here

advertisement

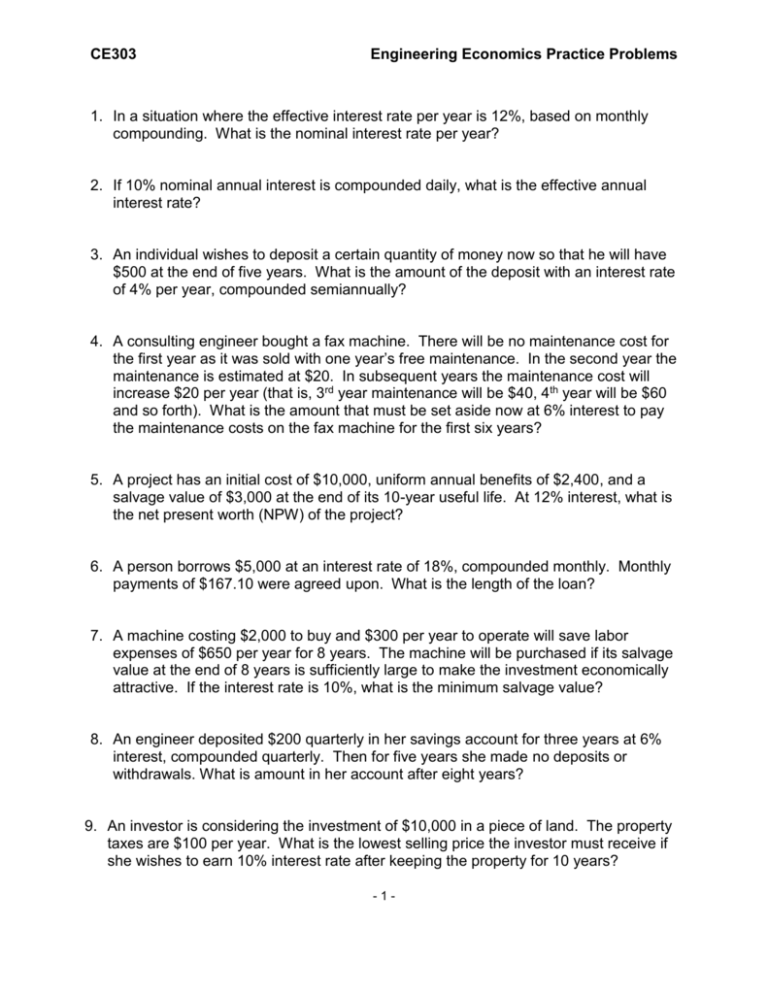

CE303 Engineering Economics Practice Problems 1. In a situation where the effective interest rate per year is 12%, based on monthly compounding. What is the nominal interest rate per year? 2. If 10% nominal annual interest is compounded daily, what is the effective annual interest rate? 3. An individual wishes to deposit a certain quantity of money now so that he will have $500 at the end of five years. What is the amount of the deposit with an interest rate of 4% per year, compounded semiannually? 4. A consulting engineer bought a fax machine. There will be no maintenance cost for the first year as it was sold with one year’s free maintenance. In the second year the maintenance is estimated at $20. In subsequent years the maintenance cost will increase $20 per year (that is, 3rd year maintenance will be $40, 4th year will be $60 and so forth). What is the amount that must be set aside now at 6% interest to pay the maintenance costs on the fax machine for the first six years? 5. A project has an initial cost of $10,000, uniform annual benefits of $2,400, and a salvage value of $3,000 at the end of its 10-year useful life. At 12% interest, what is the net present worth (NPW) of the project? 6. A person borrows $5,000 at an interest rate of 18%, compounded monthly. Monthly payments of $167.10 were agreed upon. What is the length of the loan? 7. A machine costing $2,000 to buy and $300 per year to operate will save labor expenses of $650 per year for 8 years. The machine will be purchased if its salvage value at the end of 8 years is sufficiently large to make the investment economically attractive. If the interest rate is 10%, what is the minimum salvage value? 8. An engineer deposited $200 quarterly in her savings account for three years at 6% interest, compounded quarterly. Then for five years she made no deposits or withdrawals. What is amount in her account after eight years? 9. An investor is considering the investment of $10,000 in a piece of land. The property taxes are $100 per year. What is the lowest selling price the investor must receive if she wishes to earn 10% interest rate after keeping the property for 10 years? -1- CE303 Engineering Economics Practice Problems 10. Two alternatives are being considered: Initial Cost Uniform Annual Benefit Useful Life A $500 $140 8 B $800 $200 8 What is the Benefit Cost Ratio of the difference between the alternatives, based on 12% interest rate? 11. $20,000 is invested today. If the annual inflation rate is 6% and the effective annual return on investment is 10%, what will be the approximate future value of the investment, adjusted for inflation, in 5 years? 12. A factory that manufactures chairs costs $180,000 per year to operate, including rent, depreciation charges on equipment, and salaries. Each chair costs $31 to make, and sells for $59. What is the factory’s break-even sales volume? -2- CE303 Engineering Economics Practice Problems SOLUTIONS 1. In a situation where the effective interest rate per year is 12%, based on monthly compounding. What is the nominal interest rate per year? Solution: ie = (1+r/m)m -1 0.12 = (1+r/12)12 -1 (1.12)1/12 = (1+r/12) 1.00949 = (1+r/12) r = 0.00949 x 12 = 0.1138 = 11.38% 2. If 10% nominal annual interest is compounded daily, what is the effective annual interest rate? Solution: ie = (1+r/m)m -1 = (1+0.10/365)365 -1 = 0.1052 = 10.52% 3. An individual wishes to deposit a certain quantity of money now so that he will have $500 at the end of five years. What is the amount of the deposit with an interest rate of 4% per year, compounded semiannually? Solution: P = F (P/F, i, n) = 500 (0.8203) = $410 4. A consulting engineer bought a fax machine. There will be no maintenance cost for the