LivingstoneProfessionalResearchSyllabus

advertisement

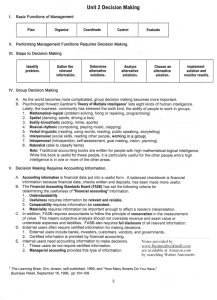

PROFESSIONAL ACCOUNTING RESEARCH RECOMMENDED MATERIALS: 1. Prentice Hall’s Federal Taxation 2010 Comprehensive, by Pope, Anderson, and Kramer (ISBN 978-0-13-611245-7) – Corporate Chapters 1 and 14 and Appendix A 2. It is also recommended to have access to an intermediate financial accounting text. 3. Other materials provided. ELECTRONIC RESOURCES: We will use a number of electronic resources for this course. I will provide access information, when necessary, and external links in Blackboard. For tax research, we will access resources including CCH Tax Research, RIA Checkpoint, LexisNexis Academic and the IRS. For financial research, we will access resources including FASB Accounting Standards Codification, the SEC Edgar database, and the FASB. GRADING: Your grade will be determined based on the following: Homework (6 @ 15 points each) Research & Writing Assignments (4 assignments) Assignment 1 (in 2 parts) Assignment 2 (in 2 parts) Assignment 3 Assignment 4 (in teams with presentations) Midterm Exam Final Exam (40 to 50% take home) Total points 90 165 percentage 20% 36% 100 100 455 22% 22% 100% 25 50 30 60 COURSE OBJECTIVES: 1. To develop and enhance your skills in identifying tax questions and planning opportunities; in locating and using tax authority to respond to these questions and plans; and in using the law to prepare a response to a question or to formulate a planning strategy. 2. To develop and enhance your skills in identifying financial research issues; in locating and using financial accounting authority to address the issues; and in using the authority to prepare a response to a question or to formulate a suggested solution. 3. Expand your communication skills, especially written. 4. Provide an environment in which you can a. Learn to analyze facts, distinguish relevant information from irrelevant, recognize and state the issues, and reduce the rules to succinct statements. b. Develop reasoning skills, planning skills, and synthesis skills. TAX TOPICS 1. Introduction to Tax Research 2. Ethics in Tax a. Tax Shelters b. Code of Professional Conduct 3. Sources of Tax Law a. Statutory b. Administrative c. Judicial 4. Tax Administration 5. Tax Planning FINANCIAL TOPICS 1. Introduction to Financial Research 2. Authoritative Financial Literature a. FASB, EITF, AICPA & SEC b. FASB Accounting Standards Codification (ASC) 3. International a. IASB b. IASB & FASB Convergence Projects c. Some Similarities & Differences d. SEC Roadmap 4. SEC Reporting AICPA CORE COMPENTENCIES 1. Communication 2. Research 3. Decision modeling a. Problem solving b. Strategic / critical thinking c. Legal / regulatory perspective d. Risk Analysis 4. Global perspective 5. Leverage technology