DEPRECIATION-AFTER/BEFORE TAX RATE OF RETURN

advertisement

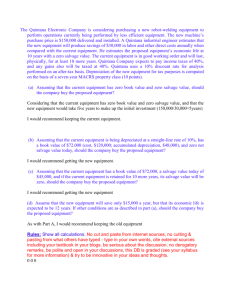

DEPRECIATION-AFTER/BEFORE TAX RATE OF RETURN Exercise:An automobile manufacturer is buying some special tools for 100.000 $. The corporation will pay 20.000 $ now and borrow the remaining 80.000 $ which will be paid starting from the first year with an interest rate on loan of 10% by 4 equal end of year payments. The tools are being depreciated by double declining balance using a 4 year depreciable life and a 6250 $ salvage value. It is expected the tools will actually be kept in service for 6 years and then sold for 6250 $. The income tax rate is 46%. a)Calculate the before tax rate of return b) Compute the after-tax rate of return by preparing an expanded cash flow table. c) What woul be the after-tax rate of return if the company did not borrow 80.000 $ ( In other words total equity= 100.000 $) Hint: Interest payments are tax deductible . Year Before-Tax Cash Flow ($) 1 30.000 2 30.000 3 35.000 4 40.000 5 10.000 6 10.000 Solution: 80000 (A/P,10%,4) = 25240 =Total loan paid annually 80000/4= 20000 (principal annual payment) 25240-20000 = 5240 (interest annual payment) Year BeforeTax Cash Flow 2 Principal payment 3 Interest payment 4 Total Loan Payment 5=3+4 Net Cash Flow before tax 6= 2-5 Depreciation 7 (DDB= 2/4= 50%) Taxes 8= [2(4+7)] x 0.46 0 -20000 1 30000 20000 5240 25240 4760 50000 - 4760 2 30000 20000 5240 25240 4760 25000 - 4760 3 35000 20000 5240 25240 9760 12500 7940 1820 4 40000 20000 5240 25240 14760 6250 13115 1645 5 10000 10000 4600 5400 6 10000 6250 10000 6250 4600 11650 20000 Net Cash Flow After taxes 9= 6-8 -20000 • a) Trial error for estimating IRRBT • Compound interest tables i=30% • NPW= -20000+ 4760 (P/F, 30%,1) + 4760 (P/F,30%,2) + 9760 (P/F,30%,3) + 14760 (P/F,30%,4) + 10000 (P/F,30%,5) + 16250 (P/F,30%,6)= 2148 • For i= 35% NPW= -537,25 30 % 2148 X 0 35% -537,25 (X-30) / -2148 = (35-30)/ -537,25-2148 IRRBT = 34% • b) Calculating IRRAT • Trial Error for i=12% • NPW= -20000 + 4760 (P/F,12%,1) + 4760(P/F,12%,2) + 1820 (P/F,12%,3) + 1645 (P/F,12%,4) + 5400 (P/F,12%,5) + 11650 (P/F,12%,6)= -648,4 • Trial error for i= 10% NPW= 681 • Interpolation 1329.4 x -13294=1296.8 • X= 10.97 % • If we had used the equation iAT= iBT x (1-T), we would have found out iAT= 0.34x(1-0.46) = 0.1836 , but this is inaccurate since this method is prevalent for capital gains or losses obtained by the sale of non-depreciable assets such as land or stocks Replacement Analysis-Exercise • The Traverse company bought 5 years ago a milling machine Y for 35.000 TL. The salvage value at the end of its useful life is 5000 TL and its useful life is 10 years. The present market value of Y is 13.000 TL . If the company makes a revision and modifies the machine Y by spending 8000 TL, the machine Y will be available for additional 10 years with an annual operating cost of 7500 TL and a salvage value of 3000 TL • On the other hand, there is a second alternative :It buys a new machine Z of 50.000 TL with a useful life of 20 years and annual maintenance costs of 4000 TL? • Assess which of the alternatives should be selected? Solution DEFENDER CHALLENGER Present value 21.000(13.000 +8000) 50.000 Salvage value 3000 20.000 Annual operating cost 7500 4000 Useful life 10 years 20 years MARR 40% 40% EUACD= 21.000 (A/P,40%,10) – 3000(A/F,40%,10) + 7500= 16.158 TL EUACC= 50.000 (A/P, 40%, 20) – 20.000 (A/F,40%,20) + 4000= 24.014 TL In this case, the old machine must be used for 10 years by making a modification since its equivalent uniform annual costs are lower