Mortgage Crisis - Casualty Actuarial Society

advertisement

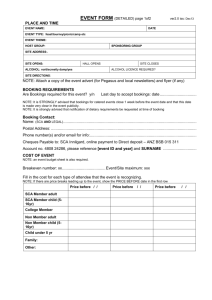

TRENDS AND ISSUES IN THE D&O AND E&O MARKETPLACE Michael F McManus, FCAS, MAAA Senior VP and Actuary Chubb Group of Insurance Companies Casualty Loss Reserve Seminar September 19, 2008 DISCLAIMER The views, information and content expressed herein are those of the author and do not necessarily represent the views of any of the insurers of the Chubb Group of Insurance Companies. Chubb did not participate in and takes no position on the nature, quality or accuracy of such content. INDUSTRY D&O RESULTS Tracking of industry results for D&O and E&O is generally difficult because results are included in the Other Liability-Claims Made section of Schedule P. Data on federal securities class actions (SCA’s) however is readily available and widely followed by the industry as key indicator of profitability. SCA’s account for most of Public D&O loss costs. Source: NERA 2008 Mid-Year Update SCA FREQUENCY 1996-2008 1997-2004 averaged 230 “standard” SCA’s, then significant declines in 2005 (188) and 2006 (131) but increases in 2007 (195) and 2008 (278 projected). Systemic events caused spikes in 2001 (IPO laddering – 300) and 2002 (analyst claims - 47). Increase in 2007 and especially 2008 is due to subprime and auction rate securities cases. Options backdating was a systemic event in 2006 (24 SCA’s) but was primarily a derivative claim issue (about 200 cases). Source: NERA 2008 Mid-Year Update SCA FREQUENCY 2002-2008 Looking at recent data in six month intervals shows dramatic decline began in 2H/05 and continued through 1H/07. Increase in 2H/07 and 1H/08 primarily due to credit crisis cases. Cornerstone study found that these SCA patterns are largely explained by the level of stock market volatility in each period. Source: NERA 2008 Mid-Year Update AVERAGE SCA SEVERITY Average settlement data by calendar year is quite volatile because of small # of very large cases > $1 billion (Enron, Worldcom, Nortel, AOL) When these mega cases are removed, averages are much more stable and show reasonably steady upward trend. These numbers exclude defense costs, which can be very significant. Source: NERA 2008 Mid-Year Update MEDIAN SCA SEVERITY Because of impact of large cases, median is more useful indicator of general severity trends. Source: NERA 2008 Mid-Year Update DRIVERS OF SETTLEMENT VALUES NERA has found that investor losses due to decline in share price are single most powerful determinant of settlements. However ratio of settlements to investor losses decreases steadily as investor losses rise. Source: NERA 2008 Mid-Year Update OTHER KEY DRIVERS OF SEVERITY Defendant company’s market capitalization Institutional investors serving as lead plaintiff Allegations of accounting impropriety Involvement of professional firms as codefendants, especially accountants. Source: NERA 2008 Mid-Year Update WHERE ARE FUTURE SETTLEMENTS HEADING? Median investor losses for cases settled in 2005-2008 averaged $350M. For cases filed in 2005-2008, however, there is a sharp increase in median investor losses, especially in 2008 ($800M) and especially 2008 subprime cases ($4.3B). Source: NERA 2008 Mid-Year Update Source: NERA 2008 Mid-Year Update TRENDS AND ISSUES IN THE D&O AND E&O MARKETPLACE Michael F McManus, FCAS, MAAA Senior VP and Actuary Chubb Group of Insurance Companies Casualty Loss Reserve Seminar September 19, 2008 Credit & Liquidity Crisis: D&O Reserving – A Reinsurance Perspective Agenda Introduction Liquidity Crisis Credit Crisis Mortgage Crisis Securities Class Action Law Suits Sector / Industry Loss Reserving Introduction Introduction 139 securities class action law suits (H1 2008) Bank failures (Bear Stearns, Indy Mac, etc) Mortgage lender failures (Countrywide Financial, etc) Federal assistance for Fannie Mae and Freddie Mac Expectation of future failures of financial institutions Anticipated total cost of $1.0 – $1.5 trillion Introduction Reinsurers set a plan loss ratio for the following year Represents a loss pick until claim data is gathered from primary companies Availability and quality of data varies Remains D&O loss pick even after market conditions have reversed Liquidity Crisis Liquidity Crisis