Presentation IV.3 The London Underground Case

advertisement

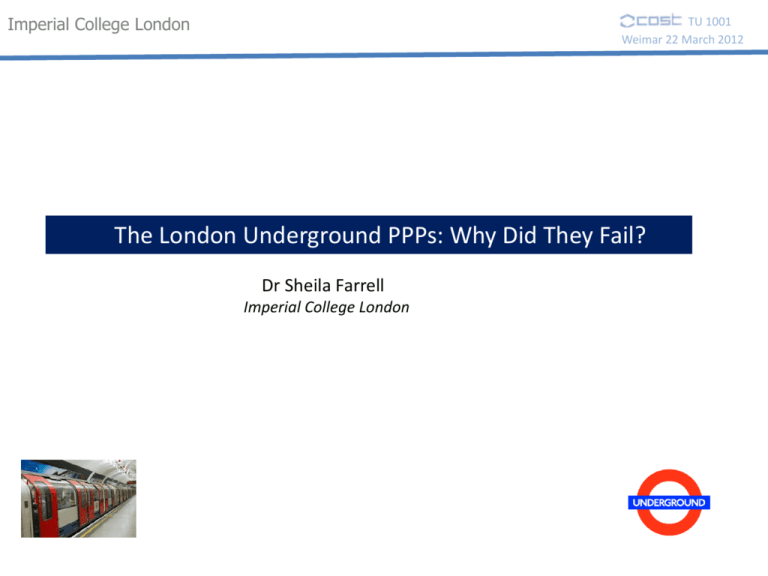

Imperial College London TU 1001 Weimar 22 March 2012 The London Underground PPPs: Why Did They Fail? Dr Sheila Farrell Imperial College London Imperial College London TU 1001 Weimar 22 March 2012 Why did London Underground go down the PPP route? • Urgent need for refurbishment of elderly infrastructure • Long history of public sector under-funding + variable expenditure allocations • Desire to keep CAPEX off balance sheet • Weak management of major investment projects by London Underground Ltd Solution: private management of infrastructure + public management of operations TU 1001 Weimar 22 March 2012 Imperial College London Started 2002 Failed 2007-8 Private sector: upgrading and maintenance of infrastructure & rolling stock Network split between three contracts, assigned to Two private sector consortia Public sector: operation of trains London Underground Ltd to continue as before Supervision & control Day-by-day control Policy control ownership Financial control money Contract adjustments Independent Arbiter TU 1001 Weimar 22 March 2012 Imperial College London Private sector partners were selected by competitive tendering Bombardier, Balfour Beatty, Atkins, Thames Water, Seeboard BCV contract Bakerloo Central Victoria Waterloo &City Jarvis, Amey, Bechtel SSL contract District Circle Metropolitan East London Hammersmith &City JNP contract Jubiliee Northern Picadilly Expected capital investment over 30 year contract was £15.7bn (€19bn) • 4 x 7.5 year periods, with firm bids for the first 7.5 years (£9.7bn) - core investment programme defined in advance - costs recovered through monthly Infrastructure Service Charge - other works carried out on a cost plus basis • Terms for later periods to be negotiated with the Independent Arbiter Imperial College London TU 1001 Weimar 22 March 2012 Low level of private sector risk • High equity returns - 18-26% return on equity, guaranteed for 4 x 7.5 year periods • High proportion of debt - 85% of CAPEX debt-funded - equity requirements only £350m for Metronet and £315m for Tube Lines • Government guarantees - 95% of debt under-written by Government - 30 year profit guarantee in event of “unreasonable behaviour” by London Underground • Capped liabilities - liability for cost over-runs in first 7.5 years capped at £50m per contract for Metronet and £200m for Tube Lines High price of risk transfer TU 1001 Weimar 22 March 2012 Imperial College London Performance requirements Engineering Technical standards - pass/fail monitoring of work carried out Asset condition - removal of maintenance backlog by 2026 Residual life - 50% of asset life remaining at end of contract (2033) Long-term engineering targets difficult to enforce because of unknown condition of assets Operations Key Performance Indicators - complex & detailed monitoring system measured impact of PPP on customers rules for allocating blame between public & private partners linked to monthly payments Operational KPI’s more important than monitoring of large engineering contracts TU 1001 Weimar March 2012 Imperial College London Key performance indicators - linked to monthly Infrastructure Service Charges Availability - customer hours lost or saved travelling through network compared with performance before PPP £6 per hour lost (normal) £9 per hour lost (severe) £3 per hour saved Capability - maximum number of people per hour that could be moved between different pairs of stations if services were available Ambience - cleanliness, lighting, passenger information, staff attitudes points system based on “mystery shopper” surveys Service points - penalty points for failing to carry out