first year as it was sold with one year’s free maintenance. In the second year the maintenance is estimated at $20. In subsequent years the maintenance cost will increase $20 per year (that is, 3rd year maintenance will be $40, 4th year will be $60 and so forth). What is the amount that must be set aside now at 6% interest to pay the maintenance costs on the fax machine for the first six years? Solution: Using single payment present worth factors: P = 20(P/F, 6%, 2) + 40 (P/F, 6%, 3) + 60 (P/F, 6%, 4) + 80 (P/F, 6%, 5) + 100 (P/F, 6%, 6) = 20 (0.8900) + 40 (0.8396) + 60 (0.7921) + 80 (0.7473) + 100 (0.7050) = $229.19 An alternative solution is to use the gradient present worth factor. P = 20 (P/G, 6%, 6) = 20 (11.459) = $229.18 5. A project has an initial cost of $10,000, uniform annual benefits of $2,400, and a salvage value of $3,000 at the end of its 10-year useful life. At 12% interest, what is the net present worth (NPW) of the project? Solution: NPW = PW of Benefits - PW of Cost = 2,400(P/A,12%,10) + 3,000(P/F,12%,10) – 10,000 = = 2,400(5.650) + 3,000(.3220) – 10,000 = $4,526 -3- CE303 Engineering Economics Practice Problems 6. A person borrows $5,000 at an interest rate of 18%, compounded monthly. Monthly payments of $167.10 were agreed upon. What is the length of the loan? Solution: PW of Benefits = PW of Cost $5,000 = $167.10(P,A,1.5%,n) (P/A,1.5%,n) = 5,000/167.10 = 29.92 From 1½% Table n= 40 7. A machine costing $2,000 to buy and $300 per year to operate will save labor expenses of $650 per year for 8 years. The machine will be purchased if its salvage value at the end of 8 years is sufficiently large to make the investment economically attractive. If the interest rate is 10%, what is the minimum salvage value? Solution: NPW = PW of Benefits –PW of Cost = 0 = (650-300)(P/A,10%,8) + S8(P/F,10%,8) –2,000 = 0 = 350(5.335) + S8(0.4665) – 2,000 = 0 S8 = $284.57 8. An engineer deposited $200 quarterly in her savings account for three years at 6% interest, compounded quarterly. Then for five years she made no deposits or withdrawals. What is amount in her account after eight years? Solution: FW 200(F/A,1.5%,12)(F/P,1.5%,20) = 200(13.041)(1.347) = $3,513.25 9. An investor is considering the investment of $10,000 in a piece of land. The property taxes are $100 per year. What is the lowest selling price the investor must receive if she wishes to earn 10% interest rate after keeping the property for 10 years? Solution: Min Sale Price = 10,000(F/P,10%,10) + 100(F/A,10%,10) = = 10,000(2.594) + 100(15.937) = $27,533.70 10. Two alternatives are being considered: Initial Cost Uniform Annual Benefit Useful Life A $500 $140 8 B $800 $200 8 What is the Benefit Cost Ratio of the incremental cash flow of the two alternatives, based on 12% interest rate? Solution: B/C = PW of Benefits/PW of Cost = 60(P/A,12%,8)/300 = 60(4.968)/300 = 0.99 -4- CE303 Engineering Economics Practice Problems Alternative B/C = EUAB/EUAC = 60/300(A/P,12%,8) = 60/300(0.2013) = 0.99 11. $20,000 is invested today. If the annual inflation rate is 6% and the effective annual return on investment is 10%, what will be the approximate future value of the investment, adjusted for inflation, in 5 years? Solution: The interest rate adjusted for inflation is d = I +f +i*f = .10+.06+.1*.06 = 0.166 So F = P(i+d)n = $20000(1+0.166)5 = $43105 12. A factory that manufactures chairs costs $180,000 per year to operate, including rent, depreciation charges on equipment, and salaries. Each chair costs $31 to make, and sells for $59. What is the factory’s break-even sales volume? Solution: The break-even point occurs when costs and sales total zero. Let x be the number of chars per year at break-ven. Costs = $180000+$31*x Revenues = $59*x So, $180,000+$31*x = $59*x X = 6429 chairs/year -5-