FORECLOSURE VOCABULARY (answers)

advertisement

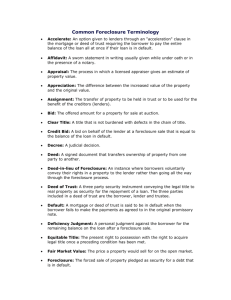

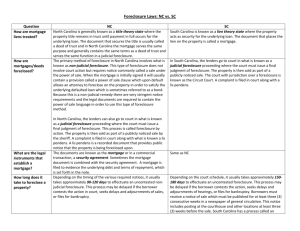

NAME: Rosa Pazhouh LESSON: Overview of Foreclosure and the Foreclosure Crisis (Model Lesson Plan) SOURCE: Mostly original – Certain sections pulled from the PBS NewsHour Extra: What are the Factors Behind a Foreclosure? (http://www.pbs.org/newshour/extra/teachers/lessonplans/economics/julydec10/foreclosure_10-28.html) TIME: 50+ minutes (50 minimum – includes more resources so teachers can extend lesson longer than 50 minutes if they like or cut down) MATERIALS: Vocabulary sheet handouts; “How Foreclosure Works” article (4 separate handouts); PowerPoint presentation (will need access to computer if viewing videos) **This lesson plan was intended for more advanced/older students. However, it may be amended as necessary since it contains a lot of resources and information that can be taught to students of varying levels/abilities (videos in particular can be shown to all ages). This lesson plan includes MORE rather than LESS and could take much longer than a 50-minute class, but was designed to be adjusted accordingly. I. GOALS: Studying foreclosure and the recent foreclosure crisis will help students: Understand the economic and legal implications of foreclosure Understand the basics of home ownership and what rights individuals have as home owners Provide students with the opportunity to study a relevant current effect that has a mass continuing affect on the American population II. OBJECTIVES: KNOWLEDGE OBJECTIVES: Students should understand and explain the general steps of the foreclosure process o Key concepts including the roles of homeowners and banks. o Key terms (mortgage, foreclosure, refinancing) Students will be able to articulate very generally what is meant by “foreclosure crisis” Students should understand the general allegations of wrongdoing by banks in the foreclosure crisis Students will gain knowledge of how homeowners are “fighting back”/responding to the current foreclosure crisis SKILL OBJECTIVES: Students will gain skills working in groups to brainstorm possible solutions to problems facing homeowners in foreclosure Students will learn how to summarize a complex news story and articulate it to their classmates Students will become more effective at speaking to large groups Learn to assess the impact (emotionally and economically) of foreclosure on individuals ATTITUDE OBJECTIVES: Learn to respect different viewpoints expressed by fellow classmates Students should be able to competently express their emotional responses to the videos they watch (express “emotional knowledge/maturity”) Students should be able to embrace several sides to a story and thoughtfully balance competing arguments III. CLASSROOM METHODS: OPENING QUESTIONS for students Today we are going to be talking about foreclosure and the foreclosure crisis that took place a couple years ago (and is still relevant/ongoing). OPEN WITH VIDEO for perspective: http://www.pbs.org/newshour/extra/video/blog/2008/10/what_really_happens_in_ a_forec.html. (need not show entire clip) o Aspect of foreclosure that you never really think of – what happens to the things in a home that gets foreclosed on? o What students should take away from this video: How much waste a foreclosure can result in. How could this problem of waste from foreclosure be remedied? What solutions can you think of? o Emotional wake up call to introduce the lesson plan/get students to be engaged. This is just ONE ASPECT of foreclosure o Follow up questions (verbal): 1) How does watching this video make you feel? 2) Why do you think the family left so many of their belongings behind? ASK: Have you heard anything about the foreclosure crisis? What do you know about it? Does anyone know what foreclosure means? What happens in a foreclosure? Don’t worry if you don’t know anything about foreclosure – that is why we are going to be covering the topic today! Foreclosure/the current foreclosure crisis is not an easy subject to teach because it is highly complex. That means we are going to gloss over a lot of things and move quickly – we just want you to take away the basics and not worry about the more technical aspects. Explain that in recent times, home foreclosures have reached record highs. Since 2007, approximately 3 million Americans have lost their homes. Showstudents the most recent statistics on foreclosures in your area with the RealtyTrac Map of Foreclosures [http://www.realtytrac.com/trendcenter/]. (MAP on 2nd slide of power point – hyperlinked to go to website above) Discuss in general terms the type of impact that foreclosures can have on the nation’s economy and political landscape. How does a high foreclosure rate affect everyone? SUBSTANCE (Allocate approx 15 minutes for Power Point): Deciding to purchase a home is a major decision. The price of the home is not usually what the buyer actually pays out, because many people get a loan, called a mortgage, when they buy property. The mortgage payment includes a portion of the cost of the home, as well as interest