2012_FAFSA_Day_Presentation

advertisement

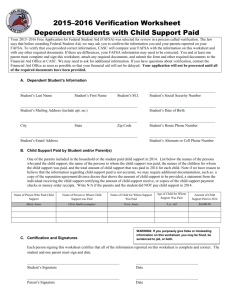

FAFSA DAY 2012 Applying for Financial Aid 2012-2013 www.FAFSADAY.org 1 Sponsors/Partners: Presenter: www.FAFSADAY.org 2 Types of Financial Aid Gift Aid - Grants or scholarships that do not need to be repaid Work - Money earned by the student as payment for a job on or off campus Loans - Borrowed money to be paid back, usually with interest www.FAFSADAY.org 3 Sources of Financial Aid Federal government State government Colleges and universities Private agencies, companies, foundations, and parents’ employers www.FAFSADAY.org 4 Types of Applications FAFSA CSS/Financial Aid PROFILE Institutional financial aid application Deadlines and requirements vary by institution www.FAFSADAY.org 5 FAFSA on the Web Internet application used by students and parents to complete electronic FAFSA at www.fafsa.gov Sophisticated on-line edits and skip logic so errors are less likely to be made Instructions incorporated throughout application Student and at least one custodial parent should get a federal PIN at www.pin.ed.gov www.FAFSADAY.org 6 FAFSA on the Web Password Before starting the on-line FAFSA you will be asked to create a password This allows you to save your application and return to it at a later time www.FAFSADAY.org 7 Federal PIN PIN (Personal Identification Number) serves as the electronic signature Both student and at least one custodial parent need a PIN to sign the FAFSA electronically May also be used to: Utilize IRS Data Retrieval Tool Correct/Update FAFSA Add additional colleges to receive FAFSA data Apply for PINs at www.pin.ed.gov Needed each year the student completes the FAFSA www.FAFSADAY.org 8 FAFSA on the Web Worksheet Used to collect information for the on-line application Does not include all questions from the FAFSA Do not mail this worksheet www.FAFSADAY.org 9 The FAFSA on the Web Worksheet— A Four Section Form Section 1 – Student information Section 2 – Student dependency status Section 3 – Parent financial information for dependent students Section 4 – Student financial information www.FAFSADAY.org 10 Section 1 (page 2) STUDENT INFORMATION Social Security Number Demographic Information Citizenship Status Selective Service Registration www.FAFSADAY.org 11 Section 1 Citizenship Status If U.S. citizen, status will be confirmed by Social Security match If eligible noncitizen, status will be confirmed by Department of Homeland Security (DHS) match. This includes: U.S. permanent residents with I-551 Conditional permanent residents with I-551C Eligible noncitizens with I-94 with certain designations Certification from Department of Health and Human Services with designation of “Victim of human trafficking” A resident of the Republic of Palau (PW), the Republic of the Marshall Islands (MH), or the Federated States of Micronesia (FM) A Canadian-born Native American under terms of the Jay Treaty If neither a citizen or eligible noncitizen, the student is ineligible for federal/state aid, but may be eligible for institutional funds www.FAFSADAY.org 12 Section 1 High School Completion Status An important question NOT on the Worksheet: High School Completion Status When the student begins college in the 2012-2013 school year, what will be the student’s high school completion status? High school diploma GED certificate Home schooled None of the above www.FAFSADAY.org 13 Section 1 High School Completion Status An important question NOT on the Worksheet: If student selects High School diploma they will be required to list the high school they received or will receive diploma from FAFSA on the Web allows students to search for high school by name, city and state www.FAFSADAY.org 14 Section 1 Interest in Receiving Federal Work-Study An important question NOT on the Worksheet: FAFSA on the Web asks If the student is interested in being considered for Federal Work-Study Indicating interest does not obligate the student to work nor will it cause the student to lose grants and scholarships Answering “no” may restrict the students opportunity to utilize Federal Work-Study www.FAFSADAY.org 15 Section 1 School Selection An important question NOT on the Worksheet: FAFSA on the Web allows the student to list up to 10 colleges/universities that will receive his/her student and parent information list all schools where student is applying for admission If school code is not known you may search by city, state or college name If the student is applying to more than ten colleges, wait for the processed Student Aid Report (SAR) before deleting/adding additional colleges www.FAFSADAY.org 16 Section 2 (page 2) STUDENT DEPENDENCY STATUS www.FAFSADAY.org 17 Section 2 Determination of Student Dependency Status To be considered independent the student must meet one of the following criteria 24 or older Married Graduate Student Serving on active duty in U.S. Armed Forces Veteran of U.S. Armed Forces Have children or dependents who receive more than half of their support In foster care, dependent or ward of the court or parents were deceased any time after age 13 Emancipated minor In legal guardianship Homeless, risk of being homeless, or unaccompanied youth www.FAFSADAY.org 18 Section 3 (page 3) PARENT INFORMATION Demographic Information Financial Information www.FAFSADAY.org 19 Section 3 Who is Considered a Parent? See instructions on page 3 of FAFSA on the Web Worksheet Biological or adoptive parent(s) Stepparent (regardless of any prenuptial agreement) In case of divorce or separation, provide information about the parent and/or stepparent the student lived with more in the last 12 months www.FAFSADAY.org 20 Section 3 Who is Not a Parent? Do NOT provide information on: Foster parents or legal guardians If the student is in foster care or has a legal guardian, he/she is automatically considered an independent student Grandparents or other relatives The student must attempt to get biological parental information Colleges may use Professional Judgment to allow the student to file as independent in special situations www.FAFSADAY.org 21 Section 3 Parents’ Tax Return Filing Status for 2011 The student will be asked to provide information about parent tax filing status for 2011: If his/her parents have completed their 2011 federal income tax return, mark the first box If they have not as yet filed, but plan to file a 