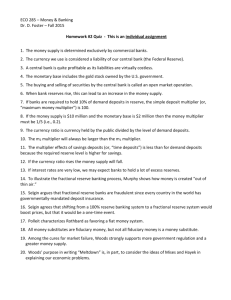

What Counts as Money

advertisement

What Counts as Money Money has several useful functions Provides a unit of account Standardized way of measuring value of things that are traded Serves as store of value One of several ways in which households can hold their wealth Yet credit cards are not considered money, even though you can use them to buy things Why is this? A more formal definition of money helps to answer questions like this Money is an asset that is widely accepted as a means of payment Only assets—things of value that people own—can be considered as money The right to borrow is not an asset - that is why credit limit on your credit card, or your ability to go into a bank and borrow funds, is not considered money Only things that are widely acceptable as a means of payment are regarded as money Other assets—such as stocks and bonds or even gold bars—cannot generally be used to pay for goods and services They fail the acceptability test Measuring the Money Supply Amount of money in circulation can affect macroeconomy Money Supply Total amount of money held by the public In practice, measuring money supply is not as straightforward as it might seem Governments have decided best way to deal with them is to have different measures of the money supply In effect, alternative ways of defining what is and what is not money Each measure includes a selection of assets that are widely acceptable as a means of payment and are relatively liquid An asset is considered liquid if it can be converted to cash quickly and at little cost An illiquid asset can be converted to cash only after a delay, or at considerable cost Assets and Their Liquidity Most liquid asset is cash in the hands of the public Next in line are asset categories of about equal liquidity Demand deposits Other checkable deposits Catchall category for several types of checking accounts that work very much like demand deposits - includes automatic transfers from saving account Travelers checks Checking accounts held by households and business firms at commercial banks Specially printed checks that you can buy from banks or other private companies, like American Express – can be easily spent at almost any hotel or store Savings-type accounts At banks and other financial institutions Are less liquid than checking-type accounts, since they do not allow you to write checks Assets and Their Liquidity Next on the list are deposits in retail money market mutual funds – which use customer deposits to buy a variety of financial assetsdepositors can withdraw their money by writing checks. Time deposits (sometimes called certificates of deposit, or CDs) Require you to keep your money in the bank for a specified period of time (usually six months or longer) Impose an interest penalty if you withdraw early Figure 1: Monetary Assets and Their Liquidity (May 23, 2005) Demand Deposits ($332 billion) + Savings Type Other Accounts Checkable Deposits ($3,512 billion) ($324 billion) Cash in the Hands of the Public ($706 billion) More Liquid + Travelers Checks ($8 billion) Money Large Small Market Time Time Mutual Deposits Deposits ($1189 billion) Funds ($700 billion) ($886 billion) Less Liquid M1 And M2 Standard measure of money stock is M1 Sum of the first four assets in our list M1 = cash in the hands of the public + demand deposits + other checking account deposits + travelers checks When economists or government officials speak about “money supply,” they usually mean M1 Another common measure of money supply, M2, adds some other types of assets to M1 M2 = M1 + savings-type accounts + retail MMMF balances + small denomination time deposits Other official measures of money supply besides M1 and M2 that add in assets that are less liquid than those in M2 M1 and M2 have been most popular, and most commonly watched, definitions M1 And M2 Important to understand that M1 and M2 money stock measures exclude many things that people use regularly as a means of payment Technological advances—now and in the future—will continue trend toward new and more varied ways to make payments For rest of our discussion, we will assume money supply consists of just two components Cash in the hands of the public and demand deposits That is Money supply = Cash in the hands of public + demand deposits You will see later that our definition of the money supply corresponds closely to liquid assets that our national monetary authority—the Federal Reserve— can control The Banking System: Financial Intermediaries What are banks? Financial intermediaries—business firms that specialize in Assembling loanable funds from households and firms whose revenues exceed their expenditures Channeling those funds to households and firms (and sometimes the government) whose expenditures exceed revenues An intermediary helps to solve problems by combining a large