on the loan. People hope their houses will increase in value over time, so when they are ready to leave it, they will make enough profit on the sale to both pay off the mortgage and have some cash left over as a profit. Previously, families or individuals could not get a mortgage if they did not have excellent credit, at least 20% down, and poof of income or assets. The rules got a bit “looser” in early 2000, and lenders seemed to make it easier to borrow money, even to borrowers less capable of paying back their loans. Sometimes, it doesn’t work out as planned. Today, we’ll talk about what happens when the “American dream” of buying a home turns out to be nightmare. HAND OUT Blank VOCAB SHEETS – First we need to be comfortable with the terminology relating to foreclosures (students take notes using these sheets) Go over vocabulary in the power point slides. For the REFINANCING slide, provide students with more background information about definition: o Many homeowners leading up to, and during the foreclosure crisis chose to refinance their homes. For borrowers who were struggling, this may have been done to reduce the monthly repayment amount (often for a longer term, contingent on interest rate differential and fees) o For many homeowners, this was done to AVOID foreclosure. This means that the homeowners took out a new loan with the bank and agreed to NEW terms (interest rates, etc.) in order to be allowed to continue making payments on their home. The old loan was a thing of the past. o Banks seem to be more willing to agree to refinancing when the amount homeowners would have to pay in the long term would be MORE under the new loan than under the old loan. Once students have demonstrated an understanding of the vocabulary words (filled out their sheets, answering any questions they may have), explain to students that while many who apply for mortgages are able to keep up with payments, without incident, there are instances when the buyer of a home can’t afford to keep up the payments. If a home is not paid for, banks are to notify residents that they will lose their homes, and staff at the bank is to review each file to confirm that they are entitled to foreclose. Ask the class to come up with a reason why someone would miss their payments, or be unable to afford a full payment. Some possible responses include: o Loss of a job o A need to take a lower paying job or part time job due to family responsibilities. o Increase in family size o Unexpected home-related expenses, such as maintenance, taxes, homeowner’s association fees, utilities o o o o o o Loss of benefits, such as health insurance, due to the loss or “scaling back” of a full time position. An “arm” or a balloon payment, meaning that the loan the individual or family was granted asked for small payments in the beginning, but larger payments later. Unsuspecting buyers assuming a mortgage for which they were preapproved meant that they could afford to spend up to that amount on the home. Illness or a disability that prevents the buyer from working. The death of, or separation from, a person with whom you planned to share expenses. Lack of understanding of the terms of the loan, such as how much money they would actually have to pay back (see Step 6) GROUP READING: Divide students into groups (4 groups). Hand out to each group one of the four sheets http://money.howstuffworks.com/personal-finance/debtmanagement/foreclosure.htm - “How Foreclosure Works”, “Effects of Foreclosure”, “The Foreclosure Process”, and “How to Avoid Foreclosure”. Let them know they do not need to understand everything stated in the article, but be able to summarize what’s going on generally. Also be sure to let them know that this article is a little outdated but still relevant. After giving students time to read and discuss among groups, ask each group to share to the other groups what their article was about and what they thought the relevant facts were. Possibly – write up responses on the board under 4 different headings. Allocate approx 15 minutes for activity. VIDEOS: Rest of class time available. Time permitting, may show 1 or 2 clips– what ever teacher prefers and can be shown at a different time in the lesson if teacher so chooses. Students should stay in groups and discuss what they felt/thought after each video. Pose questions to groups before and after watching video (see below). Video CLIP #1: Show students brief clip, ask them to determine how the bank’s actions were illegal in that specific situation/foreclosure. CLIP showing how banks may be circumventing the law regarding foreclosures – “A Bittersweet Homecoming”: The Iraq war veteran James B. Hurley’s home was illegally foreclosed on and resold while he was overseas serving in the military: http://video.nytimes.com/video/2011/01/26/business/1248069591390/abittersweet-homecoming.html?ref=foreclosures Follow up: What should homeowners be entitled to when banks foreclose on their homes illegally? Let students know: There are numerous ways that the banks could have foreclosed illegally – this is just ONE example. Note, however, that