day-to-day repairs within fixed time limits £ 50 per penalty point Performance-related payments - accounted for only 3% of Infrastructure Service Charges - absorbed management time - gave false impression of success TU 1001 Weimar 22 March 2012 Imperial College London Project outcome Refusal of Independent Arbiter to authorise further cost increases Failure of PPPs Construction cost escalation Programme delays Changes to scope of work Bankrupt 2007 Why? Declined second 7.5 year contract 2008 TU 1001 Weimar 22 March 2012 Imperial College London Private sector causes of failure Metronet • 60% of work subcontracted to consortia members without competitive bidding Tube Line • Use of sub-contractors selected by competitive tendering, increasing ability to benchmark costs for standard jobs • Lack of cost monitoring by consortium management - member firms responsible for own cost control • Project management team more independent of consortia members + lower turnover of senior managers • Requests for additional work generally accepted - revenues went straight to member forms • Stronger commitment to “core” investment programme - less accommodating of requests for additional work • Changes in scope of work negotiated individually • Network wide procedures for changing scope of work • Dispersed interactions with many different LUL staff • Single “full team” meetings involving all LUL staff Common problems • Lack of proper asset register + unknown condition of assets • Ambiguity + lack of detail in original contracts • Changing technical standards as work progressed • Limited number of suppliers for more difficult work TU 1001 Weimar March 2012 Imperial College London Public sector causes of failure London Underground • Weak project management skills - yet responsible for a very complex procurement contract Independent Arbiter • Responsible for monitoring BUT - no powers to intervene Transport for London • Strong political opposition to PPPs • Conflict of interest between contract administration and train operations • Only required to determine fair costs - in event of dispute - at 7.5 year reviews • Transport Strategy for London - significant influence on subsidy requirements BUT • Commitment to PPPs did not filter down to lower-level employees • Limited access to independent data for benchmarking • Limited responsibility for monitoring & funding PPPs Department for Transport • Rush to complete PPPs before handover of London Underground to Transport for London • Ideological commitment to separation of infrastructure from operations • Not a signatory to PPP contracts, although the main source of funding - no supervisory or monitoring role - payments not conditional on achievement of construction targets • Belief in the power of “the market” to resolve problems automatically TU 1001 Weimar 22 March 2012 Imperial College London Two questions for COST TU -1001 Q.1 Could a PPP ever work for a project as complex as London Underground? Q.2 How should the engineering contracts have been monitored? THE END TU 1001 Weimar 22 March 2012 Imperial College London Department for Transport £1.0bn pa London Mayor Policy control Transport for London £1.0bn pa fares policy London Underground Ltd Net farebox revenue approx £0.3-0.4bn pa mediation Infrastructure service charges Arbiter Infrastructure service charges JNP InfraCo BCV InfraCo SSL InfraCo Expenditure Expenditure ISC surplus Banks £1.80 bn debt £2.115bn Investment Tube Lines £2.65 bn debt Metronet Banks £0.35 bn equity £0.315 bn equity Jarvis, Amey, Bechtel ISC surplus £3.0 bn investment Bombardier (trains) Balfour Beatty (track) Trans4M (stations) contracts competitive tendering Sub-contractors Balfour Beatty Atkins Thames Water Seeboard (EDF)