2011 federal income tax return, mark the second box If they have not, nor will not, file a 2011 federal income tax return and are not required to do so, mark the third box www.FAFSADAY.org 22 Section 3 Parent 2011 Adjusted Gross Income If the student’s parents have not yet filed their 2011 federal tax return, use estimated information for this question If the student’s parents have completed their 2011 federal tax return, use actual 2011 tax return information to complete this item. Reminder: If the answer is zero or the question does not apply, enter 0 www.FAFSADAY.org 23 Section 3 Money Earned from Work by Parent(s) in 2011 Use W-2 forms and other records to list all income earned from work in 2011 (including business income earned from self-employment) for father/stepfather and/or mother/stepmother www.FAFSADAY.org 24 Section 3 Dislocated Worker The student will be asked to check if the father/stepfather and/or mother/stepmother is a dislocated worker A person may be considered a dislocated worker if he/she: is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation has been laid off or received a lay-off notice from a job was self-employed but is now unemployed due to economic conditions or natural disaster is a displaced homemaker www.FAFSADAY.org 25 Section 3 Parent 2011 U.S. Income Taxes An important question NOT on the Worksheet: What was the amount parents’ U.S. income tax for 2011? Found on federal tax return: IRS Form 1040-Line 55; 1040ALine 35; or 1040 EZ-Line 10 Not the amount withheld from parents’ paychecks www.FAFSADAY.org 26 Section 3 IRS Data Retrieval Tool Used to upload federal tax data directly to FAFSA on the Web Available after February 1st 2011 federal tax return must be submitted If student or parents initially estimate tax data to complete FAFSA, IRS Data Retrieval tool should be used to update FAFSA and submit actual tax data www.FAFSADAY.org 27 Section 3 Parents’ Household 2010 or 2011 Benefits Received Indicate if the student, his/her parents, or anyone in the parents’ household received benefits in 2010 or 2011 from any of the federal programs listed Actual amounts received are not reported www.FAFSADAY.org 28 Section 3 2011 Parent’s Additional Financial Information Check all items received or paid in 2011 FAFSA on the Web will ask for amounts received/paid www.FAFSADAY.org 29 Section 3 2011 Parent Untaxed Income Check all that apply in 2011 FAFSA on the Web will ask for amounts received www.FAFSADAY.org 30 Section 3 Parent Assets Parents may be asked to report: Current balances of cash, savings and checking accounts Net valued of investments such as real estate, rental properties, money market and mutual funds, stocks, bonds, college savings and other securities Net value of businesses and investment farms Note: Do not include the value of your primary residence, the value of life insurance, retirement accounts and small family businesses as described in the FAFSA instructions. www.FAFSADAY.org 31 Section 3 Parent Household Size An important question NOT on the Worksheet: Parent Number in Household Include in the parents’ household: The student Parent(s) Parents’ other dependent children, if the parents provide more than half their support or the children could answer “no” to every question in Section 2 Other people, if they now live with the parents and will continue to do so from 7/1/12 through 6/30/13, and if the parents provide more than half their support now, and will continue to provide support from 7/1/12 through 6/30/13 www.FAFSADAY.org 32 Section 3 College Students in the Parent Household An important question NOT on the Worksheet: College Students in the Parent Household Always include the student even if he/she will attend college less than half-time in 2012-2013 Include other household members only if they will attend at least half-time in 2012-2013 in a program that leads to a college degree or certificate Do not include the parents NOTE: Some financial aid offices will require proof that other family members are attending college www.FAFSADAY.org 33 Section 4 (page 4) STUDENT FINANCIAL INFORMATION www.FAFSADAY.org 34 Section 4 Student Information Questions in Section 4 are identical to the parent financial questions we covered in Section 3 If the student is single, ignore references to “spouse” If the student is married, report spouse’s income and assets Skip the student’s adjusted gross income question if the student is not required to file taxes www.FAFSADAY.org 35 Submitting the FAFSA Student and parent sign the online application by providing PIN or mailing a signature page Confirmation will be received after submitting application Print the confirmation page for your records You may also email the confirmation www.FAFSADAY.org 36 Special Circumstances Contact the Financial Aid Office if there are circumstances which affect a family’s ability to pay for college such as: Loss or reduction in parent or student income or assets Death or serious illness Natural disasters affecting parent income or assets Unusual medical or dental expenses not covered by insurance Financial responsibility for elderly grandparents Or any other unusual circumstances that affect a family’s ability to contribute to higher education www.FAFSADAY.org 37 What Happens Next? FAFSA information is sent to colleges listed on the application and Students receive Student Aid Report (SAR) from federal processor Students and families review SAR for important information and accuracy of data Colleges match admission records with financial aid applications and determine aid eligibility Colleges send notices of financial aid eligibility to admitted students who have completed all required financial aid forms www.FAFSADAY.org 38 Student Aid Report (SAR) After the student completes the FAFSA on the Web, a SAR will be sent to the student An electronic SAR Acknowledgment will be sent if student provides an email address A paper SAR will be mailed if no student e-mail address is provided An electronic copy of the data will be sent to each college or university listed by the student in Section 1 Keep a copy of the SAR with other financial aid documents www.FAFSADAY.org 39 Questions? Please remember to complete the FAFSA Day Survey before you leave! You can also share feedback with us at www.facebook.com/FAFSADayMA or www.twitter.com/FAFSADayMA THANK YOU www.FAFSADAY.org 40