Conceptual Framework: Revisiting the Basics A comment on Hicks

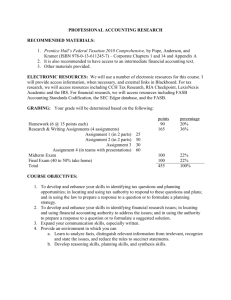

advertisement

Conceptual Framework: Revisiting the Basics A comment on Hicks and the concept of ‘income’ in the conceptual framework Michael Bromwich, London School of Economics Richard Macve, London School of Economics Shyam Sunder, Yale School of Management American Accounting Association, Anaheim Aug. 4-6, 2008 An Overview • The FSB/IASB joint project on the conceptual framework purports to base its approach on Hicks’s well known definition of income. • Hicks’s concept has been misquoted, misunderstood and misapplied. • We explore some alternative approaches also suggested by Hicks and others. • We present an alternative view (to FASB/IASB’s) of how accounting concepts and conventions are be related. 8/5/2008 Conceptual Framework 2 Introduction • FASB/IASB joint Conceptual Framework project started in October 2004 • Discussion papers on the core areas (elements, recognition and measurement) planned for release during 2008. • Overall approach outlined in an early paper Revisiting the Concepts (May 2005). • Intended to replace conventions with concepts 8/5/2008 Conceptual Framework 3 The Foundation • • • • • • ‘...a wise man, which built his house upon a rock………..a foolish man, which built his house upon the sand…and it fell; and great was the fall of it.’ Matthew, 7: 2427. All elements can be derived from the definition of assets (FASB/IASB 2005, p.6). They quote: ‘An entity’s income can be objectively determined from the change in its wealth plus what consumes during a period’ (Hicks 1946, pp. 178-9). This is the foundation for the claim of ‘conceptual primacy’ of assets, and the superiority of the ‘asset/liability’ view over the ‘revenue and expense view’ in measuring a business’s income (FASB/IASB 2005, p.7). But the FASB/IASB quote only a part of the sentence. The remaining part is: 'So long as we confine our attention to income from property, and leave out of account any increment or decrement in the value of prospects due to changes in people's own earning power (accumulation or decumulation of “Human Capital”), Income No. 1 ex post is not a subjective affair, like other kinds of income; it is almost completely objective'. 8/5/2008 Conceptual Framework 4 Why Is This a Problem • • • • • • If everyone can buy and sell every resource at a known price (including interest on money), income is fully determined and objective; Beaver and Demski (1979). Then the magnitude of wealth and changes in wealth (‘Income No.1’) are known ex ante and ex post. But then, the reporting of income is informationally redundant. When markets are not complete and perfect, the value of the future cash flows of a business enterprise must includes elements which are not captured in the market prices of its net assets This element of value (‘internal goodwill’) depends how assets are used (the skill of management and employees in exploiting resources , markets, business, social and political opportunities (Hicks’ ‘Human Capital’). The ‘objective’ version of Hicks’s ‘No.1 ex post’ income of a listed enterprise likely to be the measure of its ‘shareholder return’ (dividend plus/minus change in share price), i.e. the change in its ‘capital value’ at the stock market level, not net assets. Hicks (1979). But if firms are merely to report their stock price return (plus dividends) as their income, their accounts are redundant. No profit in perfect markets; without perfect markets, assets values cannot capture all value of business. 8/5/2008 Conceptual Framework 5 Comparing Hicks and FASB/IASB IASB/FASB 8/5/2008 Net assets Firm Developed in Hicks (1979) as ‘proprietors’ Objective Subjective Income ex post Income ex ante cf. Hicks (1948) Income 1 Income 2 Or ‘No.3’ cf. Paish (1940) Conceptual Framework 6 Firm or Net Assets of the Firm • IASB/IASB (2005, p. 18) render Hicks’s ‘capital value’ as ‘in accounting terms, its assets and liabilities’ (cf. Shipper & Vincent, 2003; Barth, 2007). • Extensive literature on the limited consistency between Hicks’s ‘capital value’ and net asset based measures of income (e.g., Edwards & Bell 1961). • Such consistency depends on restrictive assumptions (FASB/IASB 2005 paper pp. 15-16 identifies ‘cross-cutting issues’ of uncertainty, unit of account and management intentions. • FASB/IASB 2005 cites Hicks (1946). Hicks (1979) revisits income: owner seeks to ascertain ‘the maximum that could be safely taken out of the business...without damaging the prospects of the business; clearly a matter of judgement.’ 8/5/2008 Conceptual Framework 7 Permanent Income • Hicks’ argument and analysis lead him to regard profit as that defined by Lindahl: (C1t1 + V1t1) - V0t1 = rV0t1 i.e. income with the benefit of hindsight, which, if interest rates do not change will now be ex ante income for the future. • ‘This is effectively what Friedman would call the permanent income derived from the business (p.11)’. [Also favoured in Solomons’ (1989) Guidelines.] • And although he has been ‘looking for a definition of current profit which, as far as possible, should register the performance of the business within the year, excluding what has happened before and what is to come after… V1t1 …would appear to have a large part, even, in many cases, the dominant part, in determining the current profit’ (p.10). Moreover, it is the income of the proprietors, rather than of the business (p.11). 8/5/2008 Conceptual Framework 8 How Useful is Income ex post • • • • • In the paragraph following the one cited by FASB/IASB, Hicks says about expose income: 'Ex post calculations....have no significance for conduct... can have no relevance to present decisions.' If decision usefulness is the prime consideration, irrelevance of ex post income shows the FASB/IASB argument to be built on sand. Hicks allows a role for his Income No. 1 ex post to ‘have their place in economic and statistical history; they are a useful measuring rod for economic progress; but… they have no significance for conduct (1946, p. 109). The main issue with Income ex post is ‘how much of the future is it useful to bring into accounts of the past if they are to be helpful in forming expectations about future Income ex ante? This is primarily an empirical question, and the answer depends on how far ‘permanent’ and ‘transitory’ elements can be distinguished, and by business activity (e.g. Penman, 2007); and different emphases on ‘relevance’ and reliability’ (cf. Sundem, 2007). But note that there is no necessary merit in simply tracking Hicks’s ‘Income No. 1 ex post’. 