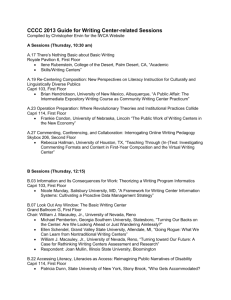

Kein Folientitel

advertisement

CAPRI General: CAPRI • Products:40 •Regions : 18 trade blocks (EU15, EU10, USA, CAN, ANZ, ACP, LDC, ROW, Mediterranean and Mercosur broken down to in single countries) • EU regions broken down in Member States • Policy variables: tariff rate quotas (global), subsidised exports, sales to intervention stocks, Minimum import prices (EU25) CAPRI Training Session Warsaw 2006 2 CAPRI Two Stage Armington CAPRI Demand (Arm1) = Human consumption + Feed Use + Processing Arm i ,r sp1i ,r dpi ,r ,rwImports i ,r Domestic Sales (DSales) dpi ,r ,r DSales i ,r 1 Imports (Arm2) Imports i ,r sp 2i ,r dpi ,r ,r1Streamsi ,r ,r1 r1 Streams(R,R1,XX) CAPRI Training Session Warsaw 2006 .... 1 Streams(R,Rn,XX) 3 CAPRI • • Policy instruments: What kind of tariffs in CAPRI? CAPRI During runs bi-lateral “applied” rates, either specific (fixed duty per quantity, “STARIFF”) or ad-valorem (percentage of import prices, “ATARIFF”) The applied rates fall in one of the following 3 categories: 1. Fixed, defined as the minimum of the bound rate (maximum tariff allowed according to WTO, so-called “Most favorite Nation” or MFN rates) and the applied rate ex-post 2. Fixed to zero, based on preferences (e.g. North-American free trade zone, EU15 EU10, Cotonou, Everything but arms) 3. Endogenous: 1. Under TRQs 2. and/or under Minimum Import Price regimes CAPRI Training Session Warsaw 2006 4 CAPRI Endogenous policy instruments CAPRI • Globally: – Tariffs as functions of import quantities in case of a Tariff Rate Quota (TRQ) • EU specific: – Flexible levies, i.e. tariffs under a minimal import price regime – Subsidized exports under WTO value commitments Intervention purchases and releases from intervention stocks CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 5 Policy instruments impacting directly on import prices CAPRI CAPRI Exogenous Endogenous tariffs MFN rates Allocated TRQs Global TRQs Preferential agreements Minimum import prices Import prices = Market Price x Exchange Rate x (1 + bilateral ad valorem tariff) + bilateral specific tariff - export subsidy Administrative price CAPRI Training Session Warsaw 2006 Function For subsidized exports 6 CAPRI • • Tariff Rate Quota, regimes and rents CAPRI Two tiered tariff: – In quota tariff up to a certain quantity – MFN (Most Favorite Nation) rate for over-quota imports Possible regimes: – TRQ not filled • lower in quota tariff applied marginal willingness to pay equal to border price plus in quota tariff • No rents – Over quota imports • higher over quota tariff applied marginal willingness to play equal to border price plus over quota tariff • Economic rents for imports up to quota: difference between tariffs times quota – Binding quota • In quota tariff applied marginal willingness to pay in between border prices plus in quota tariffs and border price plus over quota tariff • Rent as difference between marginal willingness and border prices plus in quota tariffs times quota CAPRI Training Session Warsaw 2006 CAPRI market model: TRQs 7 CAPRI Tariff Rate Quota, regimes and rents CAPRI Over quota tariff Import price = Border Price + tariff In quota tariff Border Price Imports Quota CAPRI Training Session Warsaw 2006 CAPRI market model: TRQs 8 CAPRI Regime I: underfilled TRQ CAPRI Import demand Over quota tariff Import price = Border Price + tariff In quota tariff Border Price Imports Imports CAPRI Training Session Warsaw 2006 Quota CAPRI market model: TRQs 9 CAPRI Regime III: over quota imports CAPRI Import demand Price paid for imports Economic rent Import price = Border Price + tariff Over quota tariff In quota tariff Border Price Imports Imports=Quota CAPRI Training Session Warsaw 2006 Imports CAPRI market model: Endogenous Policy 10 CAPRI Regime II: binding TRQ CAPRI Import demand Price paid for imports Economic rent Import price = Border Price + tariff Difference between marginal willingness to pay and import price In quota tariff Border Price Imports Imports=Quota CAPRI Training Session Warsaw 2006 CAPRI market model: TRQs 11 CAPRI Why are TRQs important? CAPRI • In countries with high MFN rates as the EU, larger share of imports occur under TRQs – Realistic simulations of