File monetary policy1

advertisement

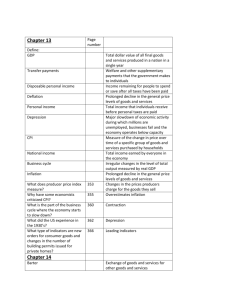

Money and Monetary Policy 1 FUNCTIONS OF MONEY • Medium of Exchange Buying goods and services •Unit of Account Prices are quoted in dollars and cents • Store of Value Money allows us to transfer purchasing power from present to future. It is the most liquid (spendable) of all assets, a convenient way to store wealth. MONEY SUPPLY is the total quantity of money in the economy at any given time. MONEY SUPPLY Definition… Currency •Token Money •Federal Reserve Notes •Intrinsic Value-The market value of the •constituent metal within a coin Checkable Deposits •Commercial Banks •Thrift Institutions MONEY SUPPLY = Plus... Near-monies * can be converted to currency (ex C. D.) Savings Deposits • Money Market Deposit Accounts (MMDAs) • Interest bearing account through which banks and thrifts pool individual deposits to buy interest bearing short term securities Smaller Time Deposits * smaller time deposits become available at their maturity * ex: mutual funds( higher interest than MMDA’s) Money Market Mutual Funds (MMMFs) *use combined funds of individual share- holders to buy interest bearing short term credit instruments like CD’s and government securities MONEY SUPPLY = Plus... Large Time Deposits • deposits of 100,000 dollars or more • Usually owned by business as CD’s MONEY SUPPLY Currency (coins & paper money) plus Checkable deposits equals M1 M1 M2 M3 $1101 2000 Data (billions of dollars) MONEY SUPPLY Currency (coins & paper money) plus Checkable deposits M1 M2 M3 equals M1 plus Savings deposits, including MMDA’s plus Small time deposits plus Money market mutual fund (MMMF) balances equals M2 $1101 $4827 2000 Data (billions of dollars) MONEY SUPPLY M1 M2 M3 Currency (coins & paper money) plus Checkable deposits equals M1 plus Savings deposits, including MMDA’s plus Small time deposits plus Money market mutual fund (MMMF) balances $1101 equals M2 plus Large time deposits equals M3 $4827 2000 Data (billions of dollars) $6853 WHAT ABOUT CREDIT CARDS? *This is a way of obtaining a short term loan - thereby reducing the cash and checkable deposits you must keep available WHAT BACKS THE MONEY SUPPLY? Money as Debt *Debt – Money is a debt of the FED, checkable deposits are debts of the banks it is purely backed by the governments ability to keep the value of money stable Value of Money • Acceptability • Legal Tender-must be accepted as legal tender • Relative Scarcity- value depends on demand Money and Prices • Value of the Dollar- inverse with price level • D = 1/Price Level (in hundredths) Inflation and Acceptability WHAT BACKS THE MONEY SUPPLY? So, What Backs the Money Supply? Stable Value! through... • Appropriate Fiscal Policy • Intelligent Management of the Money Supply (monetary policy) Section 1: The Federal Reserve System A. How did the panic of 1907 affect U.S. banking? 1. no way to expand the amount of money in circulation; because there was a fixed amount of loanable money, people withdrew their savings causing “runs” on banks 2. pyramid reserves – small banks deposit reserves in larger banks 3. to keep these two situations from recurring, Congress passed the Federal Reserve Act in 1913; created a central bank known as the Federal Reserve or the Fed B. Role of the Fed 1. supervises member banks 2. holds cash reserves 3. moves money in and out of circulation C. Organization of the Fed 1. National level a. Board of Governors 1.) seven members; appointed by the President, confirmed by the Senate 2.) 14 year term; staggered every two years 3.) Why do they serve so long? a.) free them from political influence b.) to limit the influence of any one governor b. Federal Open Market Committee (FOMC) 1.) comprised of the Board of Governors, president of the Federal Reserve of New York + four other Fed bank presidents who rotate for one year terms 2. District level a. 12 Federal Reserve district banks b. 25 branch banks 3. Local level Chairman of the Fed, Janet Yellen a. member banks th-G-Chicago (1) 7 1st-A-Boston (0) 2nd-B-New York (1) 8th-H-St. Louis (3) 3rd-C-Philadelphia (0) 9th-I-Minneapolis (1) th-J-Kansas City (3) th 10 4 -D-Cleveland (2) 5th-E-Richmond (2) 11th-K-Dallas (3) th-L-San Francisco (4) th 12 6 -F-Atlanta (5) Section 2: The Federal Reserve at Work A. Services to banks 1. clearing checks 2. loans to banks B. Services to the Government 1. serving as the government’s bank 2. supervising the Fed’s member banks 3. regulating the national money supply – the amount of money in circulation C. Money Supply 1. M1 = traveler’s checks, currency, demand deposits, other checking accounts 2. M2 = M1 + money market funds, savings deposits, small