National Income Determination - The Fed and the Supply of Money

advertisement

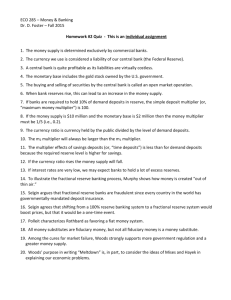

Income Determination The Monetary Dimension - I Overview $ Keynesian Income Determination Models Private sector Consumption demand Investment Demand Supply & demand for money Public Sector Government expenditure Government taxes Monetary policy manipulation of money supply International imports, exports, net exports Money - I $ C & Fair define "money" by its functions medium of exchange store of value unit of account $ Money & value confused notion of money as store of value implies money ≠ value, yet other examples of "stores of value" such as paintings imply either value lies in use, or value is "monetary value" Money - II $ C & Fair's "intrinsic value" gold --can be used for jewelry, fillings, chips cigarettes --can be smoked so, "intrinsic value" = value in use, or use value $ C&F's two notions of value: monetary value use value $ But what IS "monetary value"? to say that it is value in money brings us back to concept of money itself Money - III $ Money as command money gives command over commodities in stores money gives command over the production of commodities money gives command over labor, people's time $ Money as social power Money commands labor only when people cannot produce for themselves, money could not command American pioneers, independent farmers Money - IV $ Money as embodiment of social command in capitalist societies money gives business the power to dispossess people, to force them into the labor market money gives capitalists power to command in labor market money gives everyone else the power to resist that command, thus: centrality of wage struggle between business and labor Money - V $ Money & Value viewed socially money can be seen as embodiment of value, where "social" substance of value = labor form of value = exchange exchange between business & labor money/value as contradiction money/value as reflexive mediation money/value as syllogistic mediation money/value as infinitude $ Money as social power Monies $ Commodity money gold, silver --has value in use, takes labor to produce useful qualities: divisible, portable $ Fiat Money paper or credit money mandated by government "legal tender" from gold backed money to "Silver certificates" to "Federal Reserve Notes" Money Supply in US $ There are multiple definitions $ Differences based on differences in "liquidity" of various means of exchange $ Degree of "liquidity" = facility of use in exchange $ M1 = coin, currency, demand deposits, travelers checks, other checkable deposits $ M2 = M1 + savings accounts, money market accounts, etc. $ Most money = credit money Banks $ Banks are "financial intermediaries" $ financial intermediaries take in large number of small deposits make smaller number of larger loans Deposits BANKS Loans Bank Accounting Assets Liabilities Reserves Deposits Loans Net worth or Capital Total Total Net worth = Assets - liabilities Totals must always balance Bank Creation of Money $ Money = coin, currency, demand deposits, etc., etc. $ Bank receives deposits $ Bank can loan out most of deposits (except for reserves) $ Bank loans are deposited, $ increasing total deposits and total amount of money Money Multiplier $ Question: Repeated loaning of deposited money and depositing of loaned money will result in what increase in the money supply? $ Answer: initial deposit multiplied by "money multiplier" 1 $ Money multiplier = Required Reserve Ratio Federal Reserve System $ $ $ $ $ US "Central Bank"= Fed System = 12 regional banks Board of governors Chairman of the Federal Reserve System Functions tries to control money supply clears interbank payments regulates banking system bails out banks tries to manage exchange rates Tools for Controlling $ Supply $ Fix, change reserve requirements increasing reduction in money supply decreasing increase in money supply $ Fix, change discount rate increasing it reduces money supply decreasing it increases money supply $ Open Market Operations buying govt securities increases money supply selling govt securities decreases money supply Supply of Money (graphically) $ Within Keynesian theory question of supply and demand for money always with respect to "price" of money, i.e., interest rate i Ms = supply of money Quantity of money --END--