Partnership tax return

advertisement

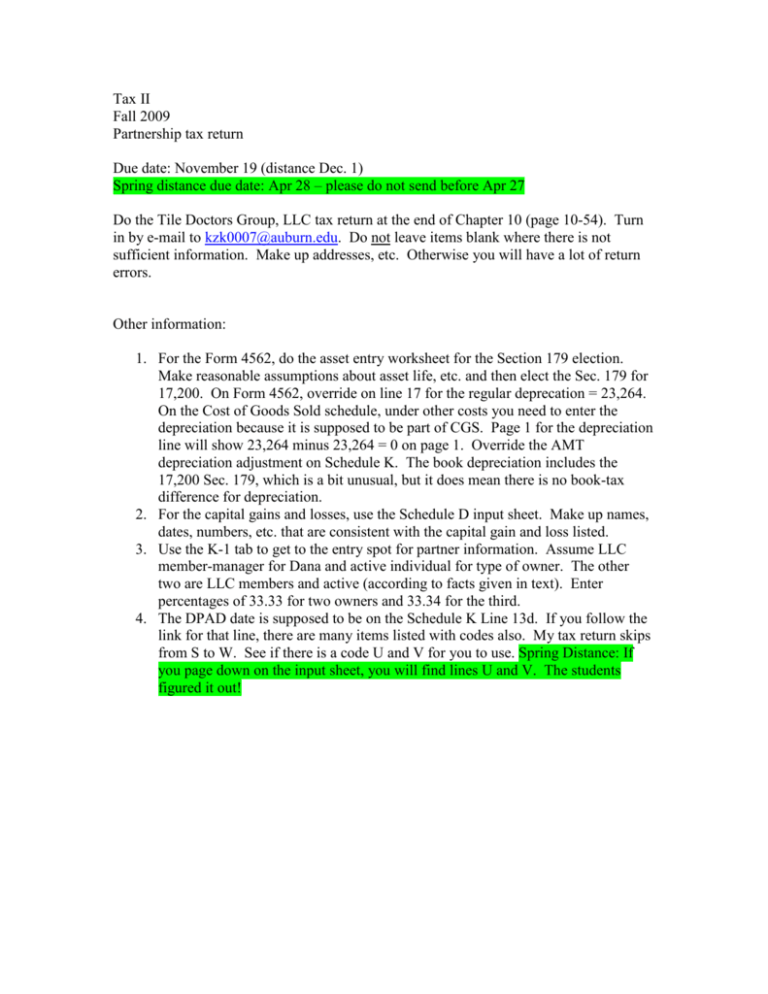

Tax II Fall 2009 Partnership tax return Due date: November 19 (distance Dec. 1) Spring distance due date: Apr 28 – please do not send before Apr 27 Do the Tile Doctors Group, LLC tax return at the end of Chapter 10 (page 10-54). Turn in by e-mail to kzk0007@auburn.edu. Do not leave items blank where there is not sufficient information. Make up addresses, etc. Otherwise you will have a lot of return errors. Other information: 1. For the Form 4562, do the asset entry worksheet for the Section 179 election. Make reasonable assumptions about asset life, etc. and then elect the Sec. 179 for 17,200. On Form 4562, override on line 17 for the regular deprecation = 23,264. On the Cost of Goods Sold schedule, under other costs you need to enter the depreciation because it is supposed to be part of CGS. Page 1 for the depreciation line will show 23,264 minus 23,264 = 0 on page 1. Override the AMT depreciation adjustment on Schedule K. The book depreciation includes the 17,200 Sec. 179, which is a bit unusual, but it does mean there is no book-tax difference for depreciation. 2. For the capital gains and losses, use the Schedule D input sheet. Make up names, dates, numbers, etc. that are consistent with the capital gain and loss listed. 3. Use the K-1 tab to get to the entry spot for partner information. Assume LLC member-manager for Dana and active individual for type of owner. The other two are LLC members and active (according to facts given in text). Enter percentages of 33.33 for two owners and 33.34 for the third. 4. The DPAD date is supposed to be on the Schedule K Line 13d. If you follow the link for that line, there are many items listed with codes also. My tax return skips from S to W. See if there is a code U and V for you to use. Spring Distance: If you page down on the input sheet, you will find lines U and V. The students figured it out!