verification

advertisement

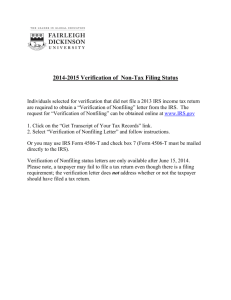

VERIFICATION 2015 TASFAA ABC Workshop Understand Verification Flag Tracking Groups and Documentation Requirements Easily Identify Verification Data Elements on Tax Documents Obtain Verification Resources Ask Verification Questions Group V2 will not be used. V6 Group – Household Resources Verification Group Institutions must use exact language provided in the Federal Register for the Statement of Educational Purpose. Verification Tracking Flag Verification Tracking Group V1 Standard Verification Verification Description Record selected because conditions based on statistical analysis error-prone risk model were met V3 Child Support Paid Record selected for Child Support paid criteria only Verification V4 Custom Verification Record selected for Identity criteria, SNAP, and Child Support Paid Group V5 Record selected for Identity criteria, “Standard Aggregate Verification Group Verification” criteria, SNAP, and Child Support Paid V6 Household Record selected for Other Untaxed Income, Resources “Standard Verification,” SNAP, and Child Verification Group Support Paid High School Completion Status • • HS Diploma or final HS transcript showing date HS diploma awarded Homeschooled – Transcript or the equivalent, signed by the parent or guardian, that lists the secondary school courses completed by the applicant and documents the successful completion of a secondary school education; or – A secondary school completion credential for home school (other than a high school diploma or its recognized equivalent) provided for under State law • Recognized Equivalent – General Educational Development (GED) Certificate; – State certificate received by a student after the student has passed a Stateauthorized examination that the State recognizes as the equivalent of a high school diploma; – Academic transcript of a student who has successfully completed at least a two-year program that is acceptable for full credit toward a bachelor's degree; or – For a person who is seeking enrollment in an educational program that leads to at least an associate degree or its equivalent and has not completed high school but has excelled academically in high school, documentation from the high school that the student excelled academically in high school and documentation from the postsecondary institution that the student has met the formalized, written policies of the postsecondary institution for admitting such students Identity/Statement of Educational Purpose • Appear in person and present to an institutionally authorized individual: – A valid government-issued photo identification (driver’s license, non-driver’s license, or passport); and – A signed statement of educational purpose • Must maintain, an annotated copy of the identification submitted by the applicant that includes: – The date documentation was received; and – The name of the institutionally-authorized individual that obtained the documentation • If unable to appear in person, must provide the institution: – A copy of a valid government-issued photo identification (driver’s license, non-driver’s license, or passport); and – An original notarized statement of educational purpose signed by the applicant Tax Filers – – – – – – – – – – – – V6 Group Household Resources Household Size Number in College Child Support Paid SNAP Adjusted Gross Income U.S. Income Tax Paid Untaxed IRA Distributions Untaxed Pensions IRA Deductions & Payments Tax-Exempt Interest Education Credits Other Untaxed Income • Payments to tax-deferred pension and savings plans • Child support received • Housing, food, and other living allowances • Veterans non-educational benefits Non-Tax Filers – Household size – Number in College – Child Support Paid – Tax-Exempt Interest – Other Untaxed Income • Payments to taxdeferred pensions and savings plans • Child support received • Housing, food, and other living allowances • Veterans noneducational benefits • Money received or paid on student’s behalf V6 Group Household Resources Non-Tax Filers W-2 Form needed for each source of employment income AND Signed statement giving the sources and amounts of the person’s income earned from work not on W2s and certifying that the person has not filed and is not required to file a tax return 2014 Tax Matrix • Earnings from Work – Wages, Salaries, Tips – Business Income/Loss – Farm Income/Loss • Untaxed Income • Adjusted Gross Income (AGI) • Additional Financial Information • U.S. Income Tax Paid • Amended Returns – Signed copy of 1040X and – Signed copy of original tax return or IRS transcript (with all data elements) • Federal Means Benefits = Verification of Group Household Resources • $25 Tolerance for non-dollar amounts • W-2 and/or Schedule C/C-EZ may be needed for tax filers • Do NOT accept IRS Verification of Nonfiling letter prior to June 15, 2015 • Must still resolve conflicting information • Verification & Available Resources • Federal Student Aid Handbook – Application and Verification Guide http://ifap.ed.gov/fsahandbook/attachments/1516AVGCh4.pd f • NASFAA Ask Regs Knowledgebase http://askregs.nasfaa.org/ics/support/splash.asp • Institutional Policies and Procedures • IRS Publication 17 found at www.irs.gov Consuela Mitchell Assistant Director of Financial Aid Tarrant County College 817-515-1786 consuela.mitchell@tccd.edu