Lecture 3 Consumption Saving

advertisement

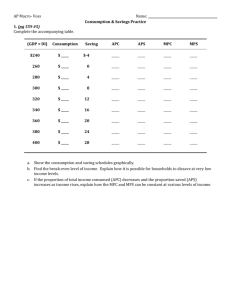

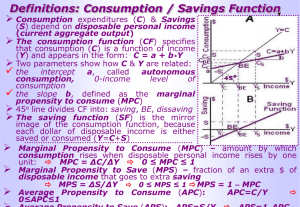

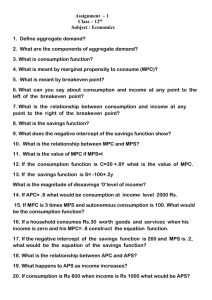

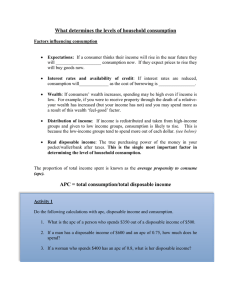

Chapter Three Consumption and Saving 1. Consumption and saving analysis Factors affect consumption current disposable income; foresight of income and price; interest rate for consumer’s credit; catch up with somebody; social security system; personal wealth Factors affect saving precaution; foresight; interest rate; independence; enterprise; pride; avarice and miser 2. Consumption Function Definition The relationship between consumption and factors that affect consumption is described by the consumption function. Especially we assume the that consumption increases with the level of disposable income: C = a + b Yd Autonomous consumption variable a in C function ----represents the level of consumption when income is zero---the intercept on vertical axis of the C-curve Induced Consumption be varied with income level---- the slope of the consumption curve and b Yd in C function Propensity to consume Average propensity to consume (APC) APC = C/Yd -----is the proportion of consumption to income . Marginal propensity to consume (MPC) MPC = ∆C/∆Y ------ is the increase in consumption per unit increase in income. It is represented by variable b in C function. 3. Short-run & long-run consumption curve “Paradox of consumption function” The shift of the Cs curve Derivation of the CL-curve Explain of the shift in the short-run curves 4. Saving Function Definition------Saving is equal to income minus consumption. APS & MPS : MPC+MPS=1 ; APC+APS=1 Saving curve Saving function S = Yd - C = - a + (1-b) Yd 5. Modern Consumption Theory Absolute Income Theory Relative Income Theory Life-cycle Theory Some assumptions Basic function C = a WR + c YL where: a ---- MPC out of wealth WR ---- real wealth c ----- MPC out of labor income YL----- labor income With lifetime consumption equal to lifetime income, we have C×NL = YL ×WL C = YL × WL/ NL Case: Numerical example Summarize: C is constant over the consumer`s lifetime and financed by lifetime income plus initial wealth. During each year, a fraction,1/(NL - T), of wealth will be consumed, where (NL - T) is the life expectancy. Current consumption spending depends on current wealth and lifetime income. Permanent income theory A) The form of the theory: C = c YP YP----- permanent disposable income c------ is the MPC B) Estimating of the YP: YP = Y-1 +θ(Y - Y-1) =θY+(1-θ)Y-1 C) Permanent Income and Consumption C = cYP = cθY + c(1-θ)Y-1