time deposits 3. M3 = M2 + large time deposits, repurchase agreements, and Eurodollars Section 3: Monetary Policy Strategies A. Monetary Policy and Aggregate Demand 1. monetary policy – the plan to expand or contract the money supply a. easy-money policy – designed to expand the money supply, increase aggregate demand, create jobs b. tight-money policy – slows business activity and helps stabilize prices B. Components of monetary policy 1. open-market operations – buying and selling of government securities (FOMC) 2. discount rate – the interest rate the Fed charges member banks to the use of its reserves – which in turn affects the prime rate 3. reserve requirement – the money that must be held by banks 4. margin requirement - the percentage of cash an investor must have to buy stocks, options, and other investments 5. credit regulation – length, down payment, only in times of national emergency 6. moral suasion – unofficial pressures that Fed policy makers can exert on the banking system C. Policy Limitations 1. economic forecasting 2. time lags in developing and carrying out monetary policy 3. priorities and trade-offs 4. lack of coordination among government agencies 5. conflicting opinions Money and Monetary Policy 24 How the Government Stabilizes the Economy 25 How the FED Stabilizes the Economy These are the three Shifters of Money Supply 26 3 Shifters of Money Supply The FED adjusting the money supply by changing any one of the following: 1. Setting Reserve Requirements (Ratios) 2. Lending Money to Banks & Thrifts •Discount Rate 3. Open Market Operations •Buying and selling Bonds The FED is now chaired by Janet Yellen. 27 #1. The Reserve Requirement If you have a bank account, where is your money? Only a small percent of your money is in the safe. The rest of your money has been loaned out. This is called “Fractional Reserve Banking” The FED sets the amount that banks must hold The reserve requirement (reserve ratio) is the percent of deposits that banks must hold in reserve (the percent they can NOT loan out) • When the FED increases the money supply it increases the amount of money held in bank deposits. • As banks keeps some of the money in reserve and loans out their excess reserves • The loan eventually becomes deposits for another bank that will loan out their excess reserves. 28 The Money Multiplier Example: Assume the reserve ratio in the US is 10% You deposit $1000 in the bank The bank must hold $100 (required reserves) The bank lends $900 out to Bob (excess reserves) Bob deposits the $900 in his bank Bob’s bank must hold $90. It loans out $810 to Jill Jill deposits $810 in her bank SO FAR, the initial deposit of $1000 caused the CREATION of another $1710 (Bob’s $900 + Jill’s $810) Money Multiplier 1 = Reserve Requirement (ratio) Example: • If the reserve ratio is .20 and the money supply increases 2 Billion dollars. How much the money supply increase? 29 Using Reserve Requirement 1. If there is a recession, what should the FED do to the reserve requirement? (Explain the steps.) Decrease the Reserve Ratio 1. 2. 3. Banks hold less money and have more excess reserves Banks create more money by loaning out excess Money supply increases, interest rates fall, AD goes up 2. If there is inflation, what should the FED do to the reserve requirement? (Explain the steps.) Increase the Reserve Ratio 1. Banks hold more money and have less excess reserves 2. Banks create less money 3. Money supply decreases, interest rates up, AD down 30 #2. The Discount Rate The Discount Rate is the interest rate that the FED charges commercial banks. Example: • If Banks of America needs $10 million, they borrow it from the U.S. Treasury (which the FED controls) but they must pay it bank with 3% interest. To increase the Money supply, the FED should _________ the Discount Rate (Easy Money Policy). DECREASE To decrease the Money supply, the FED should _________ the Discount Rate (Tight Money Policy). INCREASE 31 #3. Open Market Operations • Open Market Operations is when the FED buys or sells government bonds (securities). • This is the most important and widely used monetary policy To increase the Money supply, the FED should BUY _________ government securities. To decrease the Money supply, the FED should SELL government securities. _________ How are you going to remember? Buy bonds-BIG BUCKSBuying bonds increases money supply Sell Bonds-SMALL BUCKSSelling bonds decreases money supply 32 The Money Market (Supply and Demand for Money) 33 Interest Rates are important • Way to protect our money from the effects of inflation • Opportunity cost for holding money (keeping money in our wallets) is the interest your money would