Part-2-Cram-Session-Full-Slide-Show

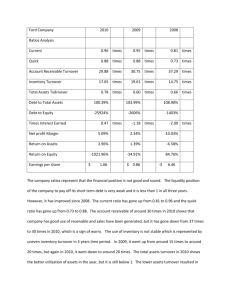

advertisement