Chapter 4

Industry and

Competitive

Analysis

McGraw-Hill/Irwin

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

1-1

Answering the Question, “Where are

We Now?”

Two situational considerations

Company’s external industry and

competitive environment

Company’s own market position and

competitiveness

» Its competencies, capabilities,

resource strengths and

weaknesses, cost position, culture,

and the strength of its leadership

4-2

External Environmental Factors

Shaping A Company’s Choice of

Strategy

4-3

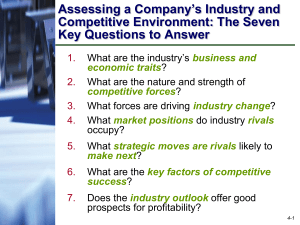

Assessing a Company’s Industry and

Competitive Environment: The Seven

Key Questions to Answer

1.

2.

3.

4.

What are the industry’s business and

economic traits?

What are the nature and strength of

competitive forces?

What forces are driving industry change?

What market positions do industry rivals

occupy?

5.

What strategic moves are rivals likely to

make next?

6.

What are the key factors of competitive

success?

7.

Does the industry outlook offer good

prospects for profitability?

4-4

Assessing a Company’s Industry and

Competitive Environment

1. What are the industry’s business

and economic traits?

2. What are the nature and strength

of competitive forces?

3. What forces are driving industry

change?

4. What market positions do

industry rivals occupy?

4-5

Assessing a Company’s Industry and

Competitive Environment

5. What strategic moves are rivals

likely to make next?

6. What are the key factors of

competitive success?

7. Does the industry outlook offer

good prospects for profitability?

4-6

Identifying the Industry’s

Dominant Economic Features

Market size and growth

rate

Number of rivals

Scope of competitive rivalry

Pace of technological change

Degree of vertical integration

Need for economies of scale

Learning and experience curve effects

4-7

Porter’s Five Forces Model of

Competition

Complementors

4-8

When Is the Bargaining

Power of Buyers Stronger ?

Buyers are large and can demand

concessions

Buyer switching costs for substitutes are

low

The number of buyers is small

Buyer demand is weak or declining

Buyers are well-informed about sellers’

products, prices, and costs

Buyers threaten to

integrate backward

4-9

When Is the Competition

From Substitutes Stronger ?

There are many good substitutes that

are readily available

Substitutes are attractively priced

Substitutes have comparable or better

quality and performance

End-users have low switching costs

4-10

When Is the Bargaining

Power of Suppliers Stronger ?

Industry members incur high switching

costs

Needed inputs are in short supply

Supplier provides a differentiated input

that enhances the quality or performance

of sellers’ products

There are only a few suppliers of a

specific input

Some suppliers threaten to integrate

forward

4-11

When Is the Threat of Entry Stronger ?

Industry growth is

rapid and profit

potential is high

Incumbents are

unwilling or unable

to contest a

newcomer’s entry

efforts

The pool of entry candidates is large

Entry barriers are low

4-12

What Causes Rivalry to Be

Stronger ?

Competing sellers

regularly launch fresh

actions to boost

market standing

Declining demand or slow market

growth

The products or services offered by

rivals are standardized or weakly

differentiated

One or more industry rivals becomes

dissatisfied with their market standing

4-13

What Causes Rivalry to Be

Stronger ?

Number of rivals increases

Buyer costs to switch brands are low

Industry conditions tempt rivals use

price cuts or other competitive

weapons to boost volume

Outsiders have recently

acquired weak firms in

the industry and are trying

to turn them into major

market contenders

4-14

When the Five Competitive Forces

Result in Attractive Market

Conditions

An industry’s competitive environment tends

to be attractive from a profit-making standpoint

when

Rivalry is moderate

Entry barriers are high

and no firm is likely to enter

Good substitutes

do not exist

Suppliers and customers are

in a weak bargaining position

thereby producing competitive

pressures that are very weak!

4-15

When the Five Competitive Forces

Result in Unattractive Market

Conditions

An industry’s competitive environment tends

to be unattractive from a profit-making

standpoint when

Rivalry is strong

Entry barriers are low

and new competitors are

likely to enter

Good substitutes exist

Suppliers and customers are

in a strong bargaining position

thereby producing competitive

pressures that are very intense

or fierce!

4-16

Analyzing Driving Forces

1.

Identify forces

likely to reshape

industry competitive

conditions

Changes likely to take place within

next 1 – 3 years

Usually no more than 3 - 4

factors qualify as real drivers of

change

4-17

Analyzing Driving Forces

2.

3.

Assess impact of driving forces on

industry attractiveness

Are the driving forces causing demand for

product to increase or decrease?

Are the driving forces acting to make

competition more or less intense?

Will the driving forces lead to higher or lower

industry profitability?

Determine what strategy changes

are needed to prepare for impact of

driving forces

4-18

Common Driving Forces

Changes in long-term industry growth

rate

Increasing globalization

of the industry

Changes in who buys the

product and how they use it

Product innovation

Technological change

Entry or exit of major firms

4-19

Identifying the Market Positions of

Rivals

4-20

What Can Be Learned from

Strategic Group Maps

Driving forces and competitive pressures

often favor some strategic groups and

hurt others

Competitive pressures may cause the

profit potential of different strategic

groups to vary

Identification of competitive

“white spaces” or

“blue ocean” opportunities

4-21

Blue Ocean Strategies

Blue ocean strategies offer growth by

discovering or inventing new industry

segments that create altogether new

demand

Cirque du Soleil has attracts 10 million

people annually to its shows by “reinventing

the circus”—its audience typically doesn’t

attend circus events

4-22

Predicting the Next Strategic

Moves Rivals Are Likely to Make

Profiling key rivals involves gathering

competitive intelligence about

Thinking and leadership styles of top

executives

Identifying trends in the timing of new

product launches and marketing promotions

Considering which rivals have the motivation

and capability to make major strategy

changes

4-23

Pinpointing the Key Factors

for Future Competitive Success

Key Success Factors (or KSFs) are

competitive factors most affecting

every industry member’s ability to

prosper.

KSFs include:

Specific product attributes

Necessary resources,

competencies, and capabilities

Specific intangible assets

Competitive capabilities

4-24

Three Questions to Ask in

Identifying Industry Key Success

Factors

1. On what basis do buyers choose

between brands?

2. What resources are needed to

compete successfully?

3. What shortcomings are almost

certain to put a company at a

competitive disadvantage?

4-25

Common Types of Industry Key

Success Factors

Expertise in a particular technology

Scale economies or experience curve

benefits

High capacity utilization

Strong network of wholesale distributors

Brand building skills

Convenient retail

locations

4-26

Deciding Whether the Industry

Presents an Attractive Opportunity

Involves assessing whether the industry

and competitive environment is attractive or

unattractive for earning good profits

Draws upon all the previous analysis

The industry’s growth potential

The intensity of competition

Whether the impacts of the driving forces

are positive or negative

The company’s competitive position in the industry

relative to rivals

How well the company performs the industry’s key

success factors

4-27