8/5/2008 Conceptual Framework 9 A role for ‘Income ex ante’ ? • Some authors argue for estimating ‘standard stream income’ so that stream and a (constant) discount rate leads of the value of the firm by capitalisation (e.g. Whittington, 1983, p.33) and to supplementary ‘underlying’ EPS numbers’ (Black (1993) ). • AstraZeneca for the half-year ended 30 June 2007: ‘Management believes that investors’ understanding of the Company’s performance is enhanced by disclosure of Core EPS, as it provides an understanding of the underlying ability to generate returns to shareholders. The Core EPS measure is adjusted to exclude certain significant items, such as charges and provisions relating to restructuring and synergy programmes, amortisation of significant intangibles rising from corporate acquisitions and those related to our current and future exit arrangements with Merck in the US, and other specified items. Core EPS is not, and should not be viewed as, a substitute for EPS in accordance with IFRS.’ [p.17]. 8/5/2008 Conceptual Framework 10 Defining Income without Assets and Liabilities • The FASB/IASB paper claims that the challenge of defining income without reference to assets and liabilities cannot be met. • Hicks met the challenge: Dissatisfied with his ‘No. 1’ version he offered ‘Income No.2’ (1946, p.174): In the case of a joint stock company this could translate as ‘the maximum dividend the company could pay this period to its current equity shareholders and expect to be able to be able to pay them the same dividend in all future periods’, which is equivalent to what financial analysts call its ‘maintainable (or ‘permanent’) income’. • Income No. 2 is the same thing as Income No. 1 only when there is no expected (or actual) change in the rate of interest used for capitalization. • When there is inflation, the expectation needs to be ‘in real terms’ (Hicks’s ‘Income No.3’ (1946, p.174)). • It was this ‘No.2’ concept of income that underlay the proposals in the UK’s Sandilands Report (1975) for ‘current cost accounting’. 8/5/2008 Conceptual Framework 11 Living with Duality • Given the conceptual tension between ‘Income No.1’ (expressed in terms of capital value changes) and ‘Income No.2’ (expressed in terms of maintainable income), there are also conceptual grounds for believing that the most relevant income concept for users and their economic decisions will vary with their individual circumstances and conditions (Paish, 1940). • This insight can go a long way towards explaining why the underlying motivations of those who identify with the ‘asset/liability’ view and those who identify with the ‘revenue/expense’ (or ‘matching’) view are sometimes complementary, but are often seen as in opposition with regard to what is the most useful approach to measuring enterprise income in the context of individual standards. • Can accounting live with this duality (just as physicists learned to live with the particle and wave theory of electromagnetic radiation) 8/5/2008 Conceptual Framework 12 Conventions’ vs ‘Conceptual principles • • • • • • The FASB/IASB 2005 sees the conceptual framework project as a crusade against conventions. ‘To be principles-based, standards cannot be a collection of conventions but rather must be rooted in fundamental concepts.’ Naïve to overlook the power of conventions, and their surrounding beliefs, in maintaining social structures and interaction. Do accounting conventions need to be replaced, how, and with what. Has the alternatives shown to be better? Academic discussion reviewed here, and the FASB/IASB paper recycle over 50 year old arguments (Solomons 1961 on the ‘twilight of income measurement’). There have been recent practical developments in alternative ways of setting out ‘income’ and ‘value’ in accounting reports. E.g., supplementary reporting of life insurance profitability according to a ‘(Market Consistent) Embedded Value’ model which bears structural similarity to a ‘Hicks no.1 ex ante-ex post’ cycle (Horton, Serafeim & Macve, 2007). Implications of emerging practices for the conception of performance measurement and reporting—perhaps it is better to look to emerging practices, rather than attempt to refine concepts such as ‘income’ or ‘assets’. 8/5/2008 Conceptual Framework 13 Conclusions • Both the “gain” and “standard stream” views have some merits in triangulating the amount to be reported as a firm’s earnings. • The ‘new conceptual framework’ project of FASB and IASB does not present convincing arguments to reject “standard stream” in favor of “gain” view; or revenue-expense in favor of asset/liability view. • If the standard setters choose “gain” and “asset/liability”, in absence of arguments, they will simply be using their authority to force a new convention, not replace existing conventions by concepts (e.g. Christensen & Demski, 2003, Hoskin & Macve, 2000). • To rewrite a key sentence from p.1 of the FASB/IASB 2005 paper: ‘To be principles-based, standards have to be a collection of (socially) useful conventions, rooted in fundamental concepts.’ • Hicks’s (1946) analysis neither provides a conceptual justification for the FASB/IASB’s exclusive focus on a ‘balance sheet’ approach to accounting, nor for its avoiding addressing the difficult problems of how best to measure and report business performance and to help users identify the drivers of value creation. 8/5/2008 Conceptual Framework 14 Thank You • Shyam.sunder@yale.edu • www.som.yale.edu/faculty/sunder 8/5/2008 Conceptual Framework 15