not all bank foreclosures are illegal – many/most are completely legitimate. COMPLEXITY: Keep in mind that simply because a bank foreclosure is not illegal does not necessarily mean that the bank, when negotiating the initial mortgage OR refinancing the home, was being “fair” to the homeowner. A lot of people were taken advantage of (by being able to take out loans/mortgages at rates that were beyond their means to pay), but their homes were still foreclosed on legitimately and legally. Video Clip #2: Activists fighting back against foreclosure – Ask students to identify the ways in which these homeowners are fighting back against bank foreclosures. http://www.pbs.org/newshour/bb/business/july-dec10/foreclosures_10-19.html. Follow up questions: 1) Do you think these people/homeowners have a right to fight back against foreclosure? Why? 2) What are the three steps that the City Life organizers use to fight back against the current foreclosure crisis? a) The sword – Physical activism (do not leave the home) b) The shield – Free legal help to drag out the process of foreclosure c) The offer – Buy back the foreclosed house, then re-sell it at current market value to the homeowner IV. EVALUATION Class participation throughout lesson (taking notes, reading article, engaging in group work) Depth and quality of responses to activities and respectfulness of other students’ opinions Collection of assignment next class period V. ASSIGNMENT: Go online to http://weshallnotbemoved.net/stories/ and choose one of the stories on the webpage. Watch the video clip and write a short piece (1 page +) summarizing the homeowner’s story (e.g., how did they end up in foreclosure?) Include your own personal reflections – How does this make you feel? What do you think should be done about the situation? Can you think of any solutions to help homeowners and/or banks get through the “foreclosure crisis”? MORE DISCUSSION QUESTIONS (for homework) 1. If your family had to move out of where you’re currently living, where do you think you would go? 2. Based on what we’ve just gone over and what you know about the housing market, do you think you would buy or rent a house if you had to find a place to live? Why? 3. If you were the owner of a bank whose housing borrowers weren’t able to pay back their loans, how would you deal with the situation? Why? FORECLOSURE VOCABULARY Borrower: Down payment: Foreclosure: Home Value: Interest Rate: Lender: Loan: Mortgage: Underwater: Refinance: FORECLOSURE VOCABULARY (answers) Borrower: The person who requests or takes out a loan. Down payment: Also known as “money down,” an amount of money paid outright when a home is purchased. A typical amount is 20% of the price of the home, so the buyer takes out a loan on the other 80%. Foreclosure: When a bank claims a property as their own because the borrower did not meet the terms of the agreement, such as making the payments. Home Value: What the house is worth, based on how other houses in the neighborhood are selling. It can go up or down. Interest Rate: The percentage above the full amount of the loan the borrower is expected to pay. Lender: The company, usually a bank or credit union, that offers the mortgage to a homebuyer. Loan: Money lent to a homebuyer. It includes the price of the house, except for any money used as a down payment, plus the interest. Mortgage: A loan to be used to buy property. Underwater: When the amount left to pay on a mortgage exceeds the value of the home. Refinance: To swap out your old loan with a new loan subject to new terms (interest rate, monthly payment, etc.) HOW FORECLOSURES WORKS By Charles W. Bryant You made smart decisions on the path to realizing your dream of homeownership. You prioritized your spending and saved enough money for a small down payment. Your mortgage broker was creative, accommodating and worked out a loan that fit your budget. You signed the closing papers, got the keys, moved in and settled into what you hoped would be a long stay in your home. Then the unthinkable happened. You got laid off from your job. Or maybe you or a family member had an accident that strained your finances. If you're in the National Guard, you may have gotten called into active duty, forcing you to close your business temporarily. Or perhaps your variable rate loan increased your monthly payments and your home didn't appreciate enough to refinance. All of these scenarios play out every day in real life, and the sad result can be foreclosure. If you suddenly find that you can't afford to pay your monthly loan payment, your lender has the legal right to repossess your home and resell it to recoup the cost of the loan. Foreclosure is a legal course of action in which nobody really comes out on top. It's a stressful and unfortunate situation for the homeowner and lender alike. Many people remain in denial about their finances, making the situation worse. As unfortunate as the foreclosure process may be, there are things you can do to save your home if you're faced with it. As the real estate bubble in the United States has begun to burst, the foreclosure rate