Document

advertisement

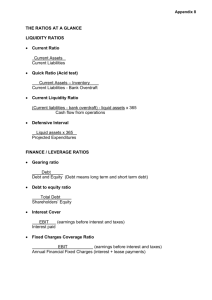

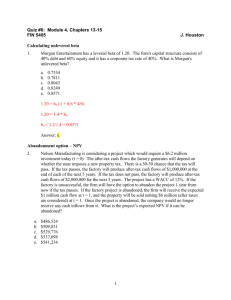

AGEC $424$ Fall 2002 Final Exam Remove this page from the exam. The data on this page apply to questions 1 and 2. 2001 2000 Cash $ 52,000 $ 57,600 AR 402,000 351,200 Inventories 836,000 715,200 Total CA $1,290,000 $1,124,000 Gross FA $ 527,000 491,000 Less: Deprec. 166,200 $ 146,200 Net FA $ 360,000 $ 344,800 Total Assets $1,650,000 $1,468,800 Accts payable Notes payable Accruals Total CL Long-term debt Common stock Retained earnings Total equity Total L&E Sales COGS Other expenses Deprec. Tot. op. costs EBIT Interest exp. EBT Taxes (40%) Net income 2001 $ 175,200 225,000 140,000 $ 540,200 424,612 460,000 225,988 $ 685,988 $1,650,800 2000 $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 $ 203,768 $ 663,768 $1,468,800 2001 $ 4,350,000 (3,250,000) (430,300) (20,000) ($3,700,300) $ 649,000 (76,000) $ 573,700 (29,480) $ 344,220 2000 $ 3,932,000 (2,864,000) (340,000) (18,900) ($3,222,900) $ 709,100 (62,500) $ 646,600 (58,640) $ 387,960 Industry Averages RATIO Current Quick Inventory Turnover Days Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Debt Ratio TIE Fixed Charge Coverage Profit Margin ROA ROE 2.0x 0.8x 6.0x 32.0 days 10.7x 2.6x 50.0% 2.5x 2.1x 3.5% 9.1% 18.2% 0 Name_________________________ Seat #_____ 2002 Final AGEC $424$ You must show correct work (and/or calculator inputs) on all problems to get credit. There are 7 pages of questions and 215 points. 1. a. (10 points) What are the company's fixed and total asset turnover ratios for 2000 and 2001? b. (5 points) Comment on the company's fixed and total asset turnover ratios. 2. a. (10 points) Calculate the company's profitability ratios--profit margin, ROA, and ROE for 2000 and 2001. b. (10 points) Comment on the company's profitability and compare to the industry using the extended DuPont Model. 1 3. (15 points) Jill's Wigs Inc. had the following balance sheet last year: Last Cash $ 800 Accounts receivable 450 Inventory 950 Net fixed assets 34,000 Total assets $36,200 Mult. 1stPass Last mult. 1st Pass Accounts payable $ 350 Accrued wages 150 Notes payable 2,000 Mortgage 26,500 Common stock 3,200 Retained earnings 4,000 Total liabilities and equity $36,200 Jill has just invented a non-slip wig for men which she expects will cause sales to double, increasing after-tax net income to $1,000. She was at 50% of capacity last year. (a) Will Jill need any outside capital if she pays no dividends? (b) If so, how much? Constant growth 4. (12 points) Investors require a 15 percent rate of return on Goulet Company’s stock (k s = 15%). What will be Goulet’s stock value if the previous dividend was D0 = $6 and if investors expect dividends to grow at a constant compound annual rate of: a. –4 percent, b. 0 percent, c. 4 percent, 2 One Pass AFN 5. (30 points). Hogan Inc. generated EBIT of $260,000 this past year using assets of $1,500,000. The interest rate on its existing long-term debt of $840,000 is 12.5 percent and the firm's tax rate is 40 percent. The firm paid a dividend of $1.27 on each of its 37,800 shares outstanding from net income of $93,000. The total book value of equity is $645,000 of which the common stock account equals $335,000. The firm forecasts a 20% increase in sales, assets, and EBIT next year, and a dividend of $1.40 per share. If the firm needs additional capital funds, it will raise 60% with debt and 40% with equity. Spontaneous liabilities are estimated at $18,000 for next year, representing an increase of 20% over this year. Except for spontaneous liabilities, the firm uses no other sources of current liabilities and will continue this policy in the future. What will be the AFN (broken into the amount of debt and equity) that Hogan will need to balance its projected balance sheet using the projected balance sheet method through one pass? Show your work in the table below and in the space beneath the table. Round figures to the nearest whole dollar. Complete the “last year” column, as well as, the Factor and First Pass columns. Last Year EBIT $ - Interest Factor First Pass $ -__________ EBT $ - Taxes $ -__________ NI $ $ Addition to RE $ $_________ Total assets $ $_________ Accruals + AP $ $ Dividends Long-term debt Common Stock RE __________ Total liab & OE $ AFN (total) Debt _________ $ $_______________ $_______________ Equity $_______________ 3 Super Normal Growth 6. Garcia Inc. has a current dividend of $3.00 per share (D0 = $3.00). Analysts expect that the dividend will grow at a rate of 25 percent a year for the next three years, and thereafter it will grow at a constant rate of 10 percent a year. The company's cost of equity capital is estimated to be 15 percent. a. (12 points) What is the current stock price of Garcia Inc.? Include a time line in your answer. b. (3 points) What are its expected dividend yield and capital gains yield for the first year? c. (3 points) Now, assume the period of supernormal growth is to last only two years rather than three years. How would this affect its price, dividend yield, and capital gains yield? Answer in words only. 7. The risk-free rate of return, kRF, is 5 percent; the required rate of return on the market, k M, is 10.5 percent; and Altman Company’s stock has a beta coefficient () of 0.2. a.(5 points)Based on the Capital Asset Pricing Model (CAPM), what should be the required return for Altman Company’s stock? b.(5 points) If the dividend expected during the coming year, D 1, is $8.00, and if g = a constant 5% at what price should Altman’s stock sell? 4 8. (5 points) You have just purchased a 10-year, $1,000 par value bond. The coupon rate on this bond is 8 percent annually, with interest being paid each 6 months. If you expect to earn a 10 percent simple rate of return on this bond, how much did you pay for it? 9. (5 points) You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months. If your simple annual required rate of return is 10 percent with semiannual compounding, how much should you be willing to pay for this bond? 10. (5 points) Tony's Pizzeria plans to issue bonds with a par value of $1,000 and 10 years to maturity. These bonds will pay $45 interest every 6 months. Current market conditions are such that the bonds will be sold to net $937.79. What is the YTM of the issue? 11. (15 points) Lorkay Seidens, Inc. just borrowed $200,000. The loan is to be repaid in equal installments at the end of each month of the next thirty years, and the interest rate is 10%. What is the monthly payment? ___________ Calculator inputs: What is the principal portion of the second payment?__________ Show work here: 5 12. The Saliford Corporation has an inventory conversion period of 40 days, a receivables collection period of 26 days, and a payables deferral period of 24 days. a. (5 points) What is the length of the firm’s cash conversion cycle? b. (5 points) If Saliford’s annual sales are $3,960,000 and all sales are on credit, what is the average balance in accounts receivable? c. (5 points) How many times per year does Saliford turn over its inventory? 13. Green Thumb Garden Centers sells 240,000 bags of lawn fertilizer annually. The optimal safety stock (which is on hand initially) is 1,200 bags. Each bag costs Green Thumb $4, inventory carrying costs are 20 percent, and the cost of placing an order with its supplier is $25. a. (5 points) What is the economic ordering quantity? b (5 points) What is the maximum inventory of fertilizer? c. (5 points) What will Green Thumb’s average inventory be? d. (5 points) How often must the company order? 6 New Investment 14. (30 points) Mars Inc. is considering the purchase of a new machine that will reduce manufacturing costs by $12,000 annually. Mars will use the MACRS (3-year class life) method to depreciate the machine, and it expects to sell the machine at the end of its 4-year operating life for $20,000. The firm expects to reduce net working capital by $15,000 when the machine is installed. Mars' marginal tax rate is 40 percent, and it uses a 12 percent required rate of return to evaluate projects of this nature. If the machine costs $50,000, what is the NPV (and IRR) of the project? 7