Tax Director Roundtable - Hargrove Miles Whittaker

advertisement

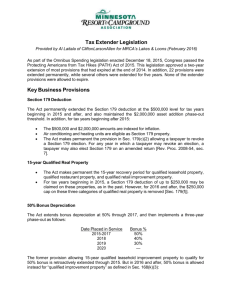

THE 7TH ANNUAL DALLAS CPA SOCIETY EDUCATION CONFERENCE Tax Director Roundtable A Panel Discussion • • • • Julie Hargrove Jim Miles Susan Whittaker Carol Salaiz 7-Eleven, Inc Lehigh Hanson, Inc FirstGroup America, Inc Ecom Atlantic, Inc Agenda • Accounting for income Tax (ASC 740) • Running a “Best Practices” Tax Dept • Corporate Tax update • Q&A Accounting for Income Tax (ASC 740) Facilitator – Jim Miles • Deferred Tax Assets - • Supporting DTA’s - • Inclusion of Non-Current Tax Liability Projected profits Number of loss years Tax Planning Strategies - • Timing differences Projected profits Tax planning strategies Scheduling Timing Differences - • Status when Deferred Taxes are net liability Status when Deferred Taxes are net assets (Naked or Uncovered) IFRS v. US GAAP Feasibility Rep letters Steps towards implementation Other Considerations - Auditors Industry – Cyclical Running a “Best Practices” Tax Department Facilitators – Carol Salaiz and Susan Whittaker • Staffing – – – – – – • Risk – – – – – • Communication with Boards and Upper Management Training and Education Record Retention Managing Audits Succession Planning Relationships: Knowing what’s going on! – – – – • In the field or in the department Organized by type of tax vs line of business vs technical expertise Flexible hours; telecommuting Project Management Skills Compliance vs. Planning Outsourcing Upper Management Operations Accounting Internal Media Effect of Technology – – – Paper vs electronic workpapers Direct access to accounting information Email (the good and the bad) Corporate Tax Update Facilitator – Julie Hargrove • Bonus Depreciation for Qualified Property – – – – – • Uncertain Tax Positions (UTP) – – – – – • Requires qualified corporations to report UTP on 2010 tax return Qualified corporations = assets equal or exceed $100 million (reduced to $50 million in 2012 and $10 million in 2014) Report only current year UTP Rank UTP by size Provide a concise description of the tax position Foreign – – • January 1, 2010 to September 8, 2010 – 50% bonus depreciation September 9, 2010 to December 31, 2010 – 100% bonus deprecation January 1, 2011 to December 31, 2011 – 100% bonus depreciation January 1, 2012 to December 31, 2012 – 50% bonus deprecation State IRC Conformity Depreciation Rules Foreign Bank Account Reporting Foreign Tax Credit Splitting Information Reporting – – Repeal of Expanded Form 1099 Information Reporting Payment card reporting Q&A