Short Sales, REO`s, HUD and VA Repo`s

advertisement

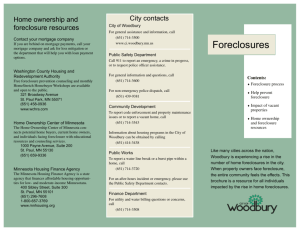

FrankMears.com 1 Frank Mears ABR, ABRM, CDPE,CRB, CSP, CSP, GRI, SFR, SRS, SRES 2 A legal process by which a mortgagee's right to redeem a mortgage is taken away, usually because of failing to make payments 3 IRVINE, Calif. – Jan. 13, 2011 – RealtyTrac® (http://www.realtytrac.com) the leading online marketplace for foreclosure properties, today released its Year-End 2010 U.S. Foreclosure Market Report™, which shows a total of 3,825,637 foreclosure filings — default notices, scheduled auctions and bank repossession — were reported on a record 2,871,891 U.S. properties in 2010, an increase of nearly 2 percent from 2009 and an increase of 23 percent from 2008. 4 Top 10 foreclosure States (2010) 1. Nevada 2. Arizona 3. Florida 4. California 5. Utah 6. Georgia 7. Michigan 8. Idaho 9. Illinois 10.Colorado 5 # 73 Milwaukee-Waukesha-West Allis # 99 Green Bay #131 Madison 6 The sellers owe more on the mortgage and home equity loans than their home is worth The seller is unwilling or unable to cover the difference. Some, but not all, sellers may be in default on their mortgage and heading for foreclosure. Some sellers don’t understand that if they have assets such as stocks, other real estate, high salaried job, savings, the lender is not going to let them just walk away with out signing a note to repay the difference in what they owe. 7 Advertise for them. Referrals Prospecting 8 The CMA will be your first indicator The seller net sheet will be next (2nd Mtg, HOA dues, property taxes) If they can afford it, the seller should also get a home inspection to see what repairs are needed and how this might affect the value. 9 To avoid the financial loss on foreclosure properties ( average $86,000) Avoid increasing the REO inventory The area or neighborhood is decreasing in value The property is in poor condition 10 Do you list the property based on your market evaluation? (disclose in MLS that price offered is subject to short sale approval by the lender. Commission offer is also subject to lender approval Does the owner notify the lender at this time that they are considering asking for a short sale and give the lender permission to discuss the loan with their agent? Do You wait until you have a contract and then notify the lender and send in the complete short sale package? 11 1. The letter of authorization If there is more than one lender you need to contact the all. 12 1. 2. The letter of authorization Cover Letter and short sale request 13 1. 2. 3. The letter of authorization Cover Letter and short sale request Hardship letter 14 1. 2. 3. 4. The letter of authorization Cover Letter and short sale request Hardship letter Owners financial package (BEWARE!!! Of major discrepancies between the sellers information and the information used to obtain the loan) 15 1. 2. 3. 4. 5. The letter of authorization Cover Letter and short sale request Hardship letter Owners financial package Broker Price Opinion 16 1. 2. 3. 4. 5. 6. The letter of authorization Cover Letter and short sale request Hardship letter Owners financial package Broker Price Opinion The Hud 1 17 1. 2. 3. 4. 5. 6. 7. The letter of authorization Cover Letter and short sale request Hardship letter Owners financial package Broker Price Opinion The Hud 1 The 1099 issue 18 Mortgage Forgiveness Debt Relief Act of 2007 Applies only to forgiven or cancelled debt used to buy or substantially improve your principal residence or to refinance debt (only up to principle balance of the old mortgage, immediately prior to re fi) incurred for those purposes Applies to debt forgiven in 2007 thru Dec 2012 Taxpayer files form 982 Reduction of tax attributes Due to discharge of Indebtness WWW.IRS.GOV 19 1. 2. 3. 4. 5. 6. 7. 8. The letter of authorization Cover Letter and short sale request Hardship letter Owners financial package Broker Price Opinion The Hud 1 The 1099 issue Submitting the package 20 Cover Letter Make sure to state the amount the lender will receive at losing and stress the reasons why the payoff amount is justified. 21 Make sure that the lender’s foreclosure department is aware of the short sale negotiations and or short sale approval. 