Mr. Maurer AP Economics

advertisement

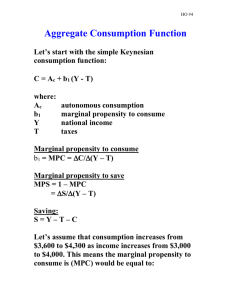

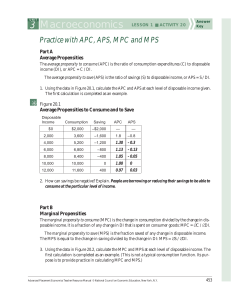

Mr. Maurer AP Economics Homework – Chapter 28.1 and 28.2 Read pages 614 – 627 and answer the following questions. Section 28.1 1. What is the relationship between disposable income and saving? 2. According to the graph on page 617, what is significant about a GDP of $390 billion? Remember that, in this model, GDP = Disposable Income. 3. What happens to the Average Propensity to Consume (APC) and the Average Propensity to Save (APS) as disposable income rises? 4. Read about the Marginal Propensity to Consume (MPC) and the Marginal Propensity to Save (MPS) on pages 618-619 , then look at the graphs on page 619. Why are the lines in the graphs straight (they have a constant slope)? We have seen graphs of marginal cost and marginal product and they are usually curved (they don’t have a constant slope). Why do the MPC and MPS curves on p. 619 have a constant slope? Is it possible that they could ever not be straight lines? If, so how and when? 5. Identify the other five determinants of consumption and saving and explain the effect of each. Section 28.2 6. Under what circumstances should a business borrow money (or spend money from cash on hand) to invest in capital? 7. How is the investment demand curve like any other demand curve we have studied? 8. What factors can shift the investment demand curve? 9. Take the quick quizzes on page (617) and page (624) and check your answers. 10. Be prepared to ask questions about this tomorrow in class. This is complicated (at least it seems complicated to me).