File

advertisement

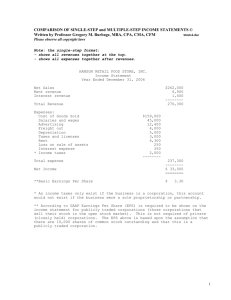

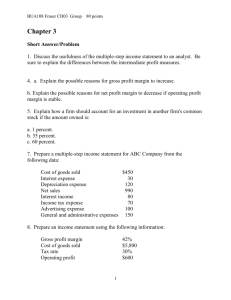

Chapter 3: Income Statement and Statement of Stockholders’ Equity 1. How would you describe operating performance? a. What are the important things you would like to know? 2. There are 4 primary categories of things found in an income statement: a. Gross profit b. Operating profit c. Earnings before Taxes d. Net Income e. What about EPS 3. Discuss the idea of control? a. What do the following line items describe with respect to control? i. Gross profit (GP) 1. production ii. Operating profit (EBIT) 1. total business “running” expenses iii. Earnings before income taxes (EBT) 1. control of expenses to do the business (operations and financing) 4. Why do we disclose these items separately? a. Discontinued operations b. Extraordinary transactions 5. How do you create a Common-Size Income Statement? a. What is the benefit? b. Gross Profit (or Gross Margin) GPM Gross Profit Sales OPM EBIT Sales i. What does it measure? c. Operating Profit Margin i. What kind of expenses are here? 6. Effective Tax Rate Effective Tax Rate a. Also known as average tax rate. Income Tax Expense Earnings Before Taxes NPM 7. Net Earnings Net Income Sales 8. Earnings Per Common Share (EPS) a. How do we calculate? b. What are outstanding shares? i. Describe the way common stock is created and then the different categories. Company becomes a corporation Decides how many shares it want to distribute Some it issues Some it holds in “inventory” The shares issued are called outstanding shares The company could buy back some of these over time; called treasury stock 9. Comprehensive Income a. there are four items i. Foreign currency translation effects ii. Unrealized gains and losses iii. Additional pension liabilities iv. Cash flow hedges 1. What is a cash flow hedge???? 10. The Statement of Stockholders’ Equity a. What are i. Dividends ii. stock dividends and splits iii. retained earnings 11. Buffett and Gates I would use the disk available from Beth or Ariana. a. Part 1 of 8 http://www.youtube.com/watch?feature=player_detailpage&v=7zC8DjXUfgU b. Part 2 of 8 http://www.youtube.com/watch?feature=player_detailpage&v=DdLy4jeT6pc c. Part 3 of 8 http://www.youtube.com/watch?feature=player_detailpage&v=LwB54Oz-Gs8 d. Part 4 of 8 http://www.youtube.com/watch?feature=player_detailpage&v=e6tBiyDcxfU Chapter 3 1. Prepare a multiple-step income statement for ABC Company from the following data: Cost of goods sold Interest expense $450 30 Depreciation expense 120 Net sales 990 Interest income 80 Income tax expense 70 Advertising expense 100 General and administrative expenses 150 Common Size Net sales 990 100% COGS 450 45.5% GP 540 54.5% Selling and Admin 150 15.5% Advertising 100 10.1% Depreciation 120 12.1% EBIT 320 32.3% 30 3.0% Interest Income +80 8.0% EBT 370 37.4% Taxes 70 7.0% Net Income 300 30.4% Interest Expense 2. Use the above statement to prepare a common-size statement. 3. Use the following information to analyze the BJ Company. Calculate any profit measures deemed necessary in order to discuss the profitability of the company . BJ Company Income Statements For the Years Ended Dec. 31, 2009 and 2008 2009 2008 $174,000 $167,000 114,000 115,000 $ 60,000 $ 52,000 54,000 46,000 Operating profit $ 6,000 $ 6,000 Interest expense (1,000) (1,000) $ 5,000 $ 5,000 2,000 2,000 $ 3,000 $ 3,000 Net sales COGS Gross profit General and administrative expenses Earnings before taxes Income taxes Net income 2009 2008 What is the GPM? 34.5% 31.1% What is the OPM? 3.4% 3.5% What is the NPM? 1.7% 1.8%