has soared. The housing boom saw unparalleled growth from 2001 to 2005. Adjustable rate mortgages (ARMs) and subprime loans made buying a house possible for many people who never thought they had the money or credit to do so. ARMs have low initial rates that typically go much higher after the first year or two. Subprime loans allow people with poor credit to secure financing at high rates. Mortgage brokers used both of these methods to get loans secured, and many of the borrowers soon found out they couldn't afford their monthly payments. Here are some startling foreclosure statistics in the United States, according to CNN Money: Nearly 1.3 million homes were foreclosed on in 2006. Colorado had the highest rate of foreclosure -- one out of every 376 houses. The total number of filings is up 43 percent from 2005. Real estate experts predict even more foreclosures in 2007. Additionally, a recent poll shows that more than six in 10 homeowners wish they better understood the terms of their loan, and 60 percent of borrowers in mortgage trouble aren't aware of services that can help them avoid foreclosure [source: FDIC]. HOW FORECLOSURES WORK By Charles W. Bryant THE FORECLOSURE PROCESS The foreclosure process differs by state, but we can take a look at the general steps that are taken. If you're faced with foreclosure, it's important that you research your state's laws and practices. Foreclosure proceedings can begin after a single missed payment, but it isn't very likely. Most banks and lenders have a grace period for late payments, usually with a fee added on. It typically takes being a full 30 days late for the alarm bells to go off. After the second missed payment, you'll be getting some phone calls. Many lenders will only accept both late payments to bring the loan current. They also may refuse any partial payments. Once you fall three months behind, things get serious. This is typically when most lenders will begin the foreclosure process in one of two ways: judicial sale, which requires that the process go through the court system, or power of sale, which can be carried out entirely by the mortgage holder. All states allow judicial sale, while only 29 allow power of sale. If your state allows power of sale, the loan papers will usually have a clause that says this method will be used. Power of sale is typically faster than the judicial route. Let's look at both methods. Judicial sale: The mortgage lender will file suit with the court system. You'll receive a letter from the court demanding payment. Typically, you'll have 30 days to respond with payment to avoid foreclosure. At the end of the payment period, a judgment will be entered and the lender can request sale of the property by auction. The auction is carried out by the sheriff's office, usually several months after the judgment. Once the property is sold, you're served with an eviction notice by the sheriff's office, and you must vacate your former home immediately. Power of sale: The mortgage lender will serve you with papers demanding payment. After an established waiting period, a deed of trust is drawn up that temporarily conveys the property to a trustee. The trustee will sell the house at public auction for the lender. Many times, these foreclosures are subject to judicial review to make sure everything was carried out legally. There is usually a requirement for the lender to post a public notice of sale for the auction. Both types of foreclosure require that any other involved parties be notified of the proceedings. For instance, if the homeowner took out another loan against the house with a third party, that lender must be contacted and its loan amount must be paid from the auction's proceeds. If the third-party lender isn't paid, it can apply the mortgage to the new property owner. Many times, the lender will actually buy the property back and attempt to sell it through the real estate market at a later date. There's one more type of foreclosure that's almost completely obsolete, called strict foreclosure. In these cases, once judgment is made on the lawsuit, the property is automatically assumed by the mortgage holder. Only Connecticut and Vermont still allow this practice [source: Realty Trac] HOW FORECLOSURES WORK By Charles W. Bryant How to Avoid Foreclosure Foreclosure is bad for both the lender and the borrower. The homeowner loses his or her house, and the lender loses anywhere from 20 to 60 cents on the dollar [source: FDIC]. This is important to remember if you fall behind on your loan. The single most important step you can take to avoid foreclosure is to communicate with your lender. Most people are scared and embarrassed to the point that they ignore calls and letters from their lender. This is human nature, but it's the worst thing you can do if you want to hang on to your home. Many lenders will work with you to avoid the foreclosure process. They will deal with your case on a personal level, and your circumstances will be taken into account. If you only fall one or two payments behind, the mortgage holder will mail you a loan workout package that will