Equity in the distribution of income - e

advertisement

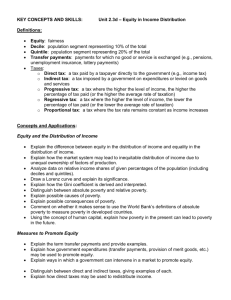

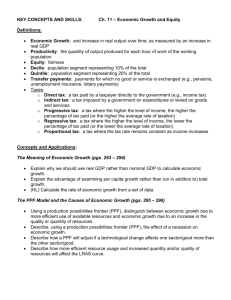

Equity in the distribution of income The meaning of equity in the distribution of income Explain the difference between equity in the distribution of income and equality in the distribution of income. Explain that due to unequal ownership of factors of production, the market system may not result in an equitable distribution of income. Equality in the distribution of income = Equity in the distribution of income = Why does the market system tend to result in an inequitable distribution of income? Poverty Distinguish between absolute poverty and relative poverty. Explain possible causes of poverty. Explain possible consequences of poverty. Absolute poverty = Relative poverty = Provide reasons why people may live in poverty What are the consequences of poverty? Indicators of income equality/inequality Analyse data on relative income shares of given percentages of the population, including deciles and quintiles. Draw a Lorenz curve and explain its significance. Explain how the Gini coefficient is derived and interpreted. Use the data above to draw Lorenz curves for Denmark, the United Kingdom and Brazil in the space provided on the next page. Make sure you label the axes correctly and include the line of absolute equality. Explain what your diagram tells you about income distribution in the three countries. Look back at the data chart – is there any relationship between the type of country, e.g. High Income/Low income, and the level of inequality? Use examples to back up your answer. Draw a diagram to help explain how the Gini co-efficient is obtained. What do the Gini coefficient values signify? The role of taxation in promoting equity Distinguish between direct and indirect taxes, providing examples of each, and explain that direct taxes may be used as a mechanism to redistribute income. Distinguish between progressive, regressive and proportional taxation, providing examples of each. Calculate the marginal rate of tax and the average rate of tax from a set of data. (HL only) Direct taxes = How are direct taxes used as a mechanism to redistribute income? Indirect taxes = Different taxes result in different burdens – explain the following, with examples, and also state the effect on income inequality Proportional taxes = Progressive taxes = Regressive taxes = Other measures to promote equity How can government expenditure be used to improve equity/equality? Make sure you include examples in your answer. Explain the term transfer payments, and provide examples The relationship between equity and efficiency Evaluate government policies to promote equity (taxation, government expenditure and transfer payments) in terms of their potential positive or negative effects on efficiency in the allocation of resources. Calculate the ratio of the richest fifth of households to the poorest fifth of households for: Original income Gross income after benefits are added Disposable income after taxes taken Final income when “benefits in kind” added Draw a sketch graph to show Lorenz curves depicting total original income and final income after government redistributive policies