number of small savers’ funds into customdesigned packages Then lending them to larger borrowers Intermediaries must earn a profit for providing brokering services By charging a higher interest rate on funds they lend than rate they pay to depositors The Banking System: Financial Intermediaries United States boasts a wide variety of financial intermediaries, including Commercial banks Savings and loan associations Mutual savings banks Credit unions Insurance companies Some government agencies There are four types of financial intermediariesdepository institutions- that accept deposits from the general public and lend the deposits to borrowers Savings and Loan associations – obtain funds through their customers’ time, saving and checkable deposits and use them primarily to make mortgage loans Mutual savings banks – accept deposits (shares) and use them primarily to make mortgage loans (differ from S&L because they are owned by their depositors rather than outside investors) Credit unions – specialize in working with particular group of people, acquire funds through their member deposit – make consumer and mortgage loans Commercial banks – largest group of depository institutions, obtain funds mainly by accepting checkable deposits, saving deposits and the time deposits - make business, mortgage and consumer loans Commercial Banks A commercial bank (or just “bank” for short) is a private corporation that provides services to the public Owned by its stockholders Enables bank’s customers to pay bills and make purchases without holding large amounts of cash that could be lost or stolen Every year, US households and businesses write trillions of dollars’ worth of checks to pay their bills For our purposes, most important service is to provide checking accounts Banks provide checking account services in order to earn a profit Where does a bank’s profit come from ??? Only by charging check-printing fees and ATM-using fee??NO……then what is the most important source of profit? What about interest rate differentials?? A Bank’s Balance Sheet A balance sheet is a two-column list that provides information about financial condition of a bank at a particular point in time Amounts bank owes On the other side, the bank’s liabilities are listed A promise to pay back borrowed funds, issued by a corporation or government agency An agreement to pay back borrowed funds, signed by a household or noncorporate business –examples? Next come two categories that might seem curious Everything of value that it owns Loan Bond In one column, bank’s assets are listed “Vault cash” – coin and currency that bank has stored in its vault “Account with the Federal Reserve” – banks maintain their own accounts with the Fed reserve – they add and subtract to these accounts when they make transaction with other banks Neither vault cash nor accounts with the Fed pay interest Then why does the bank hold them? Commercial Bank’s Balance Sheet Liabilities and Net Worth Assets Property and buildings $5 million Demand deposit liabilities $100 million Government and corporate bonds $25 million Net Worth $5 million Loans $65 million ` Cash in vault $2 million In accounts with the Federal Reserve $8 million Total Assets $105 million Total Liabilities plus Net Worth $105 million The Federal Reserve System Every large nation controls its money supply with a central bank A nation’s principal monetary authority Most developed countries established central banks long ago England’s central bank—Bank of England—was created in 1694 France established Banque de France in 1800 United States established Federal Reserve System in 1913 U.S. waited such a long time to establish a central authority because of Suspicion of central authority that has always been part of U.S. politics and culture Large size and extreme diversity of our country Fear that a powerful central bank might be dominated by the interests of one region to the detriment of others The Federal Reserve System Our central bank is different in form from its European counterparts One major difference is indicated in the very name of the institution Does not have the word “central” or “bank” anywhere in its title Another difference is the way the system is organized Another interesting feature of Federal Reserve System is its peculiar status within government Strictly speaking, it is not even a part of any branch of government Both President and Congress exert some influence on Fed through their appointments of key officials Figure 2: The Geography of the Federal Reserve System 1 9 Minneapolis 12 San Francisco 2 7 Boston New York Philadelphia 10 Cleveland Washington Kansas City 4 Richmond St. Louis 5 8 3 Chicago Atlanta 11 6 Dallas Note: Both Alaska and Hawaii are in the Twelfth District District boundaries State boundaries Reserve Bank cities Board of Governors of the Federal Reserve System Figure 3: The