections notes and alternative source other than traditional credit bureaux • Interactive self service Omni-channel technologies – redirecting the collector costs/process back to the consumer 10 4 Inactive Accounts “Remembering Your Customer” • Retaining customers has been always challenging – – – – the true nature of their attrition never really understood is it your product? Is it that the competitor simply has a better product? has the customer outgrown your brand? • Leaders are turning to complex modelling techniques – commodity clustering analysis (“baskets”) – ensures an improvement in spend stimulation (particularly in the retail and FMCG sectors) • Models are assisting with longer term customer retention – more importantly understanding customer behaviour – allowing a more targeted retention approach 11 In Conclusion “Simple Strategies Often Work Best” • Consumers product needs, brand affiliation commodity cluster models are producing results: & – Sizeable reduction in direct marketing costs: 25% to 75% – Satisfying customers needs and spend stimulation: 10%+ lift • Profit-driven, longer term Credit Risk Mandates tend to chalk out the credit risk playing field – has curbed the effects of shorter term challenger ‘wins’ • Optimal use of internal & external contact information – tends to outperform sophisticated collection strategies • Redirection of collections (and customer actions) using self-service omni-channels services – is proving to reduce high staffing costs 12