external environment

advertisement

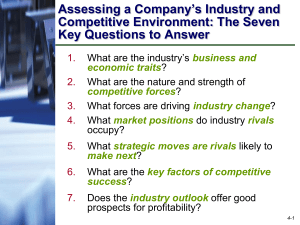

Exploring the External Environment THE COLA WARS (TIMELINE) Coca-Cola Coca-Cola invented “Kick Pepsi's can” Diet Coke New Coke Repair Coke and restore Stock price Diversify product line Pepsi 1886 1950 “Beat Coke” 1960 “Pepsi Generation” 1970 “Pepsi Challenge” 1980 Foster entrepreneurial spirit of Pepsi’s people 1990 Jettison slow-growing businesses 2000 Diversify beyond soft-drinks 1 External Environmental Factors Shaping A Company’s Choice of Strategy A thorough environmental analysis uses the tools to come to specific conclusions regarding the nature of the competitive arena, what it takes to succeed in the industry, and what strategies are 2 possible. The Firm’s External Environment REMOTE ENVIRONMENT Economic Factors 1. Prime interest rates 2. Inflation rates 3. Trends in the growth of the 4. 5. 6. gross national product Unemployment rates Globalization of the economy Outsourcing Social Factors Present in the external environment: Beliefs & Values Attitudes & Opinions Lifestyles Developed from: Cultural conditioning Ecological conditioning Demographic makeup Religion Education Ethnic conditioning Political Factors Political constraints on firms: • • • • • • Fair-trade Decisions Antitrust Laws Tax Programs Minimum Wage Legislation Pollution and Pricing Policies Administrative jawboning Technological Factors Technological forecasting helps protect and improve the profitability of firms in growing industries. It alerts strategic managers to impending challenges and promising opportunities. The key to beneficial forecasting of technological advancement lies in accurately predicting future technological capabilities and their probable impacts. Ecological Factors • Ecology refers to the relationships among human beings and other living things and the air, soil, and water that supports them. • Threats to our life-supporting ecology caused principally by human activities in an industrial society are commonly referred to as pollution • Loss of habitat and biodiversity • Environmental legislation • Eco-efficiency International Environment Monitoring the international environment involves assessing each non-domestic market on the same factors that are used in a domestic assessment. While the importance of factors will differ, the same set of considerations can be used for each country. Economic, political, legal, and social factors are used to assess international environments. One complication to this process is that the interplay among international markets must be considered. INDUSTRY ENVIRONMENT BLURRING OF INDUSTRY BOUNDARIES With fewer companies providing these services, the power of buyers will be impacted. Long Distance Telephone Companies Cable Companies As services are bundled, the cost to switch to another service provider will be greater. Internet Provider Companies 12 Industry Environment Harvard professor Michael E. Porter propelled the concept of industry environment into the foreground of strategic thought and business planning. The cornerstone of Porter’s work first appeared in the Harvard Business Review, in which he explains the five forces that shape competition in an industry. Porter’s well-defined analytic framework helps strategic managers to link remote factors to their effects on a firm’s operating environment. 4-13 Competitive Forces Shape Strategy The essence of strategy formulation is coping with competition. Intense competition in an industry is neither coincidence nor bad luck. Competition in an industry is rooted in its underlying economics, and competitive forces exist that go well beyond the established combatants in a particular industry. The corporate strategists’ goal is to find a position in the industry where his or her company can best defend itself against these forces or can influence them in its favor. 4-14 Forces Driving Industry Competition What Causes Rivalry To Be Stronger? • Competing sellers regularly launch fresh actions to boost market standing • Declining demand or slow market growth • The products or services offered by rivals are standardized or weakly differentiated • Number of rivals increases • Buyer costs to switch brands are low • Industry conditions tempt rivals use price cuts or other competitive weapons to boost volume • Outsiders have recently acquired weak firms in the industry and are trying to turn them into major market contenders What Causes Rivalry To Be Weaker? • Industry rivals move only infrequently or in a non-aggressive manner to draw sales from rivals • Rapid market growth • Products of rivals are strongly differentiated and customer loyalty is high • Buyer costs to switch brands are high • There are fewer than 5 rivals or there are numerous rivals so any one firm’s actions has minimal impact on rivals’ business What Are the Typical Weapons for