22 1-1 HARP, HAMP & HAFA Overview 1-2 Home Affordable Refinance Program Home Affordable Modification Program • Home Affordable Foreclosure Alternatives • Short Sale • Deed-in-Lieu Note: HAFA does not apply to FHA or VA loans 1-3 • • • • • • • • $3,000 cash to seller Foreclosure suspension Liability release No notes or $$$ contributed More $$$ for 2nd liens Pre-approved short sale Approval or denial in 10 Biz days Deed-in-lieu possible with $3,000 1-4 • • • • • Standard forms No $$$ contribution No last minute commission negotiations Quicker approval or denial Listing remarks 1-5 • • Monthly payments? New process 1-6 Foreclosure Web sites Foreclosure.com Foreclosures.com Realtytrac.com treas.gov/auctions/irs/index.html HUD.gov http://www.equator.com Homesales.gov 29 REO Properties (Real Estate Owned) Property is now in the lenders inventory Redemption Period On mortgage foreclosures a property may be redeemed at any time prior to the foreclosure sale by paying the total amount owed. In Wisconsin there is a statutory redemption period after the sale. 30 Property management duties 1. Inspect 2. Secure 3. Trash Out 4. Evict 5. Cash for Keys 6. Utilities go into licensees name 7. General Property Maintenance 31 32 The Good 33 The Good The Bad 34 The Good The Bad The Ugly 35 36 One to four family homes Initially 0ffered to Owner – Occupant buyers. After the initial period has passed and the property remains unsold then it is offered to investors. General sales Conditions Buyers must obtain their own financing Sold as is Safe, Secure and Marketable 37 38 1. Owner Occupants 2. Investor buyers 3. Non-Profit Organization buyers 1. Good neighbor next door program 39 $100.00 down program $500.00 selling agent bonus 40 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Make sure your broker is registered with HUD and has an active NAID # Set up your own personal selling agent account in BidSelect so that you may place bids for buyers Find Available properties in bidSelect listing site Show and advertise available HUD homes according to regulations When you have a buyer complete a HUD sales contract package Place a bid in the appropriate bidding timeline Check the results of the bid around noon the day after the bid deadline If you win the bid, deliver the contract package to M & M contractor office within 2 business days of acceptance Contract acceptance begins the TIME SENSITIVE pre closing essentials Close 41 42 Vendee financing is a loan product offered to individuals to help finance the purchase of VA REO Properties. Vendee Financing will be offered to both veterans and non-veterans. Some of the guidelines are listed below: Seller may contribute up to 6% of the contract sales price Vendee mortgages are assumable by qualification Vendee Financing is not a credit score driven product. .. 43 Owner Occupied Purchase Can be financed with as little as 0% down. The loan amount may be increased up to 2% to finance closing costs, prepaids or other expenses. Funding fee may not be financed. Non-Owner Occupied Purchase Can be financed with as little as 5% down. Investors may use 75% of anticipated rent based on appraiser's estimate to offset against the subject property monthly payment. Investors must have experience managing rental properties to include anticipated rent on subject property in underwriting. No maximum number of investment properties 44 Any purchaser can apply for Vendee Financing. You do not have to be a Veteran. Vendee Financing is available for non-owner and owner occupied. Low Interest Rates The seller may contribute up to 6% of the contract sale price for closing costs. 2.25% VA Funding Fee No pre-payment penalties An appraisal is not required for underwriting. Non-Owner Occupied Only No maximum number of investment properties. 45 To be successful you need to learn the rules for foreclosures in your state. You also need to be patient and realize that lenders do not always understand the law of supply and demand and that market value is not what you have in it but what you can get out of it. Lenders are more likely to negotiate favorably on a property that has been in inventory for a long time than one that has just been taken in. There are many opportunities for buyers and agents in foreclosure and pre-foreclosure transactions. Learn the rules, be patient and good luck. 46 47 TM FrankMears.com