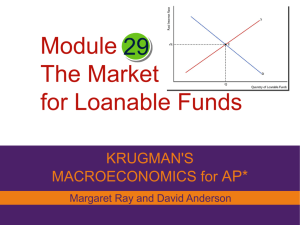

Module 29 – Loanable funds market / market for loanable funds

advertisement

Module 29 – Loanable funds market / market for loanable funds 1. Objectives: a. How the loanable funds market matches savers and investors b. How supply and demand influence the loanable funds market c. How it can be reconciled with the liquidity preference model 2. Compare graphs for liquidity model and loanable funds model a. Liquidity = demand downward sloping, supply vertical b. Loanable funds = demand downward, supply upward c. For BOTH, interest rate is at the vertex of the 2 lines 3. Why a second model? a. Fed can put more money in the economy, but can’t control whether it is made available for loans by the banks, or whether it is deposited by investors. Those decisions are based on the interest rate, thus this model. 4. Definitions/Formulas: a. Savings-investment identity in closed economy. S=1 b. National savings = private savings + public savings = 1 c. National savings + capital inflow (from foreign sector) = 1 d. This model is used to explain the interaction between these savers and borrowers and determine interest rate. 5. Equilibrium interest rate, using this model a. Assume just 1 market that brings together those who want to lend and those who want to borrow b. This = The loanable funds market c. Price determined by this market is the real interest rate (r) – not the nominal. i. Nominal = stated interest rate ii. Real = nominal minus inflation iii. HOWEVER in short term, assume no inflation, so real = nominal iv. When graphing these interest models, label the y axis “real interest rate” or “r” 1. Label x as “quantity of loanable funds” or Q d. Demand downward sloping i. Firms borrow to pay for capital investments ii. If project has expected rate of return > real interest, funds will be demanded iii. Rate of return (%) = 100 * (revenue from project – cost of project) / (cost of project) iv. As real rate falls, more projects are profitable, so quantity of loanable funds will increase e. Supply upward sloping i. Savers lend to borrowers, but in doing so forgo consumption of that $ themselves. ii. Interest is compensation for that 6. iii. As interest rate rises, opportunity to earn more income rises, so more money is deposited/invested iv. S rises when interest rates rise f. Shifts in demand i. Changes in perceived business opportunities / return on investment ii. Changes in government’s borrowing 1. Government deficits are source of demand 2. Treasury borrows funds, acquires debt, increases demand 3. Government surplus reduces demand 4. What happens to interest rates when govt runs a deficit? Increases g. Shifts in supply i. Changes in private savings behavior 1. More consumption (less savings) reduces supply ii. Changes in capital inflows 1. Increase in foreign investment in your markets = increases supply h. Inflation i. Remember real = nominal – inflation ii. For borrowers, true cost is the real; For lenders, true payoff is the real iii. Fisher effect expected real interest rate is unaffected by the change in expected future inflation (pic on 283) 1. Increase in inflation increases nominal rate; each 1% of inflation increases interest by 1% 2. Both lenders and borrowers base their decisions on the expected real interest rate 3. Affects borrowers and lenders equally supply and demand both change equally. Crises are different. 4. Example: if interest rate is 5% currently, and inflation is expected to be 5% next year, supply will increase AND demand will increase proportionately. Q point shifts UP vertically. New interest rate 10%. Reconciling the 2 models (skip this?) a. Liquidity preference model short term rate are determined at intersection of money demand and money supply b. Loanable funds model interest rates match quantity of loanable funds supplied and demanded c. Short run (look at figure 29.7) in the text, page 284 i. Under liquidity model, decrease in interest rate rise in investment spending rise in GDP and consumer spending ii. Rise in GDP rise in spending rise in savings (part of your disposable income is saved) iii. How much do they rise? Savings-investment spending identity says “total savings = investment spending” 1. So the increase in GDP and rise in spending generates exactly enough to match the quantity of savings demanded to make this possible. d. Long run (page 284) i. Short run increase in money supply leads to decrease in interest rate ii. Decrease in money supply leads to rise in interest rate iii. In long run though changes in money supply do not impact interest rates 1. Both markets (money market and loanable funds market) are in equilibrium (figure 29.8)