Sub Total – Administrative Expenses

advertisement

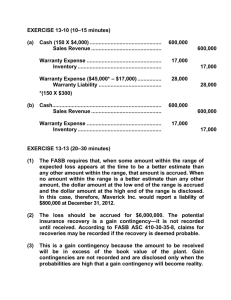

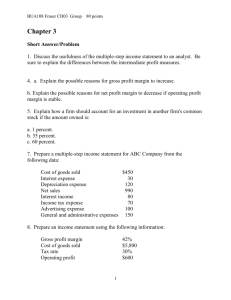

Welcome to Financial Series #1 The Income Statement Your Hosts for Today’s Conference are: Gary Elekes in Nashville, Tennessee Gary Oetker in Plano, Texas Conference Objectives: Review Income Statement fundamentals. Review how to make the Income Statement a tool to manage your company’s financial performance. Agenda for Conference Review the basic layout and terminology of the Income Statement Review line item expenses that are “above the line” and “below the line” Review handling of Allocated Fringes and Warranty Reserve Review need to departmentalize Review key points in using the Income Statement as a tool to manage company performance The Income Statement What Does It Do? Used to determine tax obligation Can be used as a management tool to monitor financial performance Need sufficient detail Need processes to collect information Need to format Income Statement in a format that’s meaningful to your needs Is a flexible document It’s a matter of setting up Chart of Accounts Simple Income Statement Sales $650,000 $377,000 (100%) (58.0%) Gross Margin Overhead $273,000 $195,000 (42.0%) (30.0%) Operating Profit Other Gain/Loss $ 78,000 $ 6,500 (12.0%) ( 1.0%) Net $ 84,500 (13.0%) Cost of Sales Profit Beginning Terminology Income (Profit & Loss Statement) Sales (Revenue) Cost of Sales (Direct Costs) Gross Margin (Gross Profit) Overhead (SG&A – Sales, General & Administration; or Indirect Costs) Operating Income Other Gain/Loss Net Income (EBIT – Earning Before Interest or Taxes) More Detailed Income Statement Total Company As of January 30: Above The Line The Line Sales $80,000 100.0% Parts Direct Labor Equipment Sub-contractor Permit Callbacks Extended Warranty-3rd Party Buydown / Financing Warranty Allocated Fringes Sales Salaries Sales Commission $9,600 $8,000 $16,000 $240 $240 $400 $800 $800 $1,200 $4,000 $0 $4,800 12.0% 10.0% 20.0% 0.3% 0.3% 0.5% 1.0% 1.0% 1.5% 5.0% 0.0% 6.0% TOTAL COST $46,080 57.6% GROSS MARGIN $33,920 42.4% Percentages to Total Sales Daily Activities Feed Financial Statements Daily Activities Completed Paperwork PaperActivities Journal & Ledger Entries Paperwork PaperActivities Income Statement Income Statement Overview Specified Accounting Period Month Year-To-Date Tied to Chart of Accounts Gross Margin Comparisons Apples-To-Apples Above & Below the Line Costs Industry Benchmarks Tax Document Versus Management Tool Other Income / Loss Direct Labor Considerations Labor Used on a Job or Ticket There’s No Such Thing As Unapplied Time Track Non-Billable Labor for: Training Callbacks Warranty Allocated Fringes Above The Line Overhead Based Tied to Labor on a Calculated Percentage Overhead Associated With Labor Versus Labor Cost Multiply Direct Labor Cost by Allocated Fringe Percentage to Get Allocated Fringe Dollar Amount Revisit Calculation Periodically Allocated Fringes (cont) Total Payroll (Labor Cost) Direct Labor Payroll (Including Unapplied Time) Commissions / Sales Salary Bonuses Administrative Wages Warehouse & Purchasing Wages Support Wages Vacation / Holiday Wages Training / Meeting Wages Allocated Fringes (cont) Fringe Benefits Vacation / Holiday FICA (Canadian Pension, etc.) Worker Comp. Group Medical 401K Contribution Uniforms Employee Relations Drug Testing Expense Education Expense Allocated Fringes (cont) Contra Treat Account Allocated Fringe as an expense above the line Deduct as an Employee Related expense below the line (Account 6900 in sample Chart of Accounts) Warranty / Warranty Reserve Warranty Reserve Concept Warranty Expense - Take a little bit out of each job and set aside for future warranty work Warranty Reserve – Put the money into an account on the Balance Sheet. This account recognizes the