Middlesex County Joint Health Insurance Fund Prescription

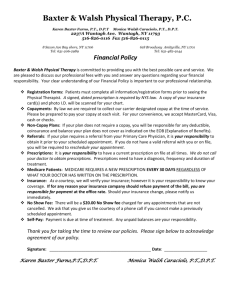

advertisement