have earned if you put it in the bank. • Interest rates that banks pay you for your deposits are related to the interest rates that banks charge when they loan money out. • When we look at the relationship between the demand for money and interest rate we are looking at shortterm rates 34 The Demand for Money At any given time, people demand a certain amount of liquid assets (money) for everyday purchases The Demand for money shows an inverse relationship between nominal interest rates and the quantity of money demanded 1. What happens to the quantity demanded of money when interest rates increase? Quantity demanded falls because individuals would prefer to have interest earning assets instead 2. What happens to the quantity demanded when interest rates decrease? Quantity demanded increases. There is no incentive to convert cash into interest earning assets 35 The Demand for Money Inverse relationship between interest rates and the quantity of money demanded Nominal Interest Rate (ir) 20% 5% 2% 0 DMoney Quantity of Money (billions of dollars) 36 The Demand for Money What happens if price level increases? Nominal Interest Rate (ir) 20% Money Demand Shifters 1. Changes in price level 2. Changes in income/ Changes in Real GDP 3. Changes in taxation that affects investment 4. Changes in banking technology (ATMs) 5. Changes in banking institutions (interest on checking) 5% 2% 0 DMoney1 DMoney Quantity of Money (billions of dollars) 37 The Supply for Money The U.S. Money Supply is set by the Board of Governors of the Federal Reserve System (FED) Interest Rate (ir) 20% The FED is a nonpartisan government office that sets and adjusts the money supply to adjust the economy 5% This is called Monetary Policy. SMoney 2% DMoney 200 Quantity of Money (billions of dollars) 38 Supply and Demand is important • The equilibrium interest rate is determined by the supply and demand for money 39 Monetary Policy When the FED adjusts the money supply to achieve the macroeconomic goals 40 Increasing the Money Supply Interest Rate (ir) SM SM1 10% 5% If the FED increases the money supply, a temporary surplus of money will occur at 5% interest. The surplus will cause the interest rate to fall to 2% 2% DM 200 Increase money supply 250 How does this affect AD? Quantity of Money (billions of dollars) Decreases interest rate Increases investment Increases AD 41 Decreasing the Money Supply Interest Rate (ir) SM1 SM 10% 5% 2% If the FED decreases the money supply, a temporary shortage of money will occur at 5% interest. The shortage will cause the interest rate to rise to 10% How does this affect AD? D M 150 Decrease money supply 200 Quantity of Money (billions of dollars) Increase interest rate Decrease Decrease AD investment 42 Showing the Effects of Monetary Policy Graphically Three Related Graphs: • Money Market • Investment Demand • AD/AS 43 Interest Rate (i) Interest Rate (i) S&D of Money SM SM1 10% 10% 5% 5% 2% 2% DM 200 PL 250 QuantityM AD/AS PL1 PLe Qe Q1 DI Quantity of Investment The FED increases the money supply to stimulate the economy… AS AD Investment Demand AD1 GDPR 1. Interest Rates Decreases 2. Investment Increases 3. AD, GDP and PL Increases 44 Interest Rate (i) Interest Rate (i) S&D of Money SM1 SM 10% 10% 5% 5% 2% 2% DM 175 PL 200 QuantityM AD/AS PLe Quantity of Investment 1. Interest Rates increase 2. Investment decreases 3. AD, GDP and PL decrease PL1 AD AD1 Qe DI The FED decreases the money supply to slow down the economy… AS Q1 Investment Demand GDPR 45 The role of the Fed is to “take away the punch bowl just as the party gets going” 46 Practice Don’t forget the Monetary Multiplier!!!! 1. If the reserve requirement is .5 and the FED sells $10 million of bonds, what will happen to the money supply? 2. If the reserve requirement is .1 and the FED buys $10 million bonds, what will happen to the money supply? 3. If the FED decreases the reserve requirement from .50 to .20 what will happen to the money multiplier? 47 Federal Funds Rate The federal funds rate is the interest rate that banks charge one another for one-day loans of reserves. The FED can’t simply tell banks what interest rate to use. Banks decide on their own. The FED influences them by setting a target rate and using open market operation to hit the target The federal funds rate fluctuates due to market conditions but it is heavily influenced by monetary policy (buying and selling of bonds) 48 2007 2008 December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January Percent Federal Funds Rate Target Federal Funds Rate 6 5 4 3 2 1 0 .25% 2009 49 50 2007B Practice FRQ (Do a. and b. only) 51 2007B Practice FRQ 52 2007B Practice FRQ 53 2009B Practice FRQ 54 55