company’s warranty liability. Warranty Call - As warranty work is performed, money is takes from the warranty reserve to pay for warranty call. Below The Line Expenses The Line Broad Categories Of Overhead SALES $80,000 TOTAL COST $46,080 57.6% GROSS MARGIN $33,920 42.4% Marketing Employee Related Plant and Equipment Vehicle Related Administration $3,200 $11,200 $3,200 $3,600 $2,800 4.0% 14.0% 4.0% 4.5% 3.5% TOTAL OVERHEAD $24,000 30.0% $9,920 12.4% OPERATING PROFIT Overhead – Marketing Accounts Yellow Pages Direct Mail Newspaper Television Home Show Co-Op Advertising (negative amount) Sub Total Marketing Overhead – Employee Related Accounts Management Bonus Administrative Wages Warehouse / Purchasing Wages Officer Salary Vacation / Holiday Training / Meeting Wages Payroll Taxes – FICA Payroll Taxes – Other Workers Comp Group Medical 401K Contribution Uniforms Employee Relations Drug Testing Hiring Expense Small Tools Education Expense Support Wages Fringe Benefits Contra Sub Total – Employee Related Expenses Overhead – Plant & Equipment Accounts Depreciation - Leasehold Depreciation Equipment Depreciation – Furniture Building Maintenance Shop Supplies Equipment Maintenance General Liability Insurance Rent Utilities Utilities Telephone Janitorial Expense Property Expense Sub Total – Plant & Equipment Expenses Overhead – Vehicle Related Accounts Depreciation Expense Vehicle Repair Vehicle Fuel Vehicle Licenses Vehicle Insurance Vehicle Lease Expense Sub Total Vehicle Related Overhead – Administrative Accounts Business Licenses Accounting Fees Goodwill Amortization Bad Debts Dues and Subscriptions Industry Group Fees Data Processing Postage Office Supplies Radio / Pager Expense Utilities Cellular Phone Expense Bank & Credit Card Expense Travel & Entertainment Meals Contributions Mileage Reimbursement Other Sub Total – Administrative Expenses Additional Income Statement Information As of January 30: Actual Last Year Budget Variance Sales $80,000 73,600 76,800 3,200 Parts Direct Labor Equipment Sub-contractor Permit Callbacks Extended Warranty-3rd Party Buydown / Financing Warranty Allocated Fringes Sales Salaries Sales Commission $9,600 $8,000 $16,000 $240 $240 $400 $800 $800 $1,200 $4,000 $0 $4,800 8,832 7,360 14,720 221 221 368 736 736 1,104 3,680 0 4,416 9,216 7,680 15,360 230 230 384 768 768 1,152 3,840 0 4,608 384 320 640 10 10 16 32 32 48 160 0 192 TOTAL COST $46,080 42,394 44,237 1,843 GROSS MARGIN $33,920 32,224 32,563 1,357 Departmentalization Above the Line Why Consider Doing It? It Tracks Revenue Mix of Business It Tracks Direct Costs & Gross Margin by Department – Can be Compared to Industry Benchmarks It Gives Essential Information to Evaluate Individual Department Performance. See Series #5. Other Income Statement Considerations Enter daily paperwork into your accounting system the day so you can get meaningful information during the month Make sure administrative people are diligent in entering information Get Income Statement in a timely manner after month-end Make sure your managers understand Income Statement and the role they play in the numbers Make sure technicians and installers are diligent at recording time and materials Other Words of Advise Set up Chart of Accounts to get the information you need to manage your company. Organize the Income Statement the way you want based on the fundamentals learned today. Use the Income Statement to decide if you need to change business mix. Use the Income Statement to compare to industry financial benchmarks Use Income Statement to help analyze pricing Departmentalize your Income Statement to monitor performance in the market segments you work in. Other Words of Advise (cont.) Embrace an “Open Book” philosophy with employees. They are part of the team and deserve to know how the company is doing. Questions & Answers