effect of changes in border protection only possible if TRQs taken into account: • A change in the in-quota or over-quota (MFN) tariff may not provoke any changes in import quantities or prices • WTO proposes to expand binding TRQs – Preference erosion: • Reducing the MFN tariff reduces rents • In many cases, (L)LDC “own” quotas and thus loose income CAPRI Training Session Warsaw 2006 12 CAPRI What are the problems with TRQs? CAPRI • In many cases, TRQ relate to specific tariff lines which are more dis-aggregated as the model’s product aggregated product is mix of TRQ and tariff only regime • Depending on quota administration, the observed fill rate may not be an indicator for the regime • Quota may be allocated to single countries or even firms, but the information may be not available • “Kinked” functional relationship leads to dis-continous derivatives of the Langrangian not suitable for gradient based solvers => “fudging” function CAPRI Training Session Warsaw 2006 13 CAPRI “Kinked” policy instruments CAPRI • Solution either by “Mixed-Complementary Programming” + Complementary slackness conditions defined explicitly - Require specific solvers • Or by “fudging functions” which smooth out kinks + no switch of solver necessary + no 0/I solution by behavioural functions for policy agent - steep derivatives can render solution difficultly CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 14 A “fudging” function CAPRI CAPRI • Sigmoid function: Sigmoid x exp min x,0 1 exp absx • Symmetric S-shaped form • Overall differentiable Sigmoid(x) • Between 0 (if x = -) and 1 (if x = +), 1 • Sigmoid(0) = 0.5 0.5 + CAPRI Training Session Warsaw 2006 0 + x 15 CAPRI How are TRQs modelled in CAPRI? CAPRI • Two types: – Bi-laterally allocated TRQs: open only for specific trading partners (TRQREG) – TRQs open to everybody who has no bi-lateral TRQ (TRQWOR) • What data are stored: – TRQNT: the quota quantity – TsMFN: specific tariff MFN (over quota tariff) – TaMFN: ad valorem tariff MFN (over quota tariff) – TsPref: preferential specific tariff (in quota tariff) – TaPref: preferential ad valorem tariff (in quota tariff) CAPRI Training Session Warsaw 2006 CAPRI market model: TRQs 16 CAPRI Where can I find the results on TRQs? 1) Who is benefiting from preference? 2) What is the maximal quantity benefiting from the preferences? 4) What is the value of the economic rents? 3) How much is imported total?/with preferences? Preferential rates = in quota tariffs CAPRI Training Session Warsaw 2006 CAPRI 5) What is rent per ton imported under preferences? MFN-rates = Over quota tariffs 17 CAPRI Flexible levy or minimum import prices Import price = Border prices + tariff Minimal import price (mip) Border price = 45 degree line Maximum tariff (max) Applied tariff (flexible levy) Applied tariff at: Import price ip: at=max ip<mip Max>at>0 ip=mip CAPRI Training Session Warsaw 2006 CAPRI Applied tariffs which are adjusted so that a minimum import price is guaranteed. They may be upper bounded by the WTO bound rate. at=0 ip>mip 18 CAPRI Why are flexible levies important CAPRI • In the typical range where the applied rate is above zero, but below the bound rate, the price transmission from border to market is zero: only the tariff is adjusted when the border price changes • A change in the bound rate may not provoke changes in import prices (specific case of “water under the tariffs”) • Used in important EU markets (some coarse grains, sugar, vegetables) • Simply using the bound rate overestimates import prices and effects of trade liberalization CAPRI Training Session Warsaw 2006 19 CAPRI Subsidised exports for EU CAPRI • Instrument to increase competitiveness of EU exports in international markets – Increase import demand for EU products – Stimulates exports – Decreases market pressure in EU markets – Increase EU market prices • So-called market comities decide in regular intervals upon amount of subsidy, but decision criteria defined in CMOs are vague • Quantities and values of subsidized exports are upper bounded since the WTO Uruguay round, so-called commitment CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 20 CAPRI Data on subsidised exports for EU CAPRI • FEOGA budget delivers yearly