When an entity experiences a shortage of cash To pay for day-to-day business operations (e.g., Payroll) To meet debt obligations on time To expand inventory and production Does not necessarily mean that the business is insolvent Liquidity Crisis Comparison to credit crisis A sound business can experience a liquidity crisis by temporary inaccessibility to required financing A credit crunch is based on insolvency of entities Due to steep decline of previously over-priced assets (mortgage-backed securities, CDO, etc) Credit Crisis Credit Crisis Widening of credit spreads Increase in credit default rates Weak corporate financials Unstable capital bases leading to… A material reduction in available credit and / or A significant increase in cost of credit Credit Crisis Crisis of insolvency Anticipated decline in value of collateral Increased perception of risk Change in monetary conditions Credit Crisis End of “housing bubble” (August 2005) U.S. Home Construction Index falls 40% in 12 months (August 2006) First national house price decline since 1991 (March 2007) Subprime industry begins to collapse (March 2007) Bear Stearns Hedge Funds collapse (July 2007) Countrywide Bank run (August 2007) Global Credit Crisis revealed as many banks declare holding mortgage backed securities (August 2007) Northern Rock Bank (U.K.) run (September 2007) Credit Crisis Federal Reserve makes $41 billion available to U.S. banks Federal reserve injects $43 billion into the money supply and more later European central Bank adds €156 billion and more later Bank of Japan injects ¥1 trillion Bear Stearns is acquired by JP Morgan for $2 per share with a $30 billion backing from Federal Reserve Fannie Mae and Freddie Mac rescue (cost: over $25 billion) Mortgage Crisis Mortgage Crisis Bank Failures in 2008 IndyMac Bancorp – 7/11 (Assets: $32 billion, Deposits: $19 billion) 3rd largest bank failure in the U.S. after Continental Illinois National Bank and Trust, Chicago (1984) and First Republic Bank, Dallas (1988) First Integrity Bank – 5/30 (Assets: $55 million, Deposits: $50 million) ANB Financial – 5/9 (Assets: $2.1 billion, Deposits: $1.8 billion) Hume Bank – 3/7 (Assets: $19 million, Deposits: $14 million) Douglas National Bank – 1/25 (Assets: $59 million, Deposits: $54 million) According to FDIC, there have been 32 bank failures in the U.S. since 2000 IndyMac is bigger than all the other 31 banks put together Mortgage Crisis The cost to economy Recession Lack of financing for solvent companies and individuals with good credit 85,000 job losses so far in the financial industry Unemployment could reach 6.5 – 7.0% The cost to financial institutions Lack of confidence Bear Stearns acquired. Who is next? Lack of capital for growth Mortgage Crisis Key Drivers Housing market Unemployment Interest rates Mortgage Crisis Other concerns Mortgage equity loans Student loans Credit cards Corporate real estate Mortgage Crisis Exacerbation of the credit cycle Major corporate failures High unemployment (6.5 – 7.0%) Stagflation (inflation and economic stagnation) Recession Mortgage Crisis BORROWER MORTGAGE LENDER CDO Mezzanine BANK HIGH RISK INVESTOR Senior Tranche LOW RISK INVESTOR Equity Tranche SPE MBS Commercial Paper SIV Mortgage Crisis – Perfect Storm Liquidity crisis Credit crisis Mortgage crisis It may not be over! Securities Class Action Law Suits Securities Class Action Law Suits Projected number of securities class action law suits in 2008: 278 all filings 139 filed law suits as of July 2008 is mainly driven by the mortgage crisis Clearly correlated with stock market volatility Severity of these claims could be high because investor losses have been very high The effect of recent legal trends yet to be quantified Resources: Cornerstone Research and NERA Sector / Industry Sector / Industry Financial Institutions materially affected during the current crisis Other sectors show competitive pricing, enough limits and favorable terms Credit and liquidity crisis affect all sectors Seems to be ample capacity keeping rates low Sector / Industry Easier to file law suits based on one or two major themes (mortgage crisis and related investor losses) Next crisis: Energy sector (when price of oil / gas drops) Manufacturing or retail (?) Other There will always be a cause and a crisis Loss Reserving – A Reinsurance Perspective Loss Reserving: A Reinsurance Perspective Plan loss ratio Loss reserve pick Plan loss ratio based on recent loss experience Adjusted for Trend Rate changes Limits / attachment points Loss Reserving: A Reinsurance Perspective If 2004, 2005 and 2006 loss experience is used to indicate plan loss ratio for 2008 If 2000, 2001 and 2002 loss OR experience is used to indicate plan loss ratio for 2004 The analyst would have indicated materially inaccurate plan loss ratios Loss Reserving: A Reinsurance Perspective Key Reason Systemic issues that are not captured by traditional actuarial methods Contagion (correlation) is not considered in the plan loss ratio pick Loss Reserving: A Reinsurance Perspective Considerations Equity market movement and volatility Debt market movement (widening of credit spreads) Change in legal environment Paradigm shifts in the market/economy Effect of correlation Disaster loss scenarios (1:100 or 1:200) Loss Reserving: The Big Picture Plan loss ratio pick should include economic, financial and political considerations based on broad and intuitive understanding of market conditions Q&A Athula Alwis, Senior Vice President, Global Credit Practice September 19, 2008 TRENDS AND ISSUES IN THE D&O AND E&O MARKETPLACE Michael F McManus Senior VP and Actuary Chubb Group of Insurance Companies Casualty Loss Reserve Seminar September 19, 2008 DISCLAIMER The views, information and content expressed herein are those of the author and do not necessarily represent the views of any of the insurers of the Chubb Group of Insurance Companies. Chubb did not participate in and takes no position on the nature, quality or accuracy of such content. D&O/E&O RESERVING CHALLENGES Traditional reserving models assume that recent loss history (adjusted to current conditions) is the best predictor of future losses. D&O and E&O business can be subject to systemic events that can cause unexpected spike in a current accident year loss ratio. Need to build reserving models that provide early insight into recent accident years results POLICY LIMIT TO LOSS MODEL Public D&O loss experience is driven by security class action (SCA) claims Look for relationship between historical ultimate losses and policy limits exposed by segment (primary, excess and side A). Need to include loading for non-SCA claims. INDIVIDUAL SCA CLAIM MODEL Ultimate SCA settlements are clearly impacted by the size of market cap losses (NERA/Cornerstone) Cornerstone compared median settlements to market cap loss and found consistent decline in this relationship MEDIAN SETTLEMENT AS A PERCENTAGE OF DISCLOSURE DOLLAR LOSSES (DDL) BY DDL RANGE Dollars in Millions 60 54.8 50 Through 2006 2007 40.5 40 30 20 10 10.1 8.9 8.6 12.9 5.1 3.8 3.4 3.3 005$ - 152$ 2.1 4.1 0 Total sample N=774 N= 109 52$ < 001$ - 52$ 052$-101$ N=215 N=21 N=212 N=26 N=140 N=25 Source: Cornerstone 2007 Review N=76 N=16 005$> N=131 N=21 INDIVIDUAL SCA SEVERITY MODEL Try to build regression model to estimate SCA severity, including factors such as: Plaintiff’s estimated damages. Whether financials were restated. Is there a corresponding SEC action? Whether accountants and/or underwriters are named as co-defendants. Existence of corresponding derivative action. Whether lead plaintiff is a public pension plan. Whether securities other than common stock are alleged to be damaged INDIVIDUAL SCA CLAIM MODEL If you can develop an estimate of ground up settlement potential, need to also estimate probability of dismissal and load defense costs for initial motion to dismiss for all cases. If case is not dismissed, then add defense costs to get through subsequent phases. Compare ground up settlement (if any) and defense costs estimate to your limit/attachment point to estimate your exposure. Include significant discount if your policy is side A only. CONCLUSION Regardless of how you model this business, it will take many years to see how accurate your model is, as this is truly a volatile, long tail line of business. TRENDS AND ISSUES IN THE D&O AND E&O MARKETPLACE Michael F McManus Senior VP and Actuary Chubb Group of Insurance Companies Casualty Loss Reserve Seminar September 19, 2008