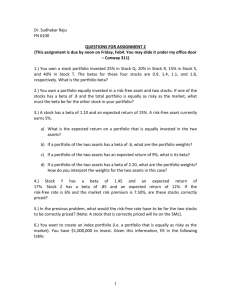

Finance Study Problems: Interest Rates, CAPM, & Investment Risk

FINC 601 Study Problems Ch.7-8

1. Inflation and interest rates) What would you expect the nominal rate of interest to be if the real rate is 4.5 percent and the expected inflation rate is 7.3 percent?

2. Assume the expected inflation rate is 3.8 percent. If the current real rate of interest is

6.4 percent, what should the nominal rate of interest be?

3. Pritchard Press,Inc., is evaluating a security. One-year Treasury bills are currently paying 9.1 percent. Calculate the following investment’s expected return and its standard deviation. Should Pritchard invest in this security?

(A)

Probability

P(ki)

(B)

Return

(ki)

.15

.30

.40

.15

-1%

2

3

8

4. Syntex Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by standard deviation) and return?

Common Stock A:

(A)

Probability

P(ki)

(B)

Return

(ki)

0.3 11

0.4 15

0.3 19

Common Stock B

(A)

Probability

P(ki)

0.2

0.3

0.3

0.2

(B)

Return

(ki)

-5%

6

14

22

1

5. Friedman Manufacturing Inc., has prepared the following information regarding two investments under consideration. Which investment should be accepted?

Common Stock A:

(A)

Probability

(B)

Return

P(ki) (ki

_______________________

0.2 - 2%

0.5

0.3

18

27

Common Stock B:

(A)

Probability

P(ki) (ki)

_________________________

0.1 4%

0.3

0.4

0.2

(B)

Return

6

10

15

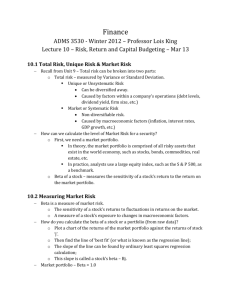

6. (Required rate of return using CAPM) a. Compute a fair rate of return for Intel common stock, which has a 1.2 beta. The riskfree rate is 6 percent and the market portfolio (New York Stock Exchange stocks) has an expected return of 16 percent b. Why is the rate you computed a fair rate?

7. Johnson Manufacturing Inc., is considering several investments. The rate on

Tresury bills is currently 6.75 percent, and the expected return for the market is 12 percent. What should be the required rates of return for each investment (using the

CAPM)?

2

Security Beta

________ ______

A

B

1.50

0.82

0.60

1.15

C

D

8. CBS,Inc., has a beta of .765. If the expected market return is 11.5 percent and the risk-free rate is 7.5 percent, what is the appropriate required rate of return of CSM

(using the CAPM)?

9. The expected return for the general market is 12.8 percent , and the risk premium in the market is 4.3 percent. Tasaco, LBM and Exxos have betas of .864, .693, and

.575, respectively. What are the appropriate required rates of return for the three securities?

10. From the following price data, compute the holding period returns for Asman and Salinas.

Asman Salinas

Time Price Price

1 $10 $30

2 12 28

3

4

11

13

32

35

How would you interpret the meaning of a holding-period return?

11. (Measuring risk and rates of return) a.

Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and the market.

3

Month

1

2

3

4

5

6

Sum

Zemin Corp

6.00%

3.00

1.00

-3.00

5.00

0.00

12.00

Market

4.00%

2.00

-1.00

-2.00

2.00

2.00

7.00 b. If Zemin’s beta is 1,54 and the risk-free rate is 8 percent, what would be an appropriate required return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe to be a fair return, given the firm's systematic risk.

12. (Portfolio beta and security market line) You own a portfolio consisting of the following stocks:

Stock

1

Percentage of Portfolio

20%

Beta

1.00

Expected

Return

16%

2

3

4

5

30%

15%

25%

10%

0.85

1.20

0.60

1.60

14%

20%

12%

24%

The risk-free rate is 7 percent. Also, the expected return on the market portfolio is 15,5 percent. a.

Calculate the expected return of your portfolio. ( Hint : The expected return of a portfolio equals the weighted average of the individual stock’s expected return, where the weights are the percentage invested in each stock.) b.

Calculate the portfolio beta c.

Given the information preceding, plot the security market line on paper. Plot the stocks from your portfolio on your graph. d.

From your plot in part ©, which stocks apperar to be your winners and which ones appear to be losers? e.

Why should you consider your conclusion in part (d) to be less than certain?

4

13. ( Expected return, standard deviation, and capital asset pricing model)

Following you will find the end-of-month prices, both for the S&P 500 Index and for

Intel common stock. a.

Using the following data, calculate the holding-period returns for each month from Aug 02 to July 03

Market S&P 500 Intel Corp

Month and

Year Price Price

Jul-02 1328.72 34.50

Aug-02

Sep-02

Oct-02

Nov-02

Dec-02

1320.41

1282.71

1362.93

1388.91

1469.25

41.09

37.16

38.72

38.34

41.16

Jan-03

Feb-03

Mar-03

Apr-03

May-03

Jun-03

Jul-03

1394.46

1366.42

1498.58

1452.43

1420.60

1454.60

1430.83

49.47

56.50

65.97

63.41

62.34

66.84

66.75 b.

Calculate the average monthly return and the standard deviation of these returns both for the S&P 500 and Intel c.

Develop a graph that shows the relationship between the Intel stock returns and the S&P 500 Index returns on the horizontal. d.

From your graph, describe the nature of the relationship between Intel stock returns and the returns for the S&P 500 Index.

5