total amount paid for the home

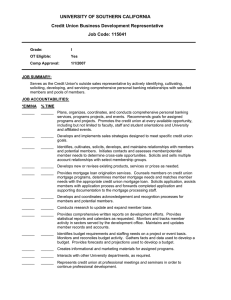

advertisement

Let’s Go Buy a

House…

Project By: Kaylah Birmingham

House Information

• Built in 1926

• Lot size: 6,969 square feet

• 66 Edgemont Road, Scarsdale,

New York 10583

• 4 Bedrooms

• 4 Bathrooms

• Single- Family Home

• Beech-Hill Neighborhood

• West-Chester County

• $649,000

http://www.trulia.com/property/3118

746592-66-Edgemont-Rd-ScarsdaleNY-10583#photo-7

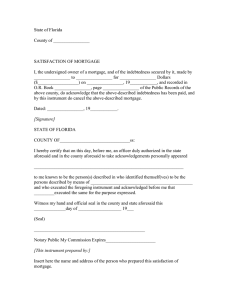

Down Payment:

$649,000 x %20 = $129,800

The down payment will be $129,800

Financed:

$649,000 - $129,800 = $519,200

The amount financed will be $519,200

I am getting the money for the down payment all from my parents, such giving,

charitable people really.

Monthly Payment

$519,200= p { [1 - ( 1 + .03625/12 )^-360 ] / [.03625/12]} =

$2,367.82

The total monthly payment will be $2,367.82

Total Interest

$2,367.82 x 360 = $852,415.2 - $519,200=

$333,215.20

The total interest will be $333,215.20

Total Cost

$129,800 + $519,200 + $333,215.20 =

$982,215.20

The total cost will be $982,215.20

Monthly Payment

$519,200= p { [1 - ( 1 + .035/12 )^-240 ] / [.035/12]} =

$3,011.15

The total monthly payment will be $3,011.15

Total Interest

$3,011.15 x 240 = $722,676.21 - $519,200=

$203,476.21

The total interest will be $203,476.21

Total Cost

$129,800 + $519,200 + $203,476.21 =

$852,476.21

The total cost will be $852,476.21

Monthly Payment

$519,200= p { [1 - ( 1 + .02750/12 )^-180 ] / [.02750/12]} =

$3,523.40

The total monthly payment will be $3,523.40

Total Interest

$3,523.40 x 180 = $634,212.65 - $519,200=

$115,012.65

The total interest will be $115,012.65

Total Cost

$129,800 + $519,200 + $115,012.65 =

$764,012.65

The total cost will be $764,012.65

• Compare the three mortgage structures. In terms of its monthly

payment, which mortgage structure would be the least expensive?

• In terms of monthly payment, structure one would be the least expensive.

• Compare the three mortgage structures. In terms of the amount paid

in interest, which mortgage structure would be the least expensive?

• In terms of the amount paid in interest, structure three would be the least

expensive.

• Compare the three mortgage structures. In terms of total amount paid

for the home, which mortgage structure would be the least expensive?

• In terms of the total amount paid for the home, mortgage structure three

would be the least expensive

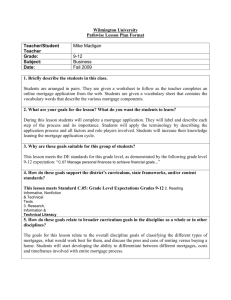

• Career: Journalist for the New York Times

• Income: $109,245

• No husband, no kids (too expensive)

NY State Taxes

Federal State Taxes

Salary Per Year

$109,245

Divide by 12 (monthly)

$9,103.75

Federal

-$2,549.05

Social Security

-$564.43

Medicare

-$132

State

-$564.85

Earned Income Tax

-$91.03

Emergency Services Tax

-$4.33

Unemployment

-$5.46

Take Home

$5,192.60

Take Home

$5,192.60

College Loans

-$250

Car Payment

Paid off

Cell Phone

-$80

Internet

-$100

Cable

^bundle^

Electric

-$150

Car Insurance

-$1,000

Homeowners Insurance

-$400

Food

-$80

Money Before House Payments

$3,132.60

• Before taking out my house payments, and with budget

considerations, I can save $3,132.60.

• The only reasonable structure plan then, it Structure One, for 30

years.

• Structure One takes $2,367.82 our per month.

• Subtracting that from $3,132.60, and I will be able to save a

total of $764.78 per month.

• By using structure three, I will have to pay off the house for $30

years though, so I’ll be 60. Wow.