10 2015-10 Market Linkages

advertisement

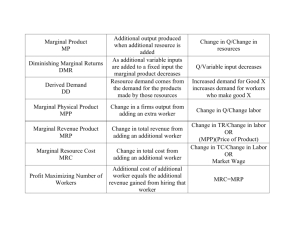

Market Linkages: Sellers as Buyers of Land, Labor and Capital The firm is the kingpin of industry but it is the network of other firms and workers who enable management to generate a return in the overall economy. The ways in which sellers link to their resource markets determines the feasibility of marketing decisions for the final product as inappropriate purchasing can drive up costs and determine the overall final selling price. The optimality rule is that the marginal revenue product of what is sold must equal the marginal resource cost in each sub market. There are three models that have been developed to examine the nature of this relationship : 1. Demand Enhancement where sellers to the firm have market power derived from technology or cultural factors by either forced compliance or market promotion. 2. Inclusive Closed Relationships set up usually by social legislation but always by the nature of the industry and only if transactions costs are reduced. 3. Bilateral Monopsony / Monopoly in which single buyers buy from single sellers. Optimality • • • Marginal Resource Cost is the addition to budgeted resource costs caused by producing the last item of output. Marginal Revenue Product is the product of the Price and the Marginal Physical Product (the physical technologically determined amount of output generated by the production of the last unit of output). Market Flexibility is the gap between what is purchased and what is offered. Marginal Resource Cost Price of Input What the firm wants to buy Supply What suppliers want to sell to the firm Wage/ Rent MRP What the firm earns in the market Market Flexibility Quantity Purchased by firms Quantity Offered by Suppliers Quantity of Input Restrictions • • • • Firms buy labor at a wage rate or land and capital at a rental price which is calibrated in terms of dollars per period of time. There is usually a market flexibility gap between what is offered and what is purchased in recognition of the technologically determined fact that labor alone cannot produce the output without someplace to work (land) ,certain tools to work with (capital), as well as something to work on (basic materials). If there is a restriction on the amount of labor that is supplied, on the amount of capital available, the amount of land, or the amount of raw materials then the firm will be unable to operate at all if one or more factors are eliminated but also if the restrictions eliminate the market flexibility gap. Restrictions can come in the form of: – – – – – – Cultural usages.. i.e. holidays, forbidden products, social structures Technological issues…i.e. anti-dated or decrepit equipment Environmental factors… i.e. tsunamis. floods, earthquakes, monsoons Legal factors ..trade embargoes , union legislation Discrimination.. i.e. price and practice discrimination Natural factors …i.e. not enough supply or running out of time. Optimality with Restrictions • Under restriction at wage rate A suppliers want to supply D and firms want to purchase C but only B is available which is the wage rate that firms are unwilling to pay for that amount of input, preferring to pay wage rate E instead. Firms believe that they are “overpaying” for the input and will take away from other input market flexibilities in order to “stay in business”. If the Marginal Resource Cost can be pushed to the right then the equilibrium can be re-established. For a fixed technology this is accomplished through transactions cost reduction. Marginal Resource Cost 2 What the firm wants to buy Restriction Marginal Resource Cost 1 What the firm wants to buy Price of Input B A C D Supply What suppliers want to sell to the firm Wage/ Rent E MRP What the firm earns in the market Market Flexibility Quantity Demanded by firms Quantity Offered by Suppliers Quantity of Input Demand Enhancement Forced Compliance • When the supplier has market power and pushes the transactions costs up such that the market flexibility gap is diminished (B:C) but the wage/rent is reduced to A . If the revenue generated at A:B is greater than the equilibrium revenue the supplier will control the market through forced compliance. Marginal Resource Cost 1 What the firm wants to buy Marginal Resource Cost 2 What the firm wants to buy Price of Input Supply 1 What suppliers want to sell to the firm Wage/ Rent B A C Supply 2 What suppliers want to sell to the firm MRP What the firm earns in the market Market Flexibility Quantity Purchased by firms Quantity Offered by Suppliers Quantity of Input Demand Enhancement Market Promotion • If the supplier can pass through the firm to the ultimate customer , the supplier can promote the consumption of the final product and thereby move the Marginal Revenue Curve upwards to the point of removing the marginal flexibility gap in the input market at the expense of other input markets. Marginal Resource Cost What the firm wants to buy Supply What suppliers want to sell to the firm Wage/ Rent MRP 2 What the firm earns in the market MRP 1 What the firm earns in the market Market Flexibility Quantity Purchased by firms Quantity Offered by Suppliers Quantity of Input Inclusive Closed Relationships • If the transactions costs of an industry can be reduced by ownership of a supplier and or control of a factor market, the market flexibility gap in one industry A can be used to cross subsidize the activity in another industry A’ by means of Forced Compliance or Market Promotion. Firm Firm A Supplier A 1 2 Supplier 2 A’ Forced Compliance in the Supplier Market 1 A’ Market Promotion in the Supplier Market Bilateral Monopsony / Monopoly • The Monopsony/Monopoly case is indeterminate because the monopolist wants to maximize profit A:F:G:C while the supplier want to maximize revenue B:H:E:O Average Cost Target for Monopolist Price Average Cost Target for Monopsonist Promoted as : The Input Supply Curve F A B H G Marginal Revenue C Demand O Quantity Target for Monopolist D E Quantity Target for Monopsonist Quantity Non Economic Actions • • • • • • In all cases of market transmission of interactions the firm may be a leader or a follower dependent upon market structure. The more competitive an industry the more likely is the firm to be a follower. The less competitive the more likely it is to be a leader and to chose to take its maximum advantage either as profit in the primary market or as revenue in the secondary market. If markets are manipulated through ownership and merger control then there is a deadweight loss to society if the taxation system is avoided or circumvented. If markets are manipulated so that costs are artificially structured then the trade-offs are biased and investment decisions will be skewed so that society in general is worse off as opportunities are missed and entrepreneurship is misguided. Discrimination between markets, people, resources, and ideas is one technique that has been used to manipulate cost structures and is a source of deadweight loss. It is effective in many cases only when the target group can be separated completely and there is no possibility of an arbitrager circumventing the discriminatory boundary. Political action is another method of attempting to stabilize markets from time to time. Of all of these approaches only price discrimination based on preferences is legal. Discrimination • Price Discrimination based on preferences for A involves paying price Pa, while for B it involves paying price Pb and for C it involves paying price Pc. The Firm gets revenue Pa (O : Qa) + Pb (Qa : Qb) + Pc (Qb : Qc) and this will be optimal as long as this revenue is greater than the revenue derived by treating all as if they were A , B, or C. A B Price Pa C Pb Pc O Qa Qb Qc Quantity Market Linkages Policy Issues • • • Market transmission can become very complex and as a result government have set about to regulate the nature of markets through securities and exchange regulations, enforcement of standards in input markets that dealing with collective bargaining, safety in handling certain materials, practices in workplaces that support a safe and healthy working environment, social policies that encourage harmony amongst people, land use restrictions through zoning and permit systems. Licenses and accreditations that cover expected performance standards and also govern liabilities. Nevertheless markets can fall under restrictions that generate deadweight losses as well as extreme diseconomies from time to time, in which cases governments have undertaken remedial actions such as public private partnerships, establishing public corporations, undertaking public works projects, and running deficits in the process. The target of policy in this area is to attempt to channel as much market interaction as possible through the pricing system , which if public and freely known can generate a fair and equitable society in which freely operating citizens can maximize their own utilities by pursuing their self interest regardless of any calamities that might come along.