Competing? •Vigorous price competition • Bigger/better dealer network •More or different performance • Low interest rate financing features •Better product performance •Higher quality •Stronger brand image and appeal •Wider selection of models and styles • Higher levels of advertising • Stronger product innovation capabilities • Better customer service • Stronger capabilities to provide buyers with custom-made products When is the Bargaining Power of Buyers Stronger? • They are large & purchase a sizable percentage of industry’s product • They buy in volume quantities • They incur low costs in switching to substitutes • They have flexibility to purchase from several sellers • Selling industry’s product is standardized • They can integrate backward 19 When is the Competition From Substitutes Stronger? • There are many good substitutes that are readily available • Substitutes are attractively priced • Substitutes have comparable or better quality and performance • End-users have low switching costs Substitutes are alternative product types (not brands) that perform essentially the same function. THREAT OF SUBSTITUTES Soft drinks Movie rentals Block buster Coke Pepsi Cable TV Bottled water Hollywood video IMPACT OF COMPLEMENTOR Complementor: Examples Any factor that makes it more attractive for suppliers to supply an industry on favorable terms or that makes it more attractive for buyers to purchase products or services from an industry at prices higher than it would pay absent the complementor Hot dogs + More sales Buns Music + MP3 player More attractive offering When is the Bargaining Power of Supplier Stronger? • Item makes up large portion of costs of product, is crucial to production process, and/or significantly affects product quality • They have good reputations & growing demand for their product • They can supply a component cheaper than industry members can make it themselves • They do not have to contend with substitutes Common Barriers to Entry • • • • • • • • Economies of scale Inability to gain access to specialized technology Brand preferences and customer loyalty Capital requirements Cost disadvantages independent of size Access to distribution channels Regulatory policies Tariffs & international trade restrictions Strategic Implications of the Five Competitive Forces • Competitive environment is unattractive from a profit-making standpoint when – Rivalry is vigorous – Entry barriers are low and entry is likely – Competition from substitutes is strong – Suppliers and customers have considerable bargaining power • Competitive environment is ideal from a profit-making standpoint when – Rivalry is moderate – Entry barriers are high and no firms is likely to enter – Good substitutes do not exist – Suppliers and customers are in a weak bargaining position Analyzing Driving Forces 1. • 2. • • • Identify forces likely to exert greatest influence over next 1 - 3 years Usually no more than 3 - 4 factors qualify as real drivers of change Assess impact Are the driving forces causing demand for product to increase or decrease? Are the driving forces acting to make competition more or less intense? Will the driving forces lead to higher or lower industry profitability? 3. Determine what strategy changes are needed to prepare for impact of driving forces PRESSURES FAVORING INDUSTRY GLOBALIZATION Markets Costs Governments Competition • Homogeneous • Large scale and • Favorable trade • Interdependent customer needs • Global customer needs • Global channels scope economies • Learning and experience • Sourcing efficiencies • Transferable • Favorable marketing approaches logistics • Arbitrage opportunities • High R&D costs policies • Common technological standards • Common manufacturing and marketing regulations countries • Global competitors Market Size INDUSTRY LIFE CYCLE Time Source: Embryonic Growing Mature In Decline Niche market – selected products for selected markets Market expands beyond niche Proliferation of products and markets served Product/market contraction Participants emphasize problem solving – product as “solution” More competitors enter Market volatility and beginnings of industry consolidation Further consolidation and industry regeneration Technological uncertainty Customers become better informed Aggressive customers Adapted from K. Rangan and G. Bowman, “Beating the Commodity Magnet,” Industrial Marketing Management 21 (1992), 215-224; P. Kotler, “Managing Products through their Product Life Cycle,” in Marketing Management: Planning, Implementation, and Control, 7 th ed (Upper Saddle River, NJ: Prentice Hall, 1991) “Market stability is threatened by short product life cycles, short product design cycles, new technologies, frequent entry by unexpected outsiders, repositioning by incumbents, and tactical redefinitions of market boundaries as diverse industries emerge.” – Richard D’Aveni