help you catch up with your loan. The package consists of information, instructions and forms regarding your ability to make payments. If your situation is temporary, there are some other solutions: The Federal Housing Authority (FHA) is willing to help. If your loan is FHAapproved, you can get in touch with an FHA housing counselor who will walk you through possible solutions. This counselor will negotiate with the lender for you and will even help you work out a monthly budget plan. If the area where you live or work has been declared a natural disaster by the federal government and you're facing foreclosure, the FHA provides relief plans to assist you. In most cases, you can get up to three months' relief from your monthly loan payments while you work out your home or work situation. Forbearance is when your lender agrees to suspend your payments temporarily if you agree to another option to satisfy your loan amount. The option is usually reinstatement -- you pay the outstanding amount in one lump sum. If you know you have a large amount of money coming your way soon, these options are good ways to prevent foreclosure. Mortgage modification is when your lender agrees to change the terms of your mortgage to make it more affordable for you. You may be eligible for a partial claim if you're able to begin making payments again but not able to bring your account current. Your lender would assist you in getting an interest-free loan that will bring your account current and you can resume payments. Payment on this loan can be delayed for a period of time. If you aren't able to keep your home, you can sell it to pay off your loan. If this is the case, call your lender -- it can suspend your loan payments while you sell your house and may even accept less than the loan amount if you sell it quickly. A final option is to surrender your deed-in-lieu of foreclosure. This is when you simply hand your property back to your lender. HOW FORECLOSURES WORK By Charles W. Bryant Effects of Foreclosure The most obvious effect of foreclosure is that you now find yourself without a home. Many people rely on family at this point to get them through the coming months. Some people are able to afford to move into an apartment while they get their finances back on track. Sadly, some people that suffer foreclosure find themselves homeless. Most states have homeless prevention programs that assist people who are down on their luck and in need of a boost. If you've been foreclosed on and have no housing options, check with your state and local department of human services to see if they can assist you. Your credit rating is another way foreclosure can affect you. While being foreclosed on does have a negative impact on your credit rating, it doesn't damage it beyond repair. Credit ratings are based on your credit history, so the foreclosure will be factored in along with everything else. If you had a good rating before you fell behind on your loan, you might be surprised at how high your credit score is after you foreclose. The most important thing to do after foreclosure is to try and repair your credit. Make sure all your other accounts are current and paid up. You may try and secure a smaller loan -- making payments on this loan will help you repair your credit. You may even be able to secure another home mortgage at a less-than-prime rate with a large down payment. If you've been foreclosed on, you may have trouble finding or keeping employment. Some employers require a good credit rating to get hired, and foreclosure can even be grounds for termination. Stress and depression are also common effects of foreclosure. A lack of self-esteem and self-worth are typically associated with people that have lost their homes. The trickle down effect of foreclosure can also have a serious impact on your community. One foreclosure can ring up as much as $34,000 in local government agency bills. Trash removal, unpaid utilities, sheriff and police costs, inspections and potentially even demolition of the property all contribute to that cost. Property values also decrease near foreclosed properties. In some housing markets, up to $220,000 in reduced property value can be expected [source: Apgar, Duda, Gorey]. Crime is another common effect of foreclosure. Slavic Village, Ohio, is the leading community for foreclosures in the United States. As of November 2007, more than 800 houses sat vacant in this Cleveland suburb. These homes are usually looted within 72 hours of becoming vacant. Aluminum siding, gutters, doors, windows, molding, appliances and basically anything else of value is stripped from the home and sold for profit. These homes are typically wrecked in the process as well, with looters using sledgehammers to break through walls to remove valuable copper wiring. With windows and doors removed, houses are open to the elements. Many abandoned houses become dumping grounds for people that don't want to pay for trash removal. The community of Slavic Village is fighting back with organized crime-watches and persistent pleas to the local police force [source: CNN Money].