Homework 3

advertisement

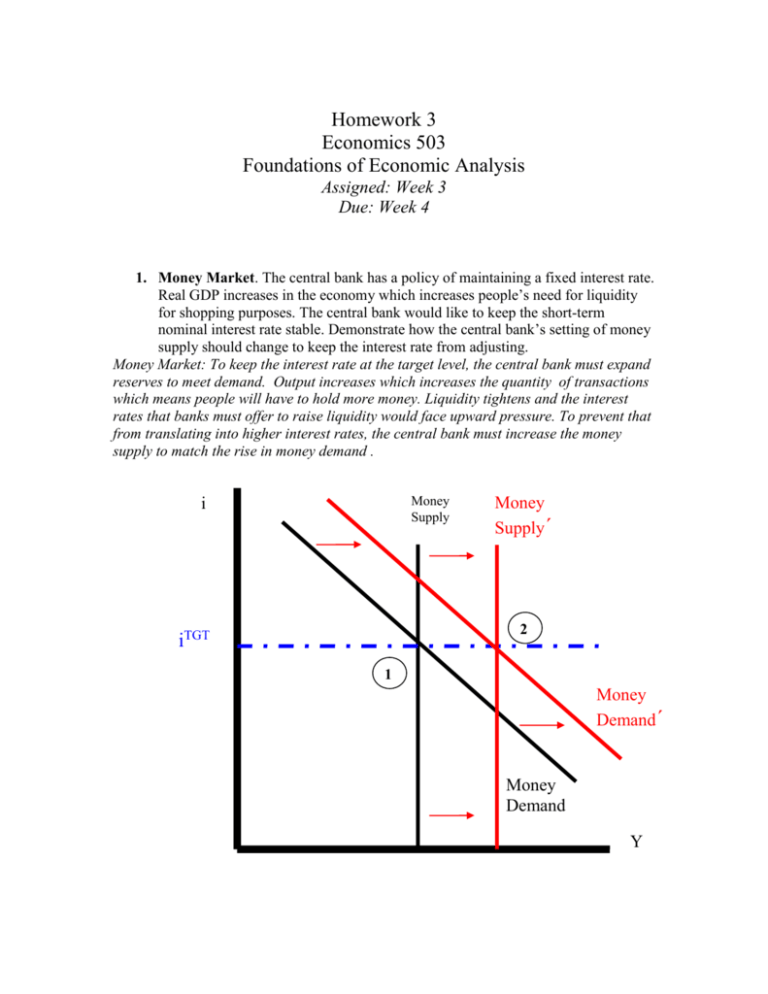

Homework 3 Economics 503 Foundations of Economic Analysis Assigned: Week 3 Due: Week 4 1. Money Market. The central bank has a policy of maintaining a fixed interest rate. Real GDP increases in the economy which increases people’s need for liquidity for shopping purposes. The central bank would like to keep the short-term nominal interest rate stable. Demonstrate how the central bank’s setting of money supply should change to keep the interest rate from adjusting. Money Market: To keep the interest rate at the target level, the central bank must expand reserves to meet demand. Output increases which increases the quantity of transactions which means people will have to hold more money. Liquidity tightens and the interest rates that banks must offer to raise liquidity would face upward pressure. To prevent that from translating into higher interest rates, the central bank must increase the money supply to match the rise in money demand . Money Supply i Money Supply´ 2 iTGT 1 Money Demand´ Money Demand Y 2. Loanable Funds Market Some economists argue that the savings behavior is not very responsive to the interest rate. Other economists argue that savings is strongly affected by the interest rate. Use the loanable funds framework for a large, closed economy. Compare the effect of expansionary fiscal policy (i.e. an increase in government deficits) on the interest rate and investment in A) an economy in which the supply of loanable funds (S) was inelastic with respect to the interest rate; with the effect in B) an economy in which the supply of loanable funds is very elastic. Draw a graph of each theory to show under which theory there is a bigger impact on investment and under which theory there is a bigger impact on the interest rate. Expansionary fiscal policy, a cut in taxes or an increase in spending, leads to an increase in the budget deficit. There is a drop in domestic saving. An inward shift in the savings curve leads to excess demand for loanable funds. Market forces push up the real interest rate, leading to a contraction in investment and an increase in savings. When saving is inelastic, savings increases by little and the interest rate must rise sharply so that investment declines by almost the entire size of the increase in the deficit. When the savings is very interest elastic, a small rise in the interest rate would attract a lot of extra savings and the interest rate would not rise sharply nor would investment decline as much. r S r 2 r 1 S I Loanable Funds r rUS$ 2 r S US$ 1 S I Loanable Funds 3. Loanable Funds Market Imagine an open economy described by the following equations: I 100 200 r S 30 500 r KA 50 800 r Investment is the demand for loanable funds; the supply of loanable funds is S+KA. Solve for the equilibrium real interest rate, investment, savings, and the capital account. What would the real interest rate and investment level be if the government cut off international borrowing so KA=0? First solve for the real interest rate at which the supply of loanable funds is equal to the level of investment 100 200 r* I S KA 30 500 r * 50 800 r* 20 1300 r * 120 .08 1500 I* 100 200 (.08) 84, S 30 500 (.08) 70, KA 14 What if net capital flows are set equal to zero, then we see that 100 200 r* I S 30 500 r * 120 1500 r* r* 70 .10 700 I* 100 200 (.10) 80 S Zero capital flows means higher interest rates and less investment (but more savings)! 70 700 r* r* 4. Foreign Exchange Market. Diamonds are discovered in Australia. Foreigners want to buy these diamonds and need Australian dollars to do so. Assume that this discovery has no particular effect on Australian demand for foreign goods or assets. Draw two graphs of the Forex market: 1) Demonstrate the effect on the Australian dollar exchange rate if Australian monetary policy remains unchanged so the exchange rate is allowed to fluctuate; 2) Demonstrate the effect on the market if the Reserve Bank of Australia conducts monetary policy to keep the exchange rate from changing. YP S Supply Supply′ 1 S* S** 2 Demand YP S Q Supply Supply′ 1 3 S* S** Demand′′ 2 Supply′′ Demand Q Foreigners need Aussie dollars to buy Aussie diamonds. They will supply more US dollars to the Oz Forex market, pushing down the price of US dollars in that market. If the Reserve Bank of Australia cuts the interest rate, then Australians will switch to US$ increasing demand for US$ and US investors will keep their funds at home reducing the supply of US dollars in OZ Forex market.