budget outlays • EU notifies to WTO quantities, budget outlays and commitments CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 21 CAPRI Modelling subsidised exports for EU CAPRI • The model cannot make a distinction between subsidized and non-subsidized exports to a specific destination • In the base period, a mix subsidized and nonsubsidized exports takes place • We don’t possess data to distinguish the subsidy by destination All exports receive the same subsidy • Value limits are integrated in the model, as the observed mix of export with and without subsidies cannot be modeled CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 22 CAPRI Function for subsidised exports PMrki i PADM i ExpsVali FEOE_maxi 1 1 exp i i PADM i EXPSVALi FEOE_maxi CAPRI value of subsidies paid WTO commitment on subsidies paid defines steepness of function percentage of administrative price PADMi at which EXPSVALi is 50% of FEOE_MAXi PMrk PADM PADM EXPSVAL 50% FEOE_MAX CAPRI Training Session Warsaw 2006 FEOE_MAX CAPRI market model: Endogenous Policy 23 CAPRI Modelling subsidised exports for EU CAPRI • Assumption to define parameters of function: – Function depends on EU market prices and administrative ones: the lower the market price relative to the administrative one, the higher the value of the subsidies – Two parameters: • Steepness of response to prices changes • Mid point of function – Function recovers values of subsidized exports for the base year period one degree of freedom left a second point is constructed by assuming that only 5% of commitment is used at 125% of administrative price • Rather rapid response to price changes CAPRI Training Session Warsaw 2006 CAPRI market model: Endogenous Policy 24 CAPRI Where to find results on subsidised exports? Table: FEGOA CAPRI Training Session Warsaw 2006 CAPRI Value of subsidies CAPRI market model: Endogenous Policy 25 CAPRI Intervention purchases CAPRI • Instrument to stabilize market prices: – If certain trigger prices are undercut, public purchases into intervention stocks take place => additional demand, price drops are softened – At higher market prices, stocks will be released, increase supply and dampen price increases • Problems for modeling: – Intervention may react to short-time price fluctuations – Complex legislation defining the trigger prices depending on short time price notations CAPRI Training Session Warsaw 2006 26 CAPRI How are intervention stocks modeled CAPRI • Three variables: – Intervention purchases: probability of market prices to undercut administrative ones times maximum intervention purchases – Intervention releases: (1-probability of market prices to undercut administrative ones) times probability of market price to exceed unit value exports without subsidies times times intervention stock size – Intervention stock size: start size + purchases releases CAPRI Training Session Warsaw 2006 27 CAPRI How are intervention stocks modeled CAPRI Assumed normal distribution around current EU market price Administrative price Export unit value Probability to undercut administrative price Probability to exceed unit value exports without subsidies Endogenous market price CAPRI Training Session Warsaw 2006 28 CAPRI Where to find results on intervention stocks? CAPRI Financial costs= Depreciation= (Size in base year x base year price (Market prices – unit value exports) + simulated final size x final price)/2 x 4% x final size Other= Purchases x Admin. Price Technical costs= – releases x unit value export (Size in base year + simulated final size)/2 x costs per ton Changes = Purchases - releases Table: FEGOA STOCKS Final stock size = start size + purchases - releases CAPRI Training Session Warsaw 2006 29 CAPRI Training with the market model CAPRI • Run on Member State level with 3 iterations one of the following simulations • (1) abolish EU15 subsidized exports for wheat (policy file policy\01NOSUPX.gms) • (2) Close EU15 tariff rate quota for wheat (policy file policy\01NOTRQ.gms While the model runs understand the policy files CAPRI Training Session Warsaw 2006 30 CAPRI CAPRI • $include pol_input\mtrstd.gms • **** policy changes • DATA("EU015000","FEOE_max",XX,SIMY) = eps; CAPRI Training Session Warsaw 2006 31