ws1 quiz

advertisement

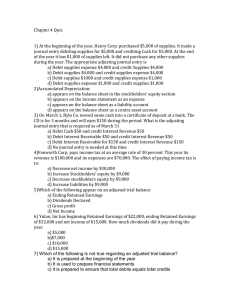

Question 1 2.5 points Save The basic purpose of a trial balance is to: list all of the accounts in the general ledger. list all of the accounts in the general ledger that have a balance be sure that all journal entries have been recorded. verify that the total credits equal the total debits. Question 2 2.5 points Save Accrued revenues have been earned and collected, but not yet recorded have been collected, but not yet earned or recorded have been earned and recorded, but not yet collected have been earned, but not yet collected or recorded Question 3 2.5 points Save Two constraints mentioned by the FASB in Statement of Financial Accounting Concepts No. 2 on qualitative characteristics are understandability and decision usefulness comparability and consistency relevance and reliability benefits greater than costs and materiality Question 4 2.5 points Save The organization that presently has the primary responsibility to establish generally accepted accounting principles that are applicable to the financial statements of entities in the private sector of the U.S. is the Accounting Principles Board Securities and Exchange Commission Financial Accounting Standards Board Committee on Accounting Procedure Question 5 2.5 points Save When preparing closing entries you would expect to find: debit Unearned Rent, credit Income Summary debit Sales Revenue, credit Income Summary debit Income Summary, credit Dividends Distributed debit Income Summary, credit Gain on Sale of Land Question 6 2.5 points Save Which of the following is a specific objective of financial reporting? provide information that is useful to investors in making investment decisions provide information useful in assessing the amounts, timing, and uncertainty of prospective cash receipts provide information useful in assessing the amounts, timing, and uncertainty of prospective cash inflows provide information about a company's economic resources, obligations, and owners' equity Question 7 2.5 points Save Which of the following is an economic resource that should be depreciated over the accounting periods estimated to be benefited? salaries incurred but unpaid at year-end rent collected in advance for a three-year rental period equipment purchased for use in the business operations interest revenue accrued on investment in bonds Question 8 2.5 points Save Which of the following documents includes all of the accounting standards? Regulation S-X The FASB Conceptual Framework Statements of Financial Accounting Standards none of the above Question 9 2.5 points Save Distributions that are paid to owners would affect both the balance sheet and statement of cash flows balance sheet and income statement income statement and statement of changes in equity income statement and statement of cash flows Question 10 2.5 points Save Which of the following errors will be detected by a trial balance? posting a credit to Sales instead of to Accounts Payable incorrectly computing the balance of the cash account not journalizing a complete sales transaction forgetting to post a complete purchase transaction Question 11 2.5 points Save If collectibility of the revenue is highly uncertain, an appropriate method that should be used to recognize revenue would be the percentage-of-completion method at the point of sale the proportional performance method the installment method Question 12 2.5 points Save A primary focus of financial reporting about a company's performance during an accounting period is information related to the company's: Balance Sheet Income Statement Comprehensive Income Cash Flows Question 13 2.5 points Save On June 1, 2006, Whiting Corporation received $4,104 in advance for a two-year rental of some land, and credited Unearned Rent. In the adjusting entry at December 31, 2006, there would be a debit to Unearned Rent for $1,026 credit to Unearned Rent for $1,197 credit to Rent Revenue for $1,197 debit to Unearned Rent for $2,907 Question 14 2.5 points Save Which of the following are considered secondary characteristics of accounting information? verifiability and feedback value predictive value and timeliness comparability and consistency representational faithfulness and neutrality Question 15 2.5 points Save Intracompany comparability would be violated if a company used LIFO as its inventory cost method while other companies in the same industry used FIFO a company changed its bad debts expense estimate from one percent to two percent a bank did not classify its assets as current assets and noncurrent assets a company expenses all expenditures of less than $500 even if the expenditures result in probable future economic benefit Question 16 2.5 points Save An organization will typically utilize a subsidiary ledger to: make sure all debits equal credits. make it easier to handle cash received from customers. keep supplier accounts up-to-date. record customer credit sales outside of the normal double entry system. Question 17 2.5 points Save Which of the following accounts would not be closed to Income Summary during the year-end closing entry process? Loss of Sale of Land Prepaid Rent Freight-in Sales Discounts Question 18 2.5 points Save The Yellow Company made year-end adjusting entries affecting each of the following accounts: Office Salaries Payable (credited); Depreciation Expense (debited); Unearned Rental Revenue (debited); and Prepaid Insurance (credited). Which account is likely to appear in Yellow's reversing entries? Office Salaries Payable Depreciation Expense Unearned Rental Revenue Prepaid Insurance Question 19 2.5 points Save Which of the following items would be a violation of materiality? a company did not separately report an unusual gain of $50,000. Its income from operations was $5,000,000 a company expensed the purchase of pencil sharpeners that have an estimated useful life of three years a $25,000 illegal bribe to a foreign official was not separately disclosed in the annual report a $5,000 expenditure to improve a building that originally cost $5,000,000 was expensed Question 20 2.5 points Save In terms of debits and credits, which accounts below will have the same normal balances? dividends, expenses, assets assets, capital stock, revenues retained earnings, dividends, liabilities expenses, liabilities, capital stock