Structure of the Federal Reserve System President appoints Senate confirms Chair of Board of Governors Board of Governors (7 members, including chair) • Supervises and regulates member banks • Supervises 12 Federal Reserve District Banks • Sets reserve requirements and approves discount rate Federal Open Market Committee (7 Governors + 5 Reserve Bank Presidents) • Conducts open market operations to control the money supply Appoints 3 directors of each Federal Reserve Bank 12 Federal Reserve District Banks • Lend reserves • Clear checks • Provide currency Elect 6 directors of each Federal Reserve Bank 3,500 Member Banks The Structure of the Fed Board of Governors Consists of seven members who are appointed by President and confirmed by Senate for a 14-year term In order to keep any President or Congress from having too much influence over Fed Each of 12 Federal Reserve Banks is supervised by nine directors Four-year term of the chair is not coterminous with four-year term of the President Three of whom are appointed by Board of Governors Other six are elected by private commercial banks—the official stockholders of the system Directors of each Federal Reserve Bank choose a president of that bank, who manages its day-to-day operations Only about 3,500 of the 8,000 or so commercial banks in United States are members of Federal Reserve System But they include all national banks and state banks All of the largest banks in United States are nationally chartered banks and therefore member banks as well The Federal Open Market Committee Federal Open Market Committee (FOMC) A committee of Federal Reserve officials that establishes U.S. monetary policy Most economists regard FOMC as most important part of Fed Consists of all 7 governors of Fed, along with 5 of the 12 district bank presidents Not even President of United States knows details behind the decisions, or what FOMC actually discussed at its meeting, until summary of meeting is finally released Committee exerts control over nation’s money supply by buying and selling bonds in public (“open”) bond market The Functions of the Federal Reserve Federal Reserve, as overseer of the nation’s monetary system, has a variety of important responsibilities including Supervising and regulating banks Acting as a “bank for banks” Issuing paper currency Check clearing Controlling money supply The Fed and the Money Supply Suppose Fed wants to change nation’s money supply It buys or sells government bonds to bond dealers, banks, or other financial institutions Actions are called open market operations We’ll make two special assumptions to keep our analysis of open market operations simple for now Households and business are satisfied holding the amount of cash they are currently holding Any additional funds they might acquire are deposited in their checking accounts Any decrease in their funds comes from their checking accounts Banks never hold reserves in excess of those legally required by law How the Fed Increases the Money Supply To increase money supply, Fed will buy government bonds Called an open market purchase Suppose Fed buys $1,000 bond from Lehman Brothers, which deposits the total into its checking account Two important things have happened Fed has injected reserve into banking system Money supply has increased Demand deposits have increased by $1,000 and demand deposits are part of money supply Lehman Brothers’ bank now has excess reserves Reserves in excess of required reserves If required reserve ratio is 10% bank has excess reserves of $900 to lend Demand deposits increase each time a bank lends out excess reserves The Demand Deposit Multiplier How much will demand deposits increase in total? Each bank creates less in demand deposits than the bank before In each round, a bank lent 90% of deposit it received Whatever the injection of reserves, demand deposits will increase by a factor of 10, so we can write ΔDD = 10 x reserve injection Demand deposit multiplier is number by which we must multiply injection of reserves to get total change in demand deposits Size of demand deposit multiplier depends on value of required reserve ratio set by Fed Cumulative Increases in Demand Deposits After a $1,000 Cash Deposit Round Additional Demand Deposits Created by Each Bank Additional Demand Deposits Created by All Banks Bank 1 $1,000 $1,000 Bank 2 $900 $1,900 Bank 3 $810 $2,710 Bank 4 $729 $3,439 Bank 5 $656 $4,095 Bank 6 $590 $4,685 … … … Bank 10 $387 $6,511 … … … Bank 20 $135 $8,784 … … … Bank 50 very close to zero very close to $10,000 The Demand Deposit Multiplier For any value of required reserve ratio (RRR), formula for demand deposit multiplier is 1/RRR Using general formula for demand deposit multiplier, can restate what happens when Fed injects reserves into banking system as follows ΔDD = (1 / RRR) x ΔReserves Since we’ve been assuming that the amount of cash in the hands of the public (the other component of the money supply) does not change, we can also write ΔMoney Supply = (1 / RRR) x ΔReserves The Fed’s Influence on the Banking System as a Whole Can also look at what happened to total demand deposits and money supply from another perspective Where did additional $1,000 in reserves end up? In the end, additional $1,000 in reserves will be distributed among different banks in system as required reserves After an injection of reserves, demand deposit multiplier stops working—and the money supply stops increasing—only when all reserves injected are being held by banks as required reserves In the end, total reserves in system have increased by $1,000 Amount of open market purchase How the Fed Decreases the Money Supply Just as Fed can increase money supply by purchasing government bonds Can also decrease money supply by selling government bonds An open market sale Process of calling in loans will involve many banks Each time a bank calls in a loan, demand deposits are destroyed Total decline in demand deposits will be a multiple of initial withdrawal of reserves Keeping in mind that a withdrawal of reserves is a negative change in reserves Can still use our demand deposit multiplier—1/(RRR)— and our general formula ΔDD = (1/RRR) x ΔReserves Some Important Provisos About the Demand Deposit Multiplier Although process of money creation and destruction as we’ve described it illustrates the basic ideas, formula for demand deposit multiplier—1/RRR—is oversimplified In reality, multiplier is likely to be smaller than formula suggests, for two reasons We’ve assumed that as money supply changes, public does not change its holdings of cash We’ve assumed that banks will always lend out all of their excess reserves Other Tools for Controlling the Money Supply While other tools can affect the money supply, open market operations have two advantages over them Precision and secrecy This is why open market operations remain Fed’s primary means of changing money supply Fed’s ability to conduct its policies in secret—and its independent status in general—is controversial In recent years, because Fed has been so successful in guiding economy, controversy has largely subsided Other Tools for Controlling the Money Supply There are two other tools Fed can use to increase or decrease money supply Changes in required reserve ratio Changes in discount rate Changes in either required reserve ratio or discount rate could set off the process of deposit creation or deposit destruction in much the same way outlined in this chapter In reality, neither of these policy tools is used very often Why are these other tools used so seldom? Partly because they can have unpredictable effects Using the Theory: Bank Failures and Banking Panics A bank failure occurs when a bank cannot meet its obligations to those who have claims on the bank Includes those who have lent money to the bank, as well as those who deposited their money there Historically, many bank failures have occurred when depositors began to worry about a bank’s financial health Run on the bank An attempt by many of a bank’s depositors to withdraw their funds Ironically, a bank can fail even if it is in good financial health, with more than enough assets to cover its liabilities Just because people think bank is in trouble Banking panic occurs when many banks fail simultaneously Using the Theory: Bank Failures and Banking Panics Banking panics can cause serious problems for the nation Hardship suffered by people who lose their accounts when their bank fails Even when banks do not fail, withdrawal of cash decreases banking system’s reserves Money supply can decrease suddenly and severely, causing a serious recession Banking panic of 1907 convinced Congress to establish Federal Reserve System But creation of Fed did not, in itself, solve problem Great Depression is a good example of this problem Officials of Federal Reserve System, not quite grasping seriousness of the problem, stood by and let it happen Using the Theory: Bank Failures and Banking Panics For five-year period ending in Dec 2004, a total of 29 banks failed—an average of about 6 per year Why the dramatic improvement? Federal Reserve learned an important lesson from Great Depression It now stands ready to inject reserves into system more quickly in a crisis In 1933 Congress created Federal Deposit Insurance Corporation (FDIC) to reimburse those who lose their deposits FDIC has had a major impact on the psychology of banking public FDIC protection for bank accounts has not been costless To many observers, experience of late 1980s and early 1990s was a reminder of the need for a sound insurance system and close monitoring of banking system Figure 4: Bank Failures in the United States, 